Stellar Bancorp Inc (STEL) Posts Solid Year-End Earnings Despite Economic Headwinds

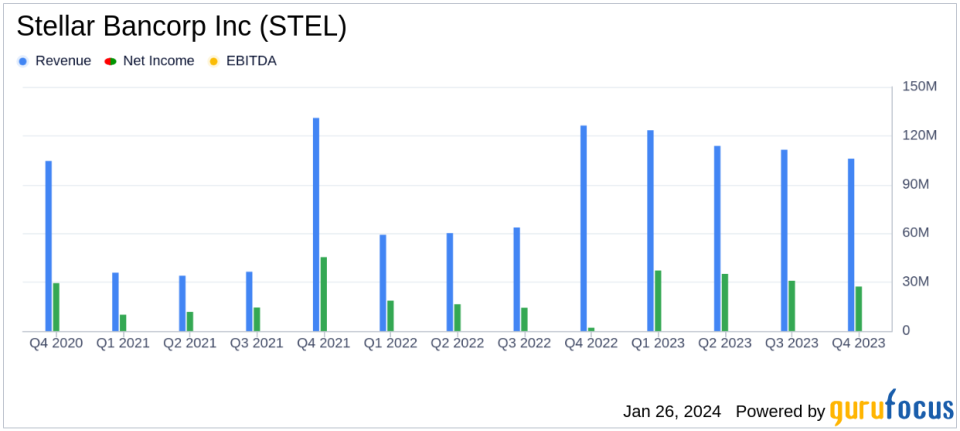

Net Income: STEL reported a net income of $27.3 million for Q4 and $130.5 million for the full year.

Earnings Per Share: Diluted earnings per share stood at $0.51 for Q4 and $2.45 for the full year.

Net Interest Margin: Tax equivalent net interest margin was 4.40% for Q4, showing an increase from the previous quarter.

Capital Ratios: Total risk-based capital ratio improved to 14.02% at the end of 2023.

Book Value Growth: Book value per share increased to $28.54, with tangible book value per share rising by 21.4%.

On January 26, 2024, Stellar Bancorp Inc (NYSE:STEL) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The U.S.-based bank holding company, which focuses on commercial banking solutions for small and mid-sized businesses, reported a net income of $27.3 million for the fourth quarter and $130.5 million for the year, indicating a robust performance amidst challenging economic conditions.

STEL's Chief Executive Officer, Robert R. Franklin, Jr., expressed satisfaction with the company's performance, highlighting the successful integration of two banks following a merger and the maintenance of a solid net interest margin and strong deposit base. Despite the slower economy anticipated in 2024, Franklin remains optimistic about the company's position to capitalize on potential opportunities.

Financial Performance and Challenges

STEL's financial achievements in 2023, including a meaningful regulatory capital build and book value growth, are significant for the banking industry, which values stability and growth in shareholder equity. The company's advantageous funding profile, with noninterest-bearing deposit balances comprising 40% of total deposits, provides a cost-effective source of capital.

However, the company faced challenges, including nonrecurring noninterest expense items such as the FDIC special insurance assessment expense of $2.4 million. These expenses contributed to an increased efficiency ratio of 69.21% for Q4 compared to 63.50% for the previous quarter. Additionally, the company's asset quality metrics, such as nonperforming assets to total assets, stood at 0.37%, a slight increase from the previous quarter.

Income Statement and Balance Sheet Summary

STEL's net interest income for Q4 decreased slightly by 0.7% to $105.9 million from the previous quarter, while the tax equivalent net interest margin saw a slight increase. Noninterest income for Q4 rose by 46.7% to $6.9 million, primarily due to Small Business Investment Company income. Noninterest expense for Q4 increased by 10.2% to $77.9 million, largely due to nonrecurring items.

For the full year, net interest income increased by 51.1% to $436.8 million, and the net interest margin on a tax equivalent basis increased by 57 basis points to 4.51%. Noninterest income for the year increased by 20.7% to $24.6 million, while noninterest expense increased by 48.2% to $290.5 million.

STEL's balance sheet reflects a decrease in total loans to $7.93 billion at the end of 2023, while total deposits increased to $8.87 billion. The company's total assets slightly decreased to $10.65 billion.

Looking Ahead

STEL's performance in 2023 demonstrates resilience and strategic growth, positioning the company well for the future. The bank's focus on optimizing and reducing noninterest expenses, coupled with a strong capital position, suggests a readiness to navigate the anticipated slower economy in 2024. Investors and stakeholders can look forward to STEL's continued efforts to build shareholder value in the coming year.

For a detailed analysis of Stellar Bancorp Inc's financial results, including full financial tables and metrics, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Stellar Bancorp Inc for further details.

This article first appeared on GuruFocus.