Stericycle Inc (SRCL) Reports Decline in Q4 Earnings Amid Operational Challenges

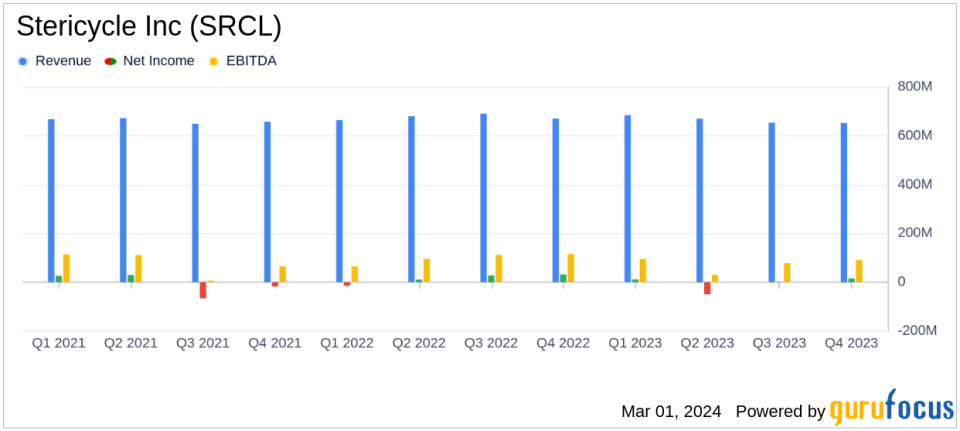

Revenue: $652.0 million in Q4 2023, down 2.7% from $670.4 million in Q4 2022.

Net Income: Decreased to $14.9 million in Q4 2023 from $31.8 million in Q4 2022.

Diluted Earnings Per Share (EPS): Dropped to $0.16 in Q4 2023 from $0.35 in Q4 2022.

Adjusted Income from Operations: Fell to $84.5 million in Q4 2023 from $90.6 million in Q4 2022.

Free Cash Flow: Improved to $112.0 million for the year ended December 31, 2023, up from $68.0 million in 2022.

Cost Savings: Anticipated over $35 million in cost savings in 2024 from workforce management actions.

Acquisitions: Acquired a U.S. regulated waste tuck-in business in January 2024.

Stericycle Inc (NASDAQ:SRCL), the leading provider of medical waste disposal and data destruction services, released its 8-K filing on February 28, 2024, detailing its financial performance for the fourth quarter ended December 31, 2023. The company reported a decrease in revenue and net income compared to the same period in the previous year, attributing the decline primarily to divestitures and lower commodity indexed revenues.

Financial Performance Overview

The company's revenue for the fourth quarter stood at $652.0 million, a 2.7% decrease from $670.4 million in the fourth quarter of 2022. The decline was largely due to divestitures amounting to $28.6 million, partially offset by favorable foreign exchange rates contributing $5.0 million. Organic revenues saw a modest growth of $5.2 million.

Net income for the quarter was reported at $14.9 million, or $0.16 diluted earnings per share, a significant drop from $31.8 million, or $0.35 diluted earnings per share, in the fourth quarter of 2022. Adjusted income from operations also decreased to $84.5 million from $90.6 million in the prior year's quarter.

Despite these challenges, Stericycle experienced a silver lining with its free cash flow, which increased to $112.0 million for the year ended December 31, 2023, up from $68.0 million in 2022. This improvement was primarily driven by higher cash flow from operations and lower settlement payments related to the Foreign Corrupt Practices Act (FCPA).

Operational Highlights and Future Outlook

Stericycle's Regulated Waste and Compliance Services (RWCS) organic revenues grew by 3.1% compared to the fourth quarter of 2022, and the company improved its gross profit by 150 basis points over the same period. Additionally, Stericycle has taken steps to streamline its workforce and implement cost-saving measures that are expected to generate over $35 million in savings in 2024.

President and CEO Cindy J. Miller commented on the company's strategic progress, stating,

Throughout 2023, we made strong progress executing across all of our key business priorities, most notably the ERP deployment for our U.S. Regulated Waste and Compliance Services business and portfolio optimization, as we completed eight divestitures in the year."

She also expressed optimism about leveraging the company's streamlined operations to drive future growth and profitability.

Balance Sheet and Cash Flow Statements

For the year ended December 31, 2023, Stericycle's cash flow from operations was $243.3 million, an increase from $200.2 million in 2022. Capital expenditures for the year were slightly down at $131.3 million compared to $132.2 million in the previous year.

The balance sheet shows that Stericycle's total assets slightly increased to $5,352.6 million as of December 31, 2023, from $5,334.1 million in 2022. The company's long-term debt, net, decreased to $1,277.8 million from $1,484.0 million, reflecting its efforts to manage its debt profile effectively.

In conclusion, Stericycle Inc (NASDAQ:SRCL) faces challenges in the form of revenue declines and operational headwinds, but its strategic initiatives and focus on cost savings may position the company for a more profitable future. Investors and stakeholders will be watching closely to see how these efforts translate into financial performance in the coming quarters.

Explore the complete 8-K earnings release (here) from Stericycle Inc for further details.

This article first appeared on GuruFocus.