Steel Partners Holdings LP Reports Solid Q4 and Full Year 2023 Financial Results

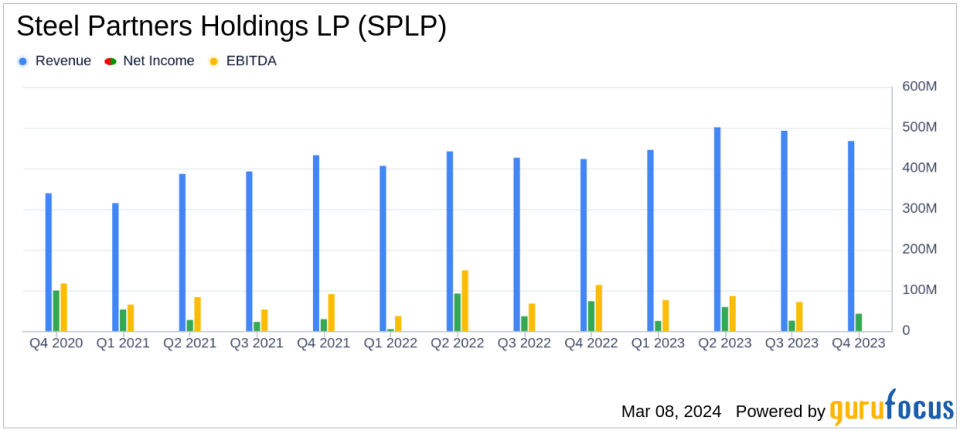

Q4 Revenue: Increased to $466.9 million, up 10.5% from Q4 2022.

Full Year Revenue: Rose to $1.9 billion, a 12.4% increase year-over-year.

Q4 Net Income: Reported at $42.7 million, with $41.3 million attributable to common unitholders.

Full Year Net Income: Totaled $154.0 million, with $150.8 million attributable to common unitholders.

Adjusted EBITDA: Q4 at $59.4 million and full year at $240.6 million, showcasing operational efficiency.

Adjusted Free Cash Flow: Demonstrated strong liquidity with $87.6 million in Q4 and $236.0 million for the full year.

Total Debt and Net Cash: Ended the year with $191.4 million in total debt and a net cash position of $56.4 million.

On March 8, 2024, Steel Partners Holdings LP (NYSE:SPLP) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, which operates across a diverse range of industries including industrial products, energy, defense, supply chain management, logistics, and banking, has reported a robust set of financial results, underlining its resilience and strategic growth initiatives.

Financial Highlights and Operational Performance

For the fourth quarter of 2023, SPLP's revenue totaled $466.9 million, a 10.5% increase from the same period in the previous year. This growth was primarily driven by the favorable impact of the recently added Supply Chain segment and higher revenue from the Financial Services segment. The full year revenue saw an even more significant increase, totaling $1.9 billion, up 12.4% from 2022. This increase was attributed to higher revenue from the Financial Services segment and the positive impact of the Supply Chain segment.

Net income for the fourth quarter stood at $42.7 million, with net income attributable to common unitholders at $41.3 million, or $1.75 per diluted common unit. For the full year, net income was reported at $154.0 million, with $150.8 million attributable to common unitholders, translating to $6.43 per diluted common unit. Despite a decrease in net income compared to the previous year, the company's profitability metrics such as Adjusted EBITDA and Adjusted free cash flow showed strength, with Adjusted EBITDA for the full year at $240.6 million and Adjusted free cash flow at $236.0 million.

Challenges and Strategic Outlook

While SPLP's diverse operations have contributed to its robust financial performance, the company also faced challenges such as lower sales from the Diversified Industrial segment and lower revenue from the Energy segment. The company's cost of goods sold and selling, general, and administrative expenses also saw increases, reflecting the impact of the newly added Supply Chain segment and higher expenses in the Financial Services segment.

Despite these challenges, SPLP's strategic acquisitions and operational efficiency have positioned it well for future growth. The company's liquidity and capital resources remain strong, with $399.3 million in available liquidity under its senior credit agreement and a net cash position of $56.4 million, an increase from the previous year. This financial stability is crucial for SPLP's ability to navigate market uncertainties and invest in growth opportunities.

Investor Considerations

For value investors, SPLP's financial achievements, including its increased revenue and strong liquidity position, are important indicators of the company's ability to generate value and sustain growth. The Adjusted EBITDA margin of 12.6% for the full year reflects the company's operational efficiency, which is a key consideration for investors looking at conglomerates with diverse business segments.

Steel Partners Holdings LP's performance in 2023 demonstrates its strategic focus and ability to adapt to market conditions. With a solid financial foundation and a diversified portfolio, SPLP continues to be an intriguing prospect for investors seeking exposure to a range of industries through a single investment vehicle.

For a detailed breakdown of SPLP's financial results and further insights into the company's performance, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Steel Partners Holdings LP for further details.

This article first appeared on GuruFocus.