Steelcase Inc (SCS) Reports Robust Earnings Growth in Fiscal 2024

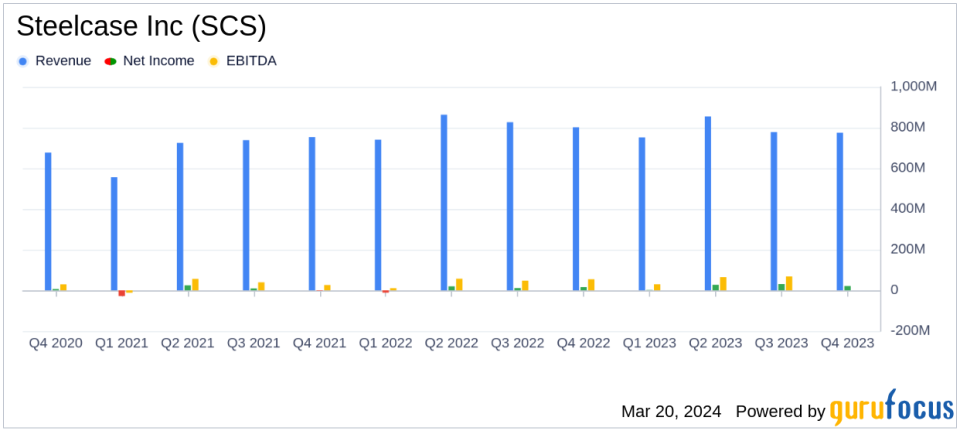

Revenue: Fiscal 2024 revenue slightly declined by 2% year-over-year, with a total of $3.2 billion.

Net Income: Net income surged to $81.1 million, a significant increase from the previous fiscal year.

Earnings Per Share (EPS): EPS saw a remarkable rise of 127% to $0.68 in fiscal 2024, compared to $0.30 in fiscal 2023.

Gross Margin: Gross margin improved by 360 basis points over the fiscal year, highlighting operational efficiencies.

Liquidity: Total liquidity increased by $238 million, demonstrating a stronger financial position.

Order Growth: Orders grew by 4% in Q4, with an 8% increase in the Americas, signaling robust demand.

On March 20, 2024, Steelcase Inc (NYSE:SCS) released its 8-K filing, announcing the fourth quarter and full fiscal year 2024 results. The company, a leading furniture entity with a global presence, operates through segments in the Americas and EMEA, offering a wide range of products to corporate, government, healthcare, education, and retail customers.

Despite a slight revenue decline of 2% in fiscal 2024, Steelcase Inc (NYSE:SCS) showcased a robust increase in net income and earnings per share (EPS). The company's net income more than doubled from the previous year, reaching $81.1 million, with EPS climbing to $0.68, a 127% increase from fiscal 2023. This performance underscores the company's ability to enhance profitability in a challenging economic environment.

Financial Highlights and Challenges

Steelcase Inc (NYSE:SCS) reported a gross margin improvement of 360 basis points for fiscal 2024, reflecting the company's operational improvements and pricing benefits. The fourth quarter saw orders grow by 4%, driven by an 8% growth in the Americas, which the company attributes to large corporate customers investing in inspiring workplaces. However, the International segment experienced a 6% decline in orders, with macroeconomic factors affecting markets in EMEA and China.

The company's adjusted operating income for fiscal 2024 was $157.5 million, a $50.0 million increase from the previous year, driven by pricing benefits and operational improvements, despite lower volume and higher operating expenses. Steelcase Inc (NYSE:SCS) also strengthened its liquidity position, ending the fiscal year with $485.5 million in cash and equivalents, a $238 million increase from the prior year.

Income Statement and Balance Sheet Metrics

Steelcase Inc (NYSE:SCS) reported fourth-quarter revenue of $775.2 million and net income of $21.3 million, or $0.18 per share. The adjusted EPS was $0.23, compared to $0.19 in the prior year. The company's gross margin for the quarter increased to 31.2%, and operating expenses rose to $213.5 million, reflecting higher variable compensation expense and divestitures.

The balance sheet shows a solid financial position, with total liquidity of $485.5 million and total debt at $446.3 million. The trailing four-quarter adjusted EBITDA of $264.0 million represents a 26% increase from the prior year, indicating strong earnings before interest, taxes, depreciation, and amortization.

Our fiscal 2024 results reflected our efforts to recover the inflationary pressure on costs from the previous two years and drive improved profitability," said Sara Armbruster, president and CEO of Steelcase Inc (NYSE:SCS). "We delivered a 360 basis point improvement in gross margin, and we more than doubled our earnings per share."

Outlook and Future Performance

Looking ahead, Steelcase Inc (NYSE:SCS) provided financial targets for fiscal 2025, expecting organic revenue growth of 1 to 5 percent and adjusted operating income between $150 to $175 million. The company anticipates adjusted EPS to range from $0.85 to $1.00 for the fiscal year. These targets are based on assumptions of mid-single digit order growth, an improvement in gross margin, and increased operating expenses due to strategic investments.

The company's backlog of customer orders at the end of the fourth quarter was approximately $625 million, 8 percent lower than the previous year. However, orders in the first three weeks of the first quarter of fiscal 2025 grew by 10 percent compared to the prior year, suggesting a positive start to the new fiscal year.

Steelcase Inc (NYSE:SCS) continues to focus on leading the transformation of the workplace and diversifying its customer and market segments. With a strong fiscal 2024 performance and a positive outlook for the coming year, the company is well-positioned to capitalize on the evolving needs of the modern workplace.

Explore the complete 8-K earnings release (here) from Steelcase Inc for further details.

This article first appeared on GuruFocus.