Steel Dynamics (STLD) Projects Higher Sequential Q1 Earnings

Steel Dynamics, Inc. STLD announced its earnings guidance for the first quarter of 2024 in the range of $3.51-$3.55 per share. This suggests an improvement from the previous quarter's earnings of $2.61 per share and a deterioration from earnings of $3.70 recorded in the first quarter of the prior year.

The company anticipates a substantial boost in profitability in its steel operations for the first quarter of 2024, particularly driven by increased shipments and earnings across the operations. The upside can be attributed to enhanced performance in its flat-rolled steel operations, with improvements observed at the Sinton Texas Flat Roll Division. Key sectors such as automotive, non-residential construction, energy and industrial segments continue to demonstrate strong demand.

Earnings from the company’s metals recycling operations are expected to surpass the previous quarter’s levels, driven by improved pricing for ferrous and nonferrous materials along with increased volumes.

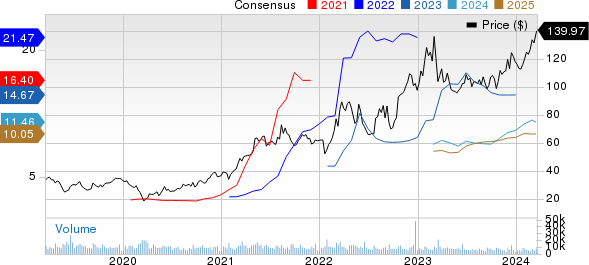

Steel Dynamics, Inc. Price and Consensus

Steel Dynamics, Inc. price-consensus-chart | Steel Dynamics, Inc. Quote

While the first quarter of 2024 is expected to witness historically robust earnings from the steel fabrication operations, it is projected to be lower than the sequential fourth-quarter results. The downtick will be primarily caused by seasonally lower shipments and a contraction in metal spread due to reduced realized pricing and increased steel input costs. The non-residential construction sector remains solid, with strong order backlog volumes and favorable pricing trends, supported by factors such as onshoring of manufacturing and ongoing U.S. infrastructure initiatives.

Demonstrating confidence in its earnings outlook and cash flow, the company repurchased $279 million (or 1.4%) worth of its common stock during the first quarter up to Mar 11, 2024. The company's board of directors announced an 8% increase in the first quarter 2024 cash dividend to 46 cents per share.

Steel Dynamics’ shares have gained 30% in the past year compared with the industry's 17% rise in the same period.

Image Source: Zacks Investment Research

In the fourth quarter of 2023, Steel Dynamics reported earnings of $2.61 per share, down from $3.61 reported in the previous year's quarter. The figure fell short of the Zacks Consensus Estimate of $2.63. Despite a 12.3% year-over-year decline in net sales to $4,233.4 million, the figure exceeded expectations and surpassed the Zacks Consensus Estimate of $4,112.4 million.

Zacks Rank & Key Picks

Steel Dynamics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, sporting a Zacks Rank #1 (Strong Buy), and Ecolab Inc. ECL and Hawkins, Inc. HWKN, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for CRS’ current fiscal year earnings is pegged at $4 per share, indicating a year-over-year surge of 250.9%. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 12.2%. The company’s shares have increased 63% in the past year.

Ecolab has a projected earnings growth rate of 22.65% for the current year. The Zacks Consensus Estimate for ECL’s current-year earnings has been revised upward by 5.4% in the past 60 days. ECL topped the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.7%. The company’s shares have rallied 46% in the past year.

The consensus estimate for HWKN’s current fiscal year earnings is pegged at $3.61 per share, indicating a 26% year-over-year rise. HWKN beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 30.6%. The company’s shares have surged 81.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report