Steel Prices Rise As Supply Tightens

Via Metal Miner

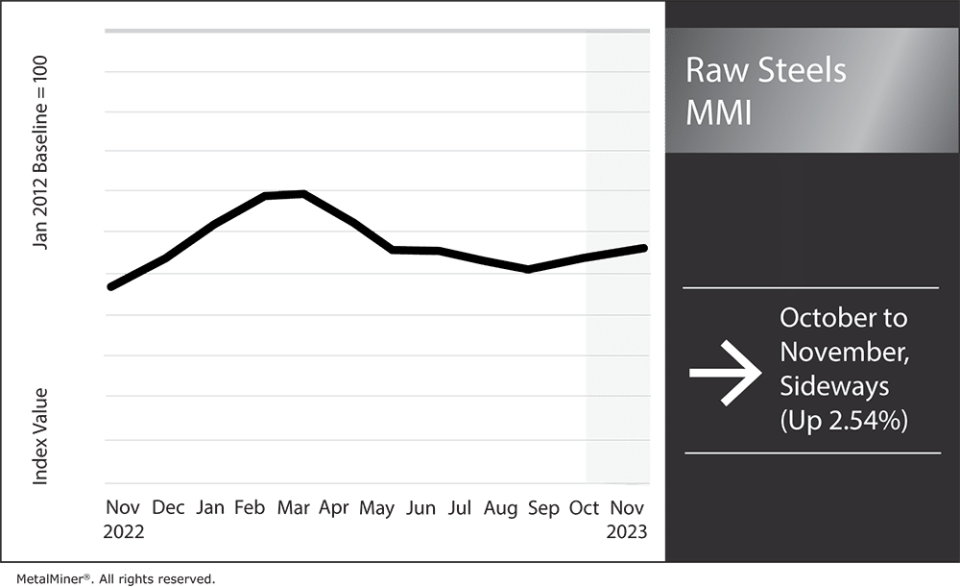

The Raw Steels Monthly Metals Index (MMI) rose 2.53% from September to October. Roughly six weeks ago, U.S. steel prices found a bottom at the close of September. However, in October, the market shifted, leading to a nearly 17% rise in HRC prices as they retraced back to their August range. Both CRC and HRC steel prices followed HRC prices up, with respective 13% and 12% increases. Plate proved the only exception, as prices continued to edge lower with an almost 3% month-over-month decline.

Steelmakers Secure Six Week Price Uptrend

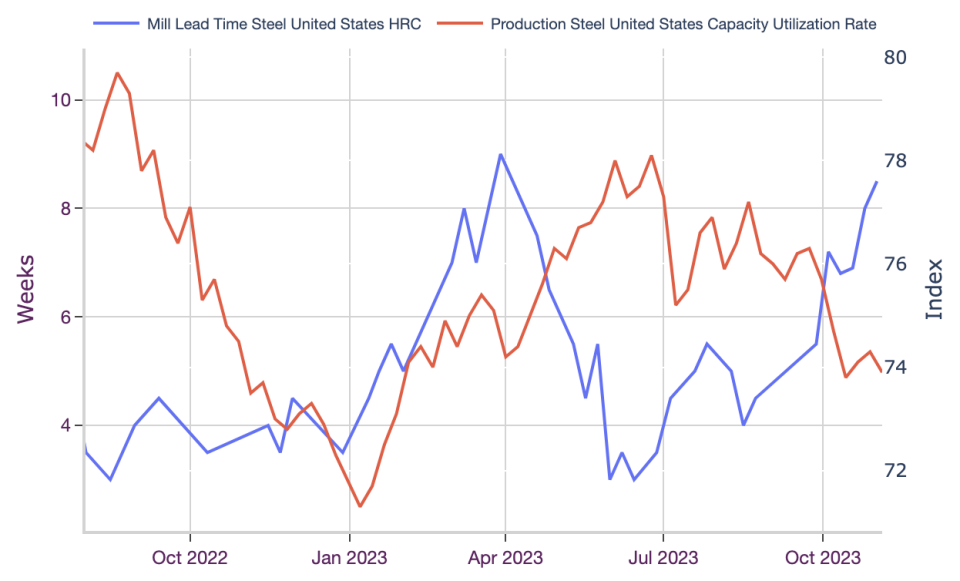

U.S. steelmakers managed to shift the price trend this past month, even as the auto sector grappled with the since-resolved UAW strikes. Maintenance-related outages saw the domestic raw steel capacity utilization rate fall to 73.8% during the third week of October, its lowest since January. Although it has subsequently seen a modest rebound, the capacity utilization rate fell back to 73.9% during the first week of November.

Tighter supply also saw mill lead times trend longer throughout the month. HRC mill lead times continued to increase from June, when they shortened to a near-all-time low of three weeks. By the close of October, lead times had nearly tripled from their June figures. In fact, they recently hit their longest average since April, their last major uptrend. Although some service centers still report December availability, average mill lead times have since extended into 2024.

Mill lead times and the domestic steel capacity utilization rate have an inverse correlation. Historically, as steel producers lower capacity, tighter supply leads to longer mill lead times.

Source: MetalMiner Insights, Chart & Correlation Tool

Lower production levels and longer mill lead times appeared enough for steelmakers to secure price increases. After Cleveland-Cliffs initiated the new round of price hikes for flat rolled steel in late September, Nucor, ArcelorMittal Dofasco, Stelco, and U.S. Steel followed suit. Meanwhile, Cliffs also issued two subsequent price increases, which by the close of October, brought Cliffs’ minimum HRC steel price to $900 per ton, the top of the domestic market.

Are you on the hook for communicating the company’s steel performance to the executive team? See what should be in that report!

How Long Will Steel Prices Continue to Rise?

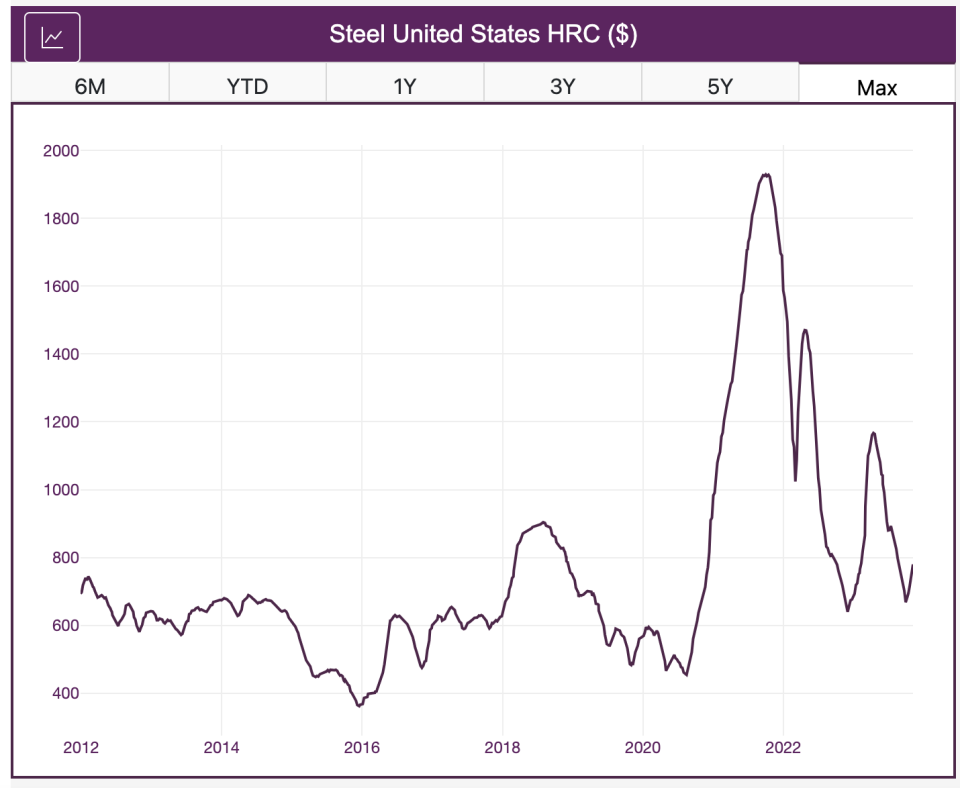

As they often say, “the trend is your friend,” and considering the most recent uptrends, steel prices may have further upside before they peak. The last three major uptrends, which began in August 2020, March 2022, and December 2022, lasted for 61 weeks, 7 weeks, and 21 weeks, respectively. This equates to an average of 30 weeks. Prior to the major uptrend 2020, price action appeared more dynamic. Week-over-week increases lasted an average of 4.3 weeks.

While the length of the historic post-pandemic uptrend remains atypical of historical steel price action, market consolidation over recent years appears to have given steelmakers greater leverage to sustain rising steel prices than in years past. Obviously, not every price hike issued by steelmakers translates to an increase in overall prices. Still, the last three uptrends suggest that when both prices and the 15-day moving average breach short-term resistance levels with enough strength, prices will likely form a sustained uptrend.

Source: MetalMiner Insights

Manufacturing Sector, Employment Suggest Downside Risk

Despite tighter supply and strong bullish technical signals, risks remain to the downside. This could foil steelmaker attempts to keep prices higher for longer. Furthermore, the manufacturing sector fell deeper into contraction during October, marking 12 consecutive months of decline. Both employment and new orders dropped, suggesting no turnaround in consumer demand that would support steel demand and, in turn, prices.

This suggests that the fate of the current uptrend will likely depend upon market discipline among steelmakers. The capacity utilization rate already started to rebound by late October. Although they have yet to, mill lead times will likely begin to retrace should that rate continue to rise. Amid a challenging economic environment, this could translate to an intentionally suppressed production levels, should mills wish to keep the market balance tight.

Meanwhile, overall employment also showed signs of weakening during the month, which could further weigh on consumer demand. While still historically low, the unemployment rate rose to 3.9%, its highest level since January 2022. According to data from the Bureau of Labor, among the 19 major sectors, durable goods manufacturing ranked eighth for the most layoffs during the month.

Sectors Offering Steel Demand

Professional and business services, accommodation and food services, and construction sectors saw the most layoffs. Interestingly, the construction and services sector has long proved resilient, seemingly offsetting weakness in the manufacturing sector and helping to support consumer demand. These sector helped the U.S. secure a 4.9% growth in GDP during the third quarter. Meanwhile, construction, specifically, has also offered steady demand for metals, including steel, throughout the year.

Should the latest employment data mean that once-resilient sectors have peaked, consumer demand could fall further amid higher unemployment rates. This would offer a new challenge to steelmakers looking to sustain the uptrend, especially with the market entering the historically slow end-of-year season.

By Nichole Bastin

More Top Reads From Oilprice.com: