The states where taking out a mortgage is least and most affordable

If you've been shopping for a house, or are being drawn to the market by today’s bargain-basement mortgage rates, prepare yourself for the unavoidable costs of closing on a home.

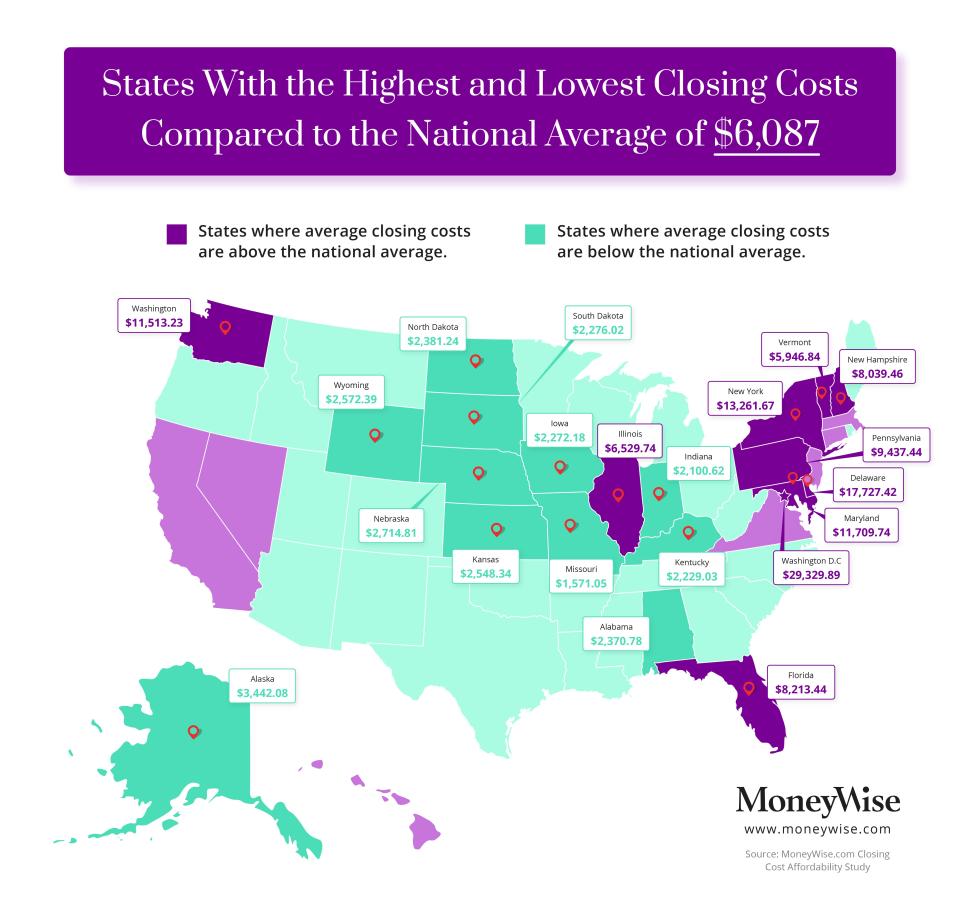

Closing costs vary from state to state: cheap and very affordable in some, pricey and painful in others.

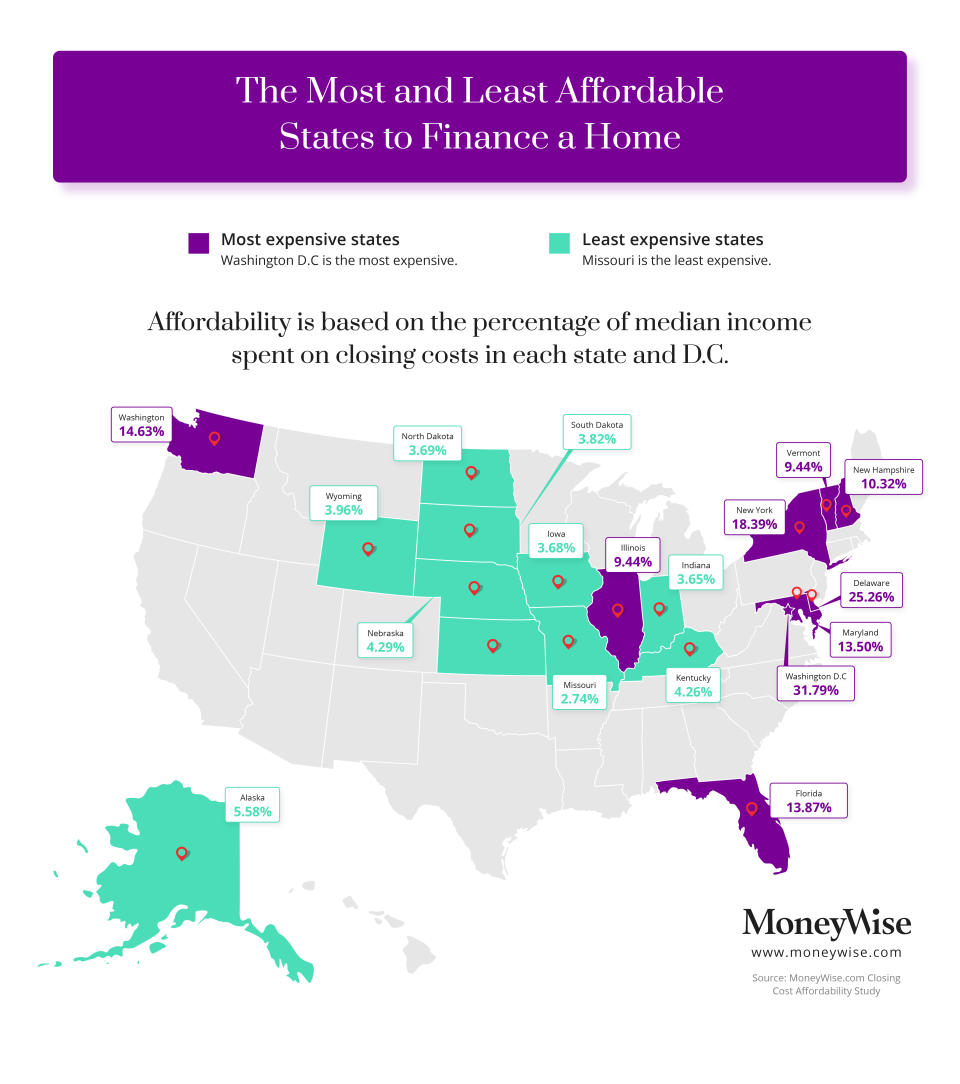

In the most expensive states for taking out a mortgage, the fees can total more than a quarter of the typical person's annual income, a MoneyWise analysis finds. In the most affordable states, average closing costs amount to less than 3% of what a borrower earns.

Closing costs must be paid upfront when the sale of a home is completed. Whether you're buying in your hometown or moving across the country — especially now that working from home has become a viable option for many Americans — you'll want to know in advance how much the costs will set you back where you're buying.

The least affordable states for financing a home

We used average closing costs calculated by the real estate data and technology firm ClosingCorp, plus state median incomes from the U.S. Census, to determine where closing costs are most and least affordable.

In 2020, the average amount homeowners paid for closing costs — including title policies, administrative expenses, appraisals, other fees and taxes — was $6,087, ClosingCorp says. That was up about 6% over 2019.

The increase was largely the result of rising U.S. home prices, says Dori Daganhardt, chief data officer for ClosingCorp: “In this market, demand is in excess of supply of housing right now and that’s really driving the costs."

Closing costs can vary depending on fees charged or regulated by your state or county. In states with higher home prices, you'll generally pay more to close on your home loan. But not always.

Looking at the 50 states plus the District of Columbia, here are the 10 where closing costs put the biggest bite on mortgage borrowers:

Washington D.C.

Delaware

New York

Pennsylvania

Washington

Florida

Maryland

New Hampshire

Vermont

Illinois

Nation's capital has most expensive closing costs

In Washington, D.C., closing costs are toughest for homebuyers to swallow, according to our analysis. This is largely due to fees the local government charges when a property changes hands.

If you buy a house in the nation’s capital for up to $400,000, you and the seller each will be required to pay a 1.1% transfer and recordation tax.

If the purchase price is more than $400,000, the tax rises to 1.45%. For a luxury home, that can mean a big chunk of cash. On a $3 million property, for example, the transfer and recordation fees would amount to $87,000.

Not all buyers face those hefty fees. Those who meet certain income limits and buy homes priced under $367,200 are not subject to the tax. They're also exempt from paying property taxes for five years.

"The government, city council and mayor of Washington, D.C., have long thought that Washington is an incredible magnet for buyers," says Corey Burr, a local real estate agent with TTR Sotheby’s International Realty. "And they’re right. Therefore they can charge almost anything on the transfer and recordation taxes."

In 2020, average homebuyer closing costs in D.C., including taxes, were a staggering $29,329, according to ClosingCorp, which focused on single-family homes. The average selling price also was at the top of the list, at $710,669.

Things that can make closing costs less affordable

States with property-related taxes typically have higher closing costs than those that don’t. And it’s not just transfer taxes. In West Virginia, for example, about 20 counties charge a "farmland protection tax."

"That’s a big driver of why the cost in some areas is more than others," Daganhardt says. "A good portion of that has to do with the amount of tax that’s charged for a purchase transaction."

Also, Texas and Florida require land surveys, which add to the costs. And in some states, an attorney is required to perform the closing — triggering an additional fee.

Often, the more expensive the house, the higher the taxes, title fees and the appraisal.

“Typically, higher-priced homes are more complex to value," Daganhardt says. "In theory, you’re not going to have as many comparable properties."

The ClosingCorp data factors in eight categories of third-party closing costs, but fees associated with the lender, such as underwriting and processing fees, are not included. With lenders controlling those fees, it’s important for consumers to shop around, Daganhardt says.

“A lender can decide to give a concession for an underwriting fee, for example, but not for an attorney fee from a settlement service provider,” she says.

The most affordable states for financing a home

Closing costs tend to be much cheaper in and around the Midwest. That's reflected in this list of the most affordable states for taking out a mortgage:

Missouri

Indiana

Iowa

North Dakota

South Dakota

Wyoming

Kansas

Kentucky

Nebraska

Alaska

In each of those states, closing costs typically come out to less than 5% of household income, MoneyWise finds.

In Missouri, the most affordable state for closing on a home loan, the costs average $1,571, according to ClosingCorp. That’s just 2.74% of the state's median household income.

Across the country, the shift to remote work amid the pandemic has helped fuel the recent housing frenzy. And in general, closing costs have risen along with home prices.

Last year, mortgages taken out to buy homes totaled more than $1.4 trillion, and the average home price increased by nearly 10%, says Bob Jennings, ClosingCorp’s CEO, in the company’s annual closing costs report.

“Thanks to record low interest rates and a rapid shift to remote work, 2020 was a strong purchase market eclipsing the 2003 high," he says.

So just what are closing costs?

When you're buying a home, it’s important to keep in mind that you’ll be paying more than just the price of the house and the interest on your mortgage.

Closing costs usually tack on another 2% or 3% of the purchase price, Daganhardt says, though they often add as much as 5%.

The costs cover a variety of fees and services. And, in most cases, you’ll need to bring cash to the closing table to pay them. Here's an overview of common closing costs.

Loan origination fees

These are costs charged by lenders for processing your mortgage application, underwriting and funding the loan, and other administrative services.

Lenders may have different criteria for setting origination fees, but they typically range from one-half of 1 percent (0.5%) to 1% of the borrower’s mortgage, according to the National Associaiton of Realtors.

Appraisals

Most homes will need an appraisal before the loan closes to determine the value of the property. Your lender will want to be certain it's not lending more than your home is worth.

Should you ever find yourself unable to make your payments, the mortgage company might be forced to foreclose — it will want to avoid ever being stuck with a house that’s overvalued.

But if the appraisal comes in under the purchase price, there could be other problems.

Say a buyer bids $300,000 for a home, but the appraisal shows the property is worth only $275,000. The mortgage lender won’t want to lend more than the appraisal amount, so the buyer would need to come up with the difference.

Appraisals tend to cost between $300 and $500 for a single-family home, but prices can vary, depending on location.

Title searches and insurance

Once you have a title, you’re free to say you legally own your home. But first, a title company must certify that there are no liens or legal judgments against the property.

This is meant to protect the buyer and lender from unforeseen issues after the sale closes. The Consumer Financial Protection Bureau says the most common title issues include a previous owner failing to pay taxes, or a contractor making a claim against the seller for work that was done on the house.

In general, title searches and insurance can total about $2,000.

In Texas, where the average for closing costs is $3,753 — near the middle of the pack among the states — borrowers can expect their biggest expense to come from title insurance, says Darel Daik, CEO of Noble Mortgage & Investments in Houston.

Title insurance fees in Texas are regulated by the state and are based on the price of the home. The basic premium for a $100,000 property is $832, according to the Texas Department of Insurance.

Transfer taxes

These fees — which, again, are quite high in Washington, D.C. — cover the cost of transferring the deed (ownership papers) to the new owner. How much you’ll pay is based on the property’s value and your county's or state's rules.

Each state determines which party is responsible for paying the tax.

A majority of states charge transfer taxes, but 13 do not, the National Association of Realtors says. Those states are:

Alaska

Idaho

Indiana

Louisiana

Mississippi

Missouri

Montana

New Mexico

North Dakota

Oregon

Texas

Utah

Wyoming

Property taxes

This is a closing cost that may be owed to the seller. Because property taxes are paid on an annual basis, the soon-to-be ex-owner may have already paid the taxes for the year.

In that case, the buyer will have to refund the seller for the portion of the year that comes after closing.

Private mortgage insurance

These insurance premiums can kick in when a homebuyer makes a down payment of less than 20% of a home's purchase price.

The reasoning behind PMI is that the lender takes on more risk when a borrower puts less skin in the game. If the borrower ever defaults, the insurance provides financial protection to the lender.

PMI premiums can cost up to $200 per month, with some of those costs typically paid at closing.

Other costs

There are other miscellaneous costs a buyer may encounter during the homebuying process.

Those can include credit report charges, flood certification costs or legal fees.

Buyers also should be prepared to pay for a homeowners insurance policy — a premium may be charged upfront at closing. And if you’re buying a condominium or townhouse, you may have a homeowners association fee, too.

What you’re expected to pay at closing

The amount of money you’ll be need to bring to your closing — usually in the form of a cashier’s check — will depend on the size of your "earnest money" deposit, which was that check you wrote earlier in the process to prove you were serious about buying the house.

The various closing fees and services are typically subtracted from the earnest money, and what’s left over is what you’ll need to hand over before you get the keys.

Say you’re buying a home for $300,000 and you’ve put down 5%. Your loan amount will be $285,000. If your closing fees are 3% of the loan value, they would amount to $8,550. So, if you had put down $2,500 in earnest money, you would need to bring $6,050 in cash when it’s time to close.

How to save on closing costs

When borrowers don’t have all the cash they're required to bring at closing — particularly in states where closing costs are more expensive — they often have the ability to finance some of the fees, by rolling them into the mortgage.

Or, in other cases, the buyer can increase the offer price and ask for a seller credit to cover closing costs.

"Essentially what happens is the buyer is financing — through the guise of a slightly larger mortgage — closing costs over a 30-year period," Burr says.

But there are limits, he says, and the buyer’s agent must communicate with the lender to make sure the amount doesn’t exceed what’s allowable. And note that whenever you finance your closing costs, you’ll be paying interest on them over the life of your loan.

Here's another option: Lenders may offer mortgages advertised as having no closing costs; be sure to ask around if that’s what you are looking for. The lender fronts the money for closing costs and recoups the expenses by charging you a higher interest rate.

Your credit score, employment history and debt-to-income ratio (how the money you owe compares to the money you make) will likely play a role in your eligibility.

Remember, if you plan to live in your home for a long time, forgoing closing costs in exchange for a higher interest rate or higher principal amount could easily have you paying more money over time than you would have paid upfront at closing.

Some closing costs can be negotiable

Some fees are set by states or counties, so there’s no wiggle room to negotiate. Service charges — like the cost of an appraisal — may be more flexible.

Many borrowers work with mortgage brokers who help them compare rates and lenders, to find the best deal. But some brokers charge the own fees, so be sure to ask about that if you’re working with a broker.

Daik, of Noble Mortgage & Investments, says it benefits borrowers to shop around for a lender or mortgage broker.

"Try to get some recommendations from people you know or your Realtor on a couple different mortgage brokers. Get an estimate of their costs and how much you’d have to bring to closing for each broker you’re talking to," he says.

After you've tried to negotiate your way to lower closing costs, you might want to get creative to save up the money needed for the remaining amounts.

For example, you might earn returns in the frothy stock market, even if you're not a financial whiz. A popular app can help you grow a diversified portfolio just by investing your "spare change."

When the costs are high, find other ways to save

While an amazing mortgage rate won't reduce your closing costs, it can cut your lifetime housing costs.

Rates can vary, so it’s important to review mortgage offers from multiple lenders. Studies have found that borrowers who compare rate quotes from five lenders can save thousands over time.

As always, your credit score will have a major influence on your ability to get mortgage credit and at what interest rate.

Borrowers with credit scores above 760 typically can score one of the best interest rates on a 30-year mortgage. If you haven’t seen your score in a while — or ever — it’s easy to take a peek at your credit score for free.

Besides locking in a low mortgage rate, another way to shrink your overall housing bills is by shopping around for your homeowners insurance. Gather prices from multiple insurers and review them side by side to find the best deal.

And, when the time comes to furnish your new home, download a free browser add-on that will help you find lower prices and coupons every time you click "Buy."

Our methodology

To determine the most and least affordable states for taking out a mortgage, MoneyWise took the average closing costs for the states and D.C. from ClosingCorp and divided those into the latest median household income numbers from the U.S. Census. The higher the resulting number, the less affordable the state.