Steel Dynamics (STLD) Sees Lower Q4 Earnings in Steel Operations

Steel Dynamics, Inc. STLD recently issued its earnings guidance for the fourth quarter of 2023, projecting earnings to range between $2.60 per share and $2.64 per share. This represents a decline from the third quarter of 2023 earnings, which were $3.47 per share, and the prior year's fourth-quarter earnings, which were $3.61 per share.

The expected decrease in profitability for the fourth quarter in the company's steel operations is attributed to lower realized flat rolled steel pricing, outweighing the benefits of reduced scrap costs. Steel order activity, however, remains robust, indicated by extended order lead times and recent pricing increases anticipated for the first quarter of 2024.

In terms of the company's metals recycling operations, fourth-quarter earnings are projected to be comparable with the preceding quarter, with pricing-related metal spread expansion compensating for lower volume. This is attributed to reduced demand from domestic steel mills due to maintenance outages.

For the steel fabrication operations, fourth-quarter earnings are anticipated to be lower than the sequential third-quarter results. This is attributed to decreased shipments and metal spread compression, influenced by declining realized selling values and increased steel input costs during the quarter. Despite this, steel joist and deck order activity have shown improvement compared with the third quarter, and pricing has stabilized.

In the year leading up to Dec 13, 2023, the company has repurchased $1.4 billion, equivalent to almost 8%, of its common stock. Additionally, cash dividends totaling $271 million have been distributed to shareholders during the year.

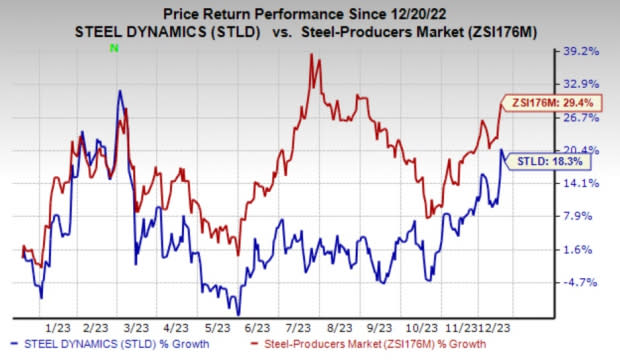

Steel Dynamics’ shares have gained 18.3% in the past year compared with the industry's 29.4% rise in the same period.

Image Source: Zacks Investment Research

In the third quarter of 2023, Steel Dynamics reported earnings of $3.47 per share, down from earnings of $5.03 per share year over year. The figure is slightly below the Zacks Consensus Estimate of earnings of $3.49 per share. Despite challenges like lower steel prices, the company saw resilient steel demand and steady customer orders. Net sales for the quarter were $4,587.1 million, surpassing expectations despite a 19% year-over-year decline from $4,553.8 million, thus reflecting a mixed performance.

Steel Dynamics, Inc. Price and Consensus

Steel Dynamics, Inc. price-consensus-chart | Steel Dynamics, Inc. Quote

Zacks Rank & Key Picks

Steel Dynamics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Axalta Coating Systems Ltd. AXTA, sporting a Zacks Rank #1 (Strong Buy), and Hawkins, Inc HWKN and Alamos Gold Inc. AGI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AXTA’s current-year earnings is pegged at $1.58 per share, indicating year-over-year growth of 6.8%. AXTA beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 6.7%. The company’s shares have increased 34.6% in the past year.

The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised upward by 1.8% in the past 60 days. HWKN beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 27.5%, on average. The stock has rallied around 80.8% in a year.

The consensus estimate for Alamos’ current fiscal year earnings is pegged at 53 cents per share, indicating a year-over-year surge of 89.3%. AGI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 25.6%. The company’s shares have surged 43.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report