StepStone Group Inc (STEP) Reports Q3 Fiscal Year 2024 Results: A Mixed Financial Performance

Management and Advisory Fees: Increased by 18% year-over-year to $151.5 million.

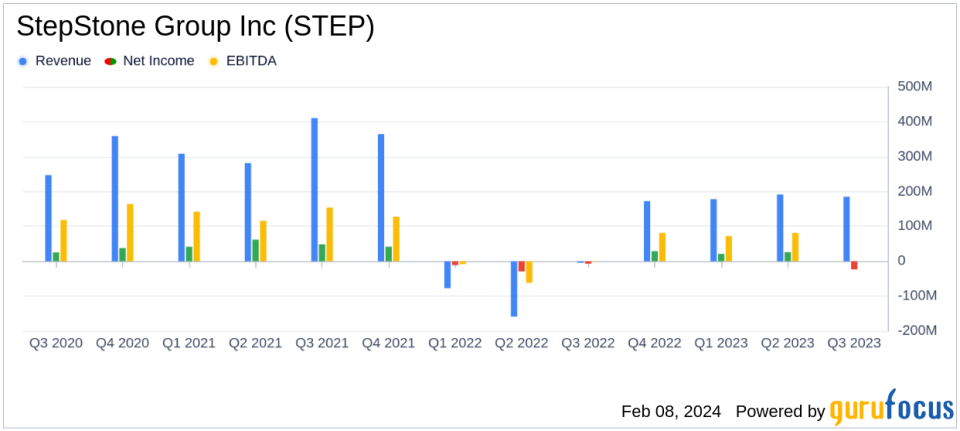

Total Revenues: Experienced a significant fluctuation, with a 245% increase compared to the previous quarter but a notable decline against the third quarter of the previous year.

Net Income: Reported a net loss of $23.4 million, contrasting with a net income of $59.3 million in the previous quarter.

Dividend: Quarterly cash dividend maintained at $0.21 per share of Class A common stock.

AUM Growth: Assets under management (AUM) grew by 11% year-over-year to $149 billion.

Non-GAAP Measures: Adjusted net income per share increased by 37% to $0.37, reflecting a stronger performance on an adjusted basis.

On February 8, 2024, StepStone Group Inc (NASDAQ:STEP) released its 8-K filing, detailing the financial results for the third quarter of the fiscal year ending March 31, 2024. The global private markets investment firm reported an 18% year-over-year increase in management and advisory fees, net, which rose to $151.5 million. However, total revenues saw a significant fluctuation, with a 245% increase compared to the previous quarter but a notable decline against the third quarter of the previous year. The company reported a net loss of $23.4 million, contrasting with a net income of $59.3 million in the previous quarter.

Despite the mixed financial performance, StepStone Group maintained its quarterly cash dividend at $0.21 per share of Class A common stock, payable on March 15, 2024. The company's assets under management (AUM) grew by 11% year-over-year to $149 billion, indicating a continued expansion of its asset management operations.

From a non-GAAP perspective, StepStone Group reported an adjusted net income per share increase of 37% to $0.37, reflecting a stronger performance on an adjusted basis. This metric is particularly important for value investors as it excludes certain non-recurring items and provides a clearer picture of the company's operating profitability.

Financial Statement Highlights

The company's balance sheet as of December 31, 2023, showed cash and cash equivalents of $139.97 million. The total assets were reported at $3.47 billion, while total liabilities stood at $1.80 billion. The balance sheet also reflected a significant amount of accrued carried interest allocations, amounting to $1.20 billion, which represents potential future income contingent upon the realization of underlying investments.

StepStone Group's income statement for the quarter ended December 31, 2023, highlighted the challenges faced in performance fees, with a total performance fee loss of $166.1 million. This was primarily due to unrealized carried interest allocations, which can be volatile and dependent on market conditions.

Analysis and Outlook

The increase in management and advisory fees is a positive indicator of StepStone Group's ability to grow its core business operations. However, the volatility in total revenues and the reported net loss underscore the challenges faced in the performance fee segment, which can be impacted by market fluctuations and the timing of investment realizations.

The company's growth in AUM is a critical metric for the asset management industry, as it often correlates with potential future revenue streams from management fees. The maintenance of the dividend also signals a commitment to shareholder returns, which may be appealing to value investors looking for steady income.

Overall, StepStone Group's third-quarter results present a mixed financial picture, with strong growth in management fees offset by challenges in performance fees. The company's ability to continue expanding its AUM and maintaining dividends will be key factors to watch in the coming quarters.

For detailed financial tables and a complete analysis of StepStone Group's performance, investors and interested parties are encouraged to review the full 8-K filing.

Value investors and potential GuruFocus.com members seeking further insights and investment opportunities can find comprehensive financial news and analysis on GuruFocus.com.

Explore the complete 8-K earnings release (here) from StepStone Group Inc for further details.

This article first appeared on GuruFocus.