STERIS' (STE) Improved Volume, New Buyouts Drive Growth

STERIS STE is gaining from a strong rebound of procedure volumes in the United States, leading to solid growth in the Healthcare business. The stock carries a Zacks Rank #2 (Buy).

STERIS' Healthcare segment is gaining from the successful market adoption of its comprehensive offerings, including infection prevention consumables and capital equipment. Further, its services to maintain that equipment, repair reusable procedural instruments and outsource instrument reprocessing services are gaining traction. Continuous procedure volume growth in the United States and favorable pricing and market share gains are driving the segment’s organic growth.

On the capital equipment side, the easing of supply-chain issues and reduced lead times have contributed to strong shipments in the first quarter of fiscal 2024. The company’s robust capital spending shows that nearly 40% of first-quarter orders have been made toward large projects.

STERIS’ customers in the Applied Sterilization Technologies (AST) business are mostly the manufacturers of single-use, sterile technologies that are used in aseptic manufacturing of vaccines and biopharmaceuticals. Since the beginning of the third quarter of fiscal 2023, STERIS’ customers have been left stranded with a bulk of inventory, possibly caused by vaccine reluctance or vaccine production in general. As a consequence, the company’s volumes went down.

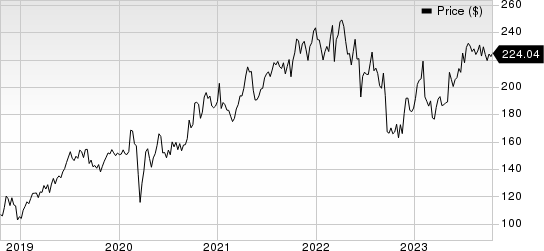

STERIS plc Price

STERIS plc price | STERIS plc Quote

However, management is certain that the sector’s long-term growth will return once the short-term destocking of the inventory is worked through. This is further solidified by the fact that customers across this segment have made significant investments to expand their manufacturing capacity for long-term growth.

Shares of STERIS have improved 31.8% over the past year against the industry’s 1% decline.

On the flip side, challenging macroeconomic conditions in the form of supply chain constraints, higher material costs, ongoing labor inflation and lower productivity continue to weigh significantly on STERIS’ margins. In fiscal 2023, the company faced additional headwinds from inflation on raw materials. Supply chain disruptions are slowing down STERIS’ ability to ship capital equipment and higher interest rates may negatively impact interest expense.

Added to this, STERIS competes for pharmaceutical, research and industrial customers against several large companies that have robust product portfolios and global reach, as well as a number of small companies with limited product offerings and operations in one or a few countries. In the Healthcare segment, STERIS’ notable competitors include 3M, Baxter, Boston Scientific, Belimed, Ecolab, Getinge, Go Jo, Johnson & Johnson, Kimberly-Clark, Skytron and Stryker.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Cardinal Health CAH, Haemonetics HAE and Align Technology ALGN, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cardinal Health stock has risen 31.1% in the past year. Earnings estimates for the company have increased from $6.65 to $6.66 in 2023 in the past 30 days and from $7.56 to $7.57 for 2024 in the past seven days.

CAH’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.03%. In the last reported quarter, it posted an earnings surprise of 4.73%.

Estimates for Haemonetics’ 2023 earnings per share have remained constant at $3.82 in the past 30 days. Shares of the company have increased 13.1% in the past year against the industry’s decline of 10.3%.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.39%. In the last reported quarter, it posted an earnings surprise of 38.16%.

Estimates for Align Technology’s 2023 earnings have moved up from $8.77 to $8.78 per share in the past 30 days. Shares of the company have increased 29.7% in the past year compared with the industry’s growth of 19.1%.

ALGN’s earnings beat estimates in three of the trailing four quarters and missed in one. In the last reported quarter, it posted an earnings surprise of 9.90%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

STERIS plc (STE) : Free Stock Analysis Report