STEEL PARTNERS HOLDINGS L.P. Reduces Stake in Aerojet Rocketdyne Holdings Inc

STEEL PARTNERS HOLDINGS L.P. (Trades, Portfolio), a prominent investment firm, recently made a significant transaction in its portfolio. The firm reduced its stake in Aerojet Rocketdyne Holdings Inc (NYSE:AJRD), a leading manufacturer of aerospace and defense products. This article will delve into the details of the transaction, provide an overview of the guru and the traded company, and analyze the potential implications of this move for value investors.

Details of the Transaction

The transaction took place on July 26, 2023, with STEEL PARTNERS HOLDINGS L.P. (Trades, Portfolio) reducing its holdings in Aerojet Rocketdyne by 25.94%. This resulted in a decrease of 933,508 shares, leaving the firm with a total of 2,665,236 shares in the company. The transaction was executed at a price of $57.18 per share, and as of the current date, the stock price stands at $57.99, marking a gain of 1.42% since the transaction. The trade had a -9.69% impact on the guru's portfolio, and the current position of the traded stock in the guru's portfolio is 30.64%.

Profile of the Guru

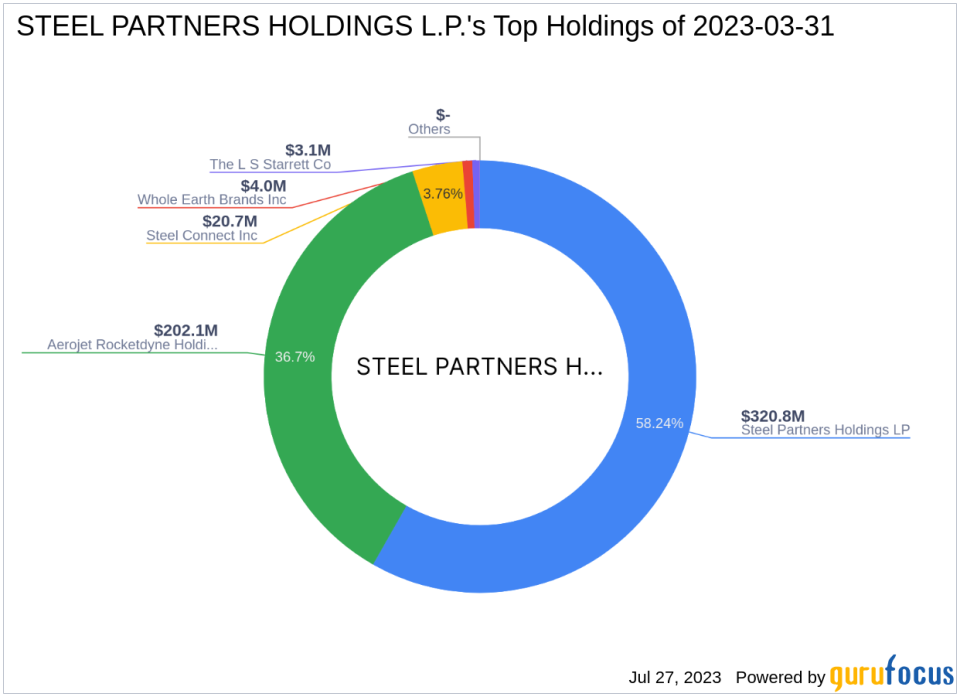

STEEL PARTNERS HOLDINGS L.P. (Trades, Portfolio) is a renowned investment firm based in New York. The firm manages a total equity of $551 million and holds five stocks in its portfolio. Its top holdings include Steel Connect Inc(NASDAQ:STCN), Aerojet Rocketdyne Holdings Inc(NYSE:AJRD), The L S Starrett Co(NYSE:SCX), Steel Partners Holdings LP(NYSE:SPLP), and Whole Earth Brands Inc(NASDAQ:FREE). The firm is primarily invested in the Industrials and Communication Services sectors.

Overview of Aerojet Rocketdyne Holdings Inc

Aerojet Rocketdyne Holdings Inc, based in the USA, has been a key player in the aerospace and defense industry since its IPO in 1992. The company manufactures driving and launch systems for defense and space applications, weapons, and weapons systems for tactical missions. It operates in two segments: aerospace and defense, and real estate. The company's market capitalization stands at $4.68 billion. According to GuruFocus, the company is modestly overvalued with a GF Value of $48.62 and a Price to GF Value ratio of 1.19. The company's GF Score is 73/100, indicating good outperformance potential.

Analysis of Aerojet Rocketdyne Holdings Inc.'s Financials

Aerojet Rocketdyne Holdings Inc. has a PE ratio of 63.73. The company's balance sheet, profitability, and growth ranks are 7/10, 6/10, and 4/10 respectively. The company's cash to debt ratio is 0.82, ranking it 137th in the Aerospace & Defense industry. The company's ROE and ROA are 13.44 and 3.12 respectively, with ranks of 67 and 119 in the industry.

Comparison with Other Gurus

GAMCO Investors is the guru with the most shares in Aerojet Rocketdyne Holdings Inc. Other gurus who also hold the stock include First Eagle Investment (Trades, Portfolio).

Conclusion

In conclusion, STEEL PARTNERS HOLDINGS L.P. (Trades, Portfolio)'s recent transaction in Aerojet Rocketdyne Holdings Inc. represents a significant shift in its portfolio. The impact of this transaction on the guru's portfolio and the stock's performance will be closely watched by value investors. As always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

This article first appeared on GuruFocus.