Sterling Check Corp (STER) Navigates Challenging Macro Environment with Strategic Acquisitions ...

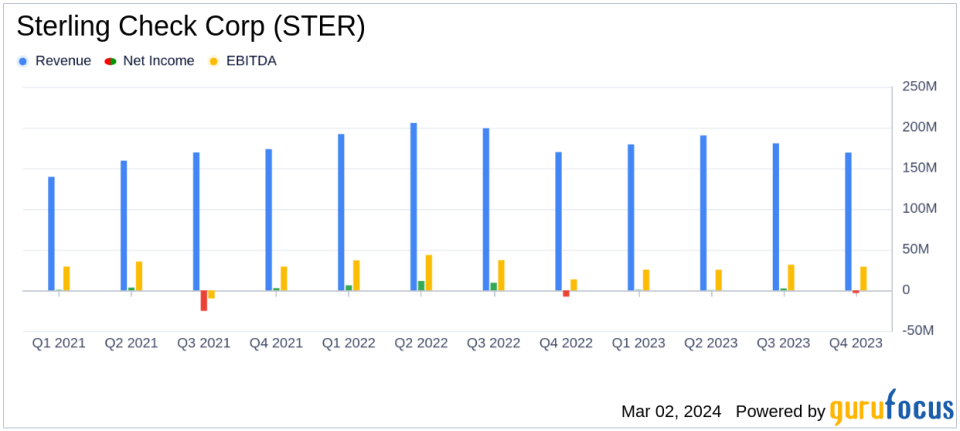

Revenue: Q4 2023 revenue slightly down by 0.3% YoY; Full Year 2023 revenue decreased by 6.1%.

Net Loss: Q4 net loss improved by 56.1% YoY; Full Year net income turned to a slight loss of $116K from a profit of $19.4M in 2022.

Adjusted EBITDA: Q4 Adjusted EBITDA rose by 1.5% YoY; Full Year Adjusted EBITDA down by 6.8%.

Cost Savings: Achieved early realization of $25M annualized cost savings target.

Strategic Acquisitions: Acquired Vault Workforce Screening, enhancing drug and health testing capabilities.

Free Cash Flow: Decreased to $76.5M in Full Year 2023 from $84.1M in the prior year.

Sterling Check Corp (NASDAQ:STER), a global provider of technology-enabled background and identity verification services, released its 8-K filing on February 29, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. Despite a challenging macroeconomic environment, the company has made significant strides in executing its long-term strategy and achieving cost savings.

Financial Performance and Challenges

For the fourth quarter of 2023, Sterling reported revenues of $169.4 million, a slight decrease of 0.3% compared to the same period last year. The company's net loss improved significantly, with a 56.1% reduction from the fourth quarter of 2022, resulting in a net loss margin improvement of 250 basis points. Adjusted EBITDA for the quarter increased by 1.5% to $41.9 million, with a 40 basis point improvement in Adjusted EBITDA Margin.

For the full year, Sterling's revenues declined by 6.1% to $719.6 million, with an organic constant currency revenue decline of 8.2%. The net income for the year slightly turned negative, with a loss of $116 thousand, compared to a net income of $19.4 million in 2022. Adjusted EBITDA for the year was down by 6.8% to $185 million.

Strategic Acquisitions and Cost Savings

Despite the revenue decline, Sterling has been proactive in its strategic initiatives. CEO Josh Peirez highlighted the company's successful integration of acquisitions Socrates and A-Check, which have started to yield benefits. The early January 2024 acquisition of Vault Workforce Screening is expected to enhance Sterling's capabilities and drive growth within the healthcare and industrials verticals.

The company's focused efforts have also led to the early realization of a $25 million annualized cost savings target, which is significant for maintaining profitability in a challenging economic climate.

Balance Sheet and Cash Flow

As of December 31, 2023, Sterling had $54.2 million in cash and cash equivalents, with total debt standing at $498 million. The decrease in cash from the previous year-end was primarily due to strategic acquisitions and stock repurchases. The company generated $96.9 million in net cash from operating activities for the year, with Free Cash Flow reaching $76.5 million, a decrease from the previous year's $84.1 million.

Outlook and Analysis

While Sterling faced headwinds in 2023, the company's strategic acquisitions and cost-saving measures position it for potential growth and improved performance in 2024. The cancellation of the Q4 2023 earnings conference call due to the announcement of a definitive agreement to combine with First Advantage Corporation indicates a significant strategic move that could reshape the company's future.

Value investors may find Sterling's cost discipline and strategic M&A activities to be positive indicators of the company's commitment to long-term value creation, despite the current challenges in the macro environment.

For further details on Sterling Check Corp's financial performance, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Sterling Check Corp for further details.

This article first appeared on GuruFocus.