Stay to Play: Hotel Giants Breaking Out to 52-Week Highs

Strong travel demand has boosted a variety of related stocks this year, ranging from cruise liners and airlines to online travel engines. Hotels have also been substantial beneficiaries. In the first quarter of 2023, U.S. hotels exceeded pre-pandemic revenue-per-available-room levels by 13%, according to data from professional audit firm PricewaterhouseCoopers. Over the summer, a recent survey from the U.S. Travel Association confirmed this trend, with 53% of all Americans planning a trip over the following six months.

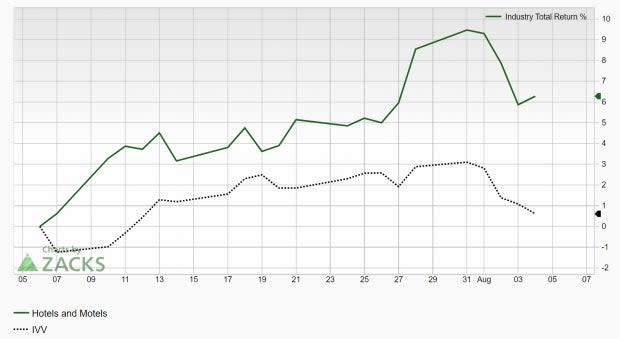

The Zacks Hotels and Motels industry group, which currently ranks in the top 44% out of approximately 250 industries, has outperformed the market this year. Momentum has clearly picked up over the last month in particular:

Image Source: Zacks Investment Research

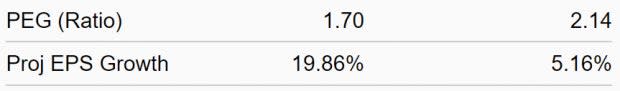

Also note the favorable characteristics for this industry group below:

Image Source: Zacks Investment Research

Quantitative research studies have illustrated that approximately half of a stock’s future price appreciation can be attributed to its industry group. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1.

It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on stocks within the top industries, we can dramatically improve our odds of success. Let’s take a deeper look at two leading stocks within this highly-rated industry.

These two hotel operators are witnessing substantial increases in their respective earnings estimates, and the market is rewarding these companies for the prospective growth. With much of big tech looking extended here in the short-term, this industry is a great place to be as these stocks have recently broken out to the upside.

Marriott International, Inc. (MAR)

Marriott is the largest hotel company in the world. The company operates, franchises, and licenses hotel, timeshare, and residential properties globally. Its portfolio includes recognized brands such as JW Marriott, Ritz-Carlton, St. Regis, Sheraton, Westin, Renaissance, Courtyard, and Residence Inn. Marriott International operates nearly 8,400 properties under 30 hotel brands in 138 countries and territories. MAR was founded in 1927 and is headquartered in Bethesda, MD.

Marriott is gaining from the reopening of international borders and greater leniency in travel restrictions. The hotel giant has witnessed robust demand thus far in 2023, as sustained levels of high employment and a shift in spending towards experiences versus goods have aided the company. Marriott is in a great spot as its strong brand position and increased demand for travel will continue to prove beneficial.

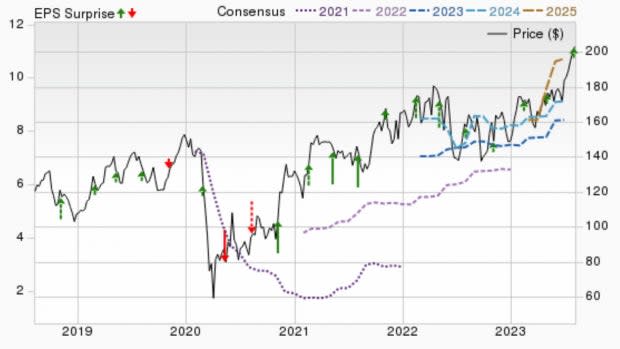

A Zacks Rank #1 (Strong Buy), MAR has exceeded earnings estimates in each of the past four quarters. The company reported second-quarter earnings last week of $2.26/share, beating the $2.19 consensus estimate by 3.2%. Revenues surged 13.8% on a year-over-year basis to $6.08 billion.

