Sterling Infrastructure Inc (STRL) Announces Record Earnings for Q4 and Full Year 2023

