Steer Clear of Federal Signal

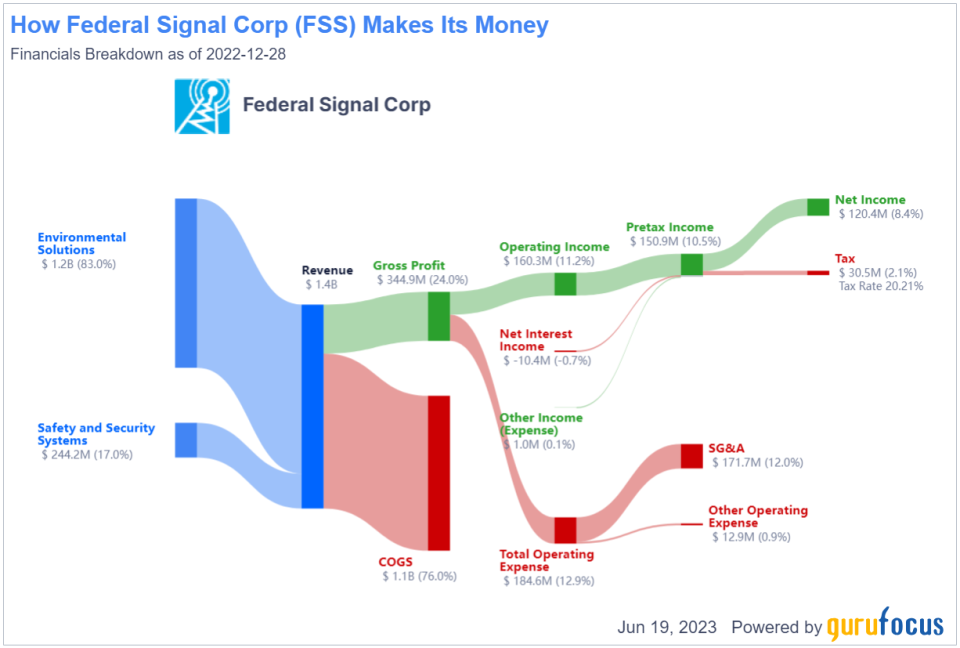

Federal Signal Corp. (NYSE:FSS) is a leading manufacturer that caters to a diverse range of customers, including municipalities, government agencies, industrial sectors and commercial enterprises. To effectively manage its operations, the company runs through two key segments: the Environmental Solutions Group and the Safety and Security Systems Group.

Under the Environmental Solutions Group, Federal Signal focuses on manufacturing a comprehensive lineup of equipment, including street sweepers, sewer cleaners, industrial vacuum loaders, safe-digging trucks, road-marking and line-removal equipment, as well as dump truck bodies.

The Safety and Security Systems Group is another integral part of the company's operations, specializing in producing cutting-edge public safety equipment, such as vehicle lightbars, sirens, industrial signaling devices, public warning systems and general alarm/public address systems.

Federal Signal has been performing exceptionally well, with its share price displaying remarkable growth. Year to date, the stock has surged by approximately 34%, surpassing the 15% increase seen in the S&P 500 Index. This impressive performance can be attributed to exceptional financial results in the fourth quarter of 2022 and first quarter of 2023.

Federal Signal recorded 16.70% year-over-year revenue growth in the first quarter. This positive trend can be attributed to improvements in supply chain constraints, robust price realization and strategic acquisitions of notable companies like Ground Force, TowHaul and Blasters. Moreover, it achieved a noteworthy improvement in its adjusted Ebitda margin, which increased by 130 basis points year over year to reach 14.10% in the first quarter due to increased sales volume and higher price realization.

Near-term outlook

In the first quarter, Federal Signal saw significant growth in its order book, demonstrating the strong demand for its products and aftermarket offerings. The order book recoded a 5% year-over-year increase, reaching an impressive value of $475 million. Additionally, the order backlog experienced substantial growth, soaring by 29% year over year to $968 million. This exceptional expansion can be attributed to the sustained healthy demand for Federal Signal's products across various market segments. The Safety and Security Systems Group witnessed a notable 21% year-over-year increase in its order book due to a significant fleet order for public safety equipment from a customer in Mexico. The Environmental Solutions Group, on the other hand, observed a 2% year-over-year increase in its order book, reaching a value of $396 million.

Notably, during the first quarter, Federal Signal experienced a remarkable 17% increase in production at two of its manufacturing facilities within the Environmental Solutions Group segment compared to the previous quarter. Looking ahead to the remainder of 2023, I believe Federal Signal is well-positioned to sustain its revenue growth. The healthy order backlog and the ongoing improvements in supply chain constraints are expected to contribute positively to the company's performance.

Long-term outlook

Over the years, Federal Signal has strategically positioned itself for long-term growth by implementing various initiatives. The company has made substantial investments in expanding its manufacturing facilities, fostering new product development and executing strategic acquisitions, all of which have broadened the product portfolio and expanded its geographic reach.

In the Environmental Solutions Group, Federal Signal continues to benefit from the American Rescue Plan Act of 2021, which allocated $350 billion for the maintenance of essential infrastructure by state, local and territorial governments. This funding has positively impacted Federal Signal, especially in areas such as sewer systems, streets and broadband. Moreover, the Infrastructure Investment and Jobs Act (IIJA), with its $1.2 trillion investment, should further drive Federal Signal's growth in the coming years. Of this investment, $550 billion has been earmarked for new ventures in roads, bridges, power, water, broadband infrastructure, public transportation and airports. The rising demand and expenditure on broadband infrastructure has led to increased interest in Federal Signal's safe digging products.

In the Safety and Security Systems Group business, Federal Signal acquired the University Park facility, enabling the company to bring production of key components in-house and reduce reliance on overseas suppliers. One notable achievement resulting from this move is the in-house production of the MicroPulse line, a highly efficient LED lighting product with a low-profile design. By introducing this in-house production line, Federal Signal has not only improved its profit margins but also generated an additional operating income of approximately $1.5 million in 2022, with further growth projected for 2023. Additionally, Federal Signal has invested in a third printed circuit board manufacturing line at University Park, set to become operational in 2023. These strategic actions taken by the company to address component shortages are expected to yield significant long-term benefits.

In the Safety and Security Systems Group segment, the company has witnessed heightened demand for warning systems as well. Under the Infrastructure Act, the Federal Management Agency has been allocated $6.8 billion for disaster mitigation programs. Over the next five years, FEMA will provide hazard mitigation assistance to local governments through the STORM Act, with funding projected to increase by 50% annually compared to the previous annual allocation of approximately $50 million for tornado, flood and fire warning projects. Federal Signal is well-positioned to capitalize on this increased funding, particularly in the warning systems sector.

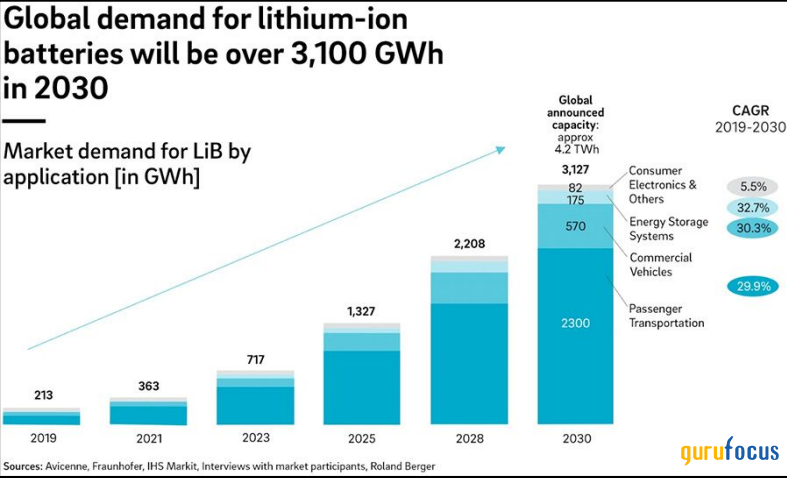

Federal Signal has also embraced the growing trend of electrification, having recently introduced its new vehicle electrification offerings in the first quarter of 2023. With a focus on vehicle electrification and other green initiatives, Federal Signal anticipates a surge in demand for its electric vehicle (EV) product offerings, alongside a corresponding increase in long-term demand for lithium batteries. The acquisitions of Ground Force and TowHaul have further strengthened Federal Signal's position in the extraction of metals and minerals, including lithium.

On the mergers and acquisitions front, Federal Signal has completed significant deals, including the acquisitions of Blasters in January and Trackless in April 2023. Blasters, a leading manufacturer of truck-mounted water-blasting equipment, fills critical product gaps in the road marking and line-removal businesses while also establishing a Florida location for additional aftermarket opportunities. Meanwhile, Trackless, a reputable Canadian manufacturer of multipurpose off-road municipal tractors and attachments, enhances Federal Signal's capabilities in serving the municipal sector.

With its robust investments, strategic acquisitions and forward-thinking initiatives, Federal Signal has laid a solid foundation for sustained growth. The company's expanded product offerings, in-house production capabilities and ability to capitalize on government initiatives and market trends position Federal Signal to thrive in the evolving landscape of safety, security and infrastructure solutions.

Valuation

Despite all the positives, we hit a snag with Federal Signal on the valuation front.

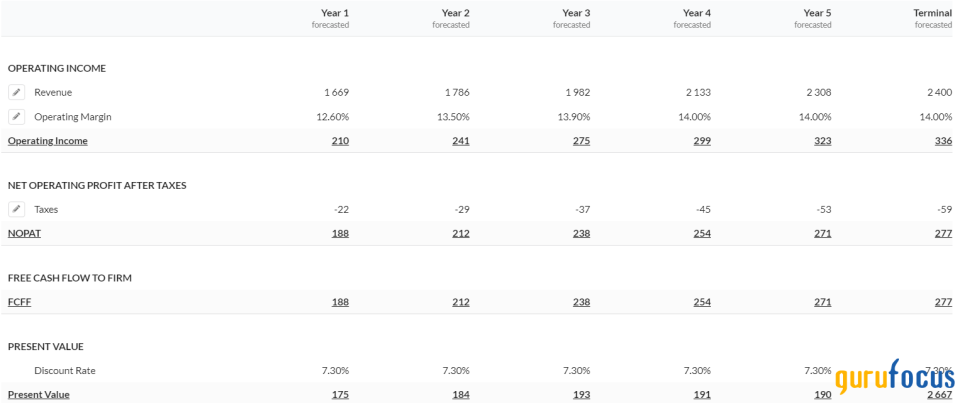

In my discounted cash flow calculations using my own personal model, I am assuming revenue growth to be low double digits in 2023, given the healthy order backlog, strong order book and acquisitions. Beyond 2023, I have assumed growth to be in the high-single digits, with a terminal growth rate in the mid-single digits, as the company will continue to benefit from funding from the IIJA, M&As and new product development. I used a discount rate of 7.30% and arrived at a fair value estimate of $47.14 for Federal Signal.

Using the relative valuation, if we use the analyst consensus earnings per share estimate of $2.36 for 2023, we get a forward price-earnings ratio of 26.42, and if we use the consensus earnings per share estimate of $2.74 for 2024, we get a forward price-earnings ratio of 22.70. These values are significantly above the company's five-year average forward price-earnings ratio of 20.02.

Conclusion

In summary, Federal Signal has demonstrated strong growth prospects and positioned itself well for long-term success through various strategic initiatives. However, despite the strong near-term and long-term growth prospects, I believe it would be best to remain on the sidelines for now given the expensive valuation.

This article first appeared on GuruFocus.