Marriott has delivered a trailing four-quarter average earnings surprise of 5.52%, helping shares advance more than 38% this year.

Image Source: Zacks Investment Research

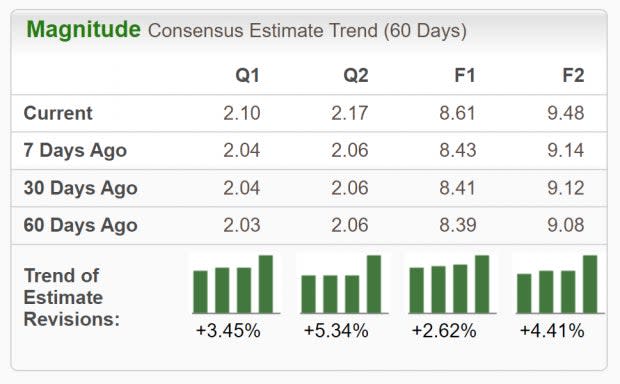

Analysts covering MAR are in agreement in terms of earnings estimate revisions and have been raising estimates across the board. For the full year, projections have been raised by 2.62% in the past 60 days. The 2023 Zacks Consensus EPS Estimate now stands at $8.61/share, representing growth of 28.7% relative to last year. Revenues are expected to climb 15% to $23.9 billion.

Image Source: Zacks Investment Research

Intercontinental Hotels Group (IHG)

Intercontinental Hotels Group manages, franchises, and leases hotels worldwide. The company owns and operates a variety of resorts, restaurants, hotels and spas under recognized names such as Kimpton, Regent, Atwell, EVEN, and Holiday Inn. IHG has over 6,000 hotels under its umbrella and operates in over 100 countries. Intercontinental Hotels Group was founded in 1777 and is based in Denham, the United Kingdom.

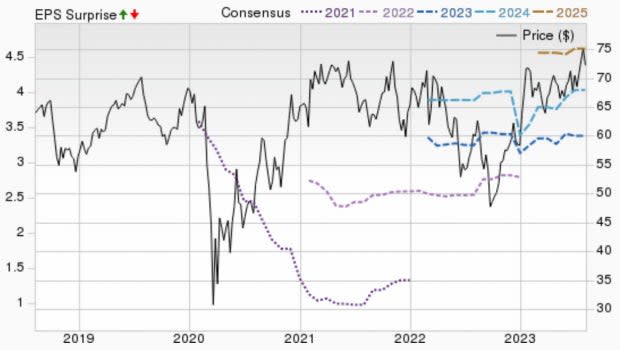

A Zacks Rank #2 (Buy) stock, IHG shares have recently broken out to a new 52-week high. The stock is up nearly 28% on the year, handily outperforming the S&P 500’s 17.2% ascent.

Image Source: Zacks Investment Research

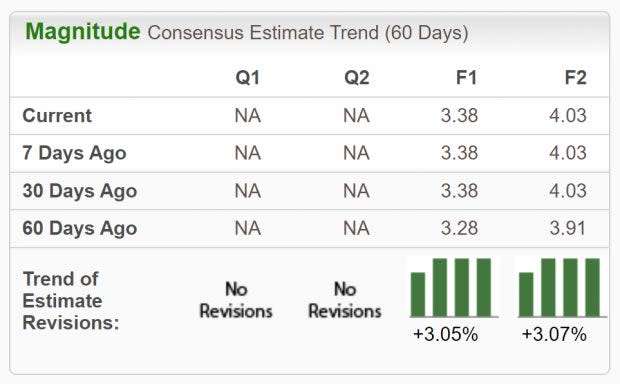

The hotel operator has been on the positive end of earnings estimate revisions. EPS estimates for 2023 have been revised upward by 3.05% in the past 60 days. The Zacks Consensus Estimate is now $3.38/share, translating to growth of 19.9% versus last year. Sales are anticipated to rise 55.69% to $4.53 billion.

Image Source: Zacks Investment Research

Keep an eye on the travel industry as well as these two highly-ranked hotel giants.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Intercontinental Hotels Group (IHG) : Free Stock Analysis Report