Steps to Managing Risks and Increasing Defenses

This article was originally published on ETFTrends.com.

Executive Summary

Similar to the one-year lag in inflation taking hold as a result of too much stimulus, we expect the U.S. Federal Reserve (the Fed) to continue their tightening policy until well after the point that additional tightening is necessary. The most obvious reason to expect economic turmoil is that the full effects of the substantial monetary tightening over 2022 have yet to be realized. In our opinion, the Fed has not sufficiently recognized that it has already won the inflation battle. As a result, we think the Fed will continue increasing interest rates and increasing economic risks.

Under this scenario, we have adjusted our Strategies to potentially provide some more protection from the fallout of an overly tight monetary policy. We are holding more cash than normal and have added to positions that we think can benefit in this scenario. In general, we are broadly underweight equity exposure, and our current exposure favors the more defensive areas that tend to do relatively well in this type of environment. Additionally, we have increased our exposure to longer-term Treasury bonds, which can benefit from falling long-term interest rates.

Recent Activity

We recently increased our existing allocations to equity ETFs that are focused on defensive sectors and earnings consistency while our Strategies are also holding slightly more cash. Our base case is for a mild recession in the U.S., a steeper downturn in Europe, and continuing struggles in other foreign economies.

[wce_code id=192]

With the economic outlook for 2023 increasingly uncertain, we placed a premium on consistency and think these adjustments will make our Strategies more resilient.

Similar to the one-year lag in inflation taking hold as a result of too much stimulus, we expect the U.S. Federal Reserve (the Fed) to continue their tightening policy until well after the point that additional tightening is necessary. In fact, we think that tipping point has already passed. Inflationary pressures are easing, and the Fed will likely push the economy into recession in 2023.

The most obvious reason to expect economic turmoil is that the full effects of the substantial monetary tightening over 2022 have yet to be realized. Still, we can see the impact of Fed policy on two of our favorite long lead-time indicators, the yield curve and broad money growth. With both flashing cautionary signals since last spring and summer respectively, we think the Fed should have paused its rate hikes last summer.

The yield curve, which is the difference between long-term and short-term interest rates, tends to anticipate changes in the pace of economic growth. A steepening curve suggests faster economic growth ahead. Conversely, an inverted curve, which we have experienced since last summer, suggests an impending economic recession. Additionally, the growth rate of broad money, which led the spike in inflation by more than a year, has also collapsed. The pace of inflation will soon follow the decline in broad money growth, and the impending recession makes this even more likely (exhibit 1).

In fact, the market already anticipates some easing of inflationary pressure. For example, market-based inflation expectations for the next 5- and 10-year periods have declined to levels that are consistent with the Fed achieving its stated target of 2% average inflation. Note that Core Personal Consumption Expenditures (PCE), which is the Fed’s favored inflationary measure, tends to trail the Consumer Price Index (CPI). The market’s expectations for CPI over the next five and 10 years are consistent with the Fed having already reached its goal.

In our opinion, the Fed has not sufficiently recognized that it has already won the inflation battle. As a result, we think the Fed will continue increasing interest rates and increasing economic risks. We rarely forecast recessions, but our work suggests that we are approaching one of those times. Since the end of World War II, we have experienced 12 recessions, so once every six years or so on average.

Over that same period since WWII, the equity market has experienced roughly 29 corrections and 13 bear markets, which means 42 significant declines, or one roughly every 18 months on average. This phenomenon of such a greater occurrence of bear markets and corrections than actual recessions inspired the saying that “the equity market has predicted nine of the past five recessions.” Historically, equity market declines alone are not indicative of a pending recession.

In recent months, our view has shifted from the opinion that the U.S. would most likely avoid a recession in the near-term to now suggesting that a U.S. recession is the most likely outcome during 2023. However, that does not mean investors need to be running for the exits. As we have continually pointed out in various publications, the economy is not the market. In fact, it is very important to keep in mind that the stock and bond markets are leading indicators that attempt to price in economic eventualities. From an investment standpoint, we think a well applied economic outlook combined with a dynamic investment process can uncover opportunities across both stock and bond markets in any economic environment.

Investment Implications

As a result, we have adjusted our Strategies to potentially provide some more protection from the fallout of an overly tight monetary policy. Recently, we slightly increased our cash positions and added to holdings that we think can benefit in this scenario. In general, we are broadly underweight equity exposure, and our current exposure favors the more defensive areas, such as health care and consumer staples, that tend to do relatively well in this type of environment. Furthermore, we have been adding positions, such as managed futures, and picking up attractive yields form longer-term Treasury bond ETFs, which can benefit from falling long-term interest rates. We expect long-term interest rates to continue to decline alongside inflationary pressures and slowing economic growth. Lastly, we expect the Fed to start cutting short-term interest rates later in 2023, and our dynamic tactical approach gives us the flexibility to adjust accordingly.

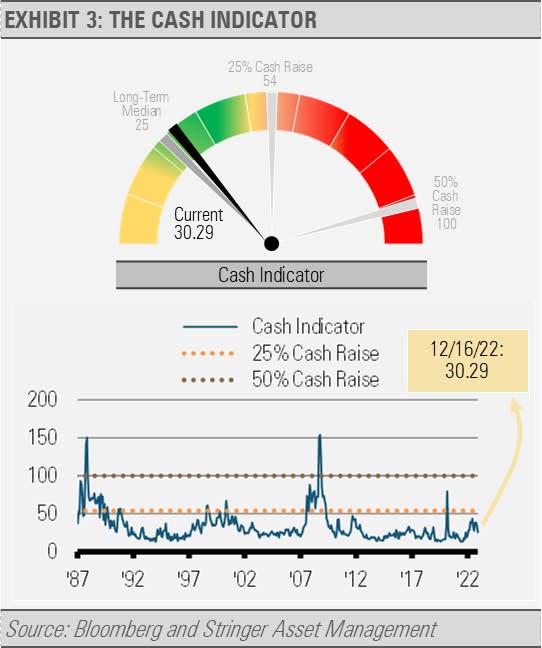

The Cash Indicator

The Cash Indicator (CI) is close to its long-term median level. This CI level suggests that, despite the economic risks in our forecast, the markets are not at risk of a collapse in the near-term. Rather, the situation looks more similar to the economic and market disruptions of 1990-1991.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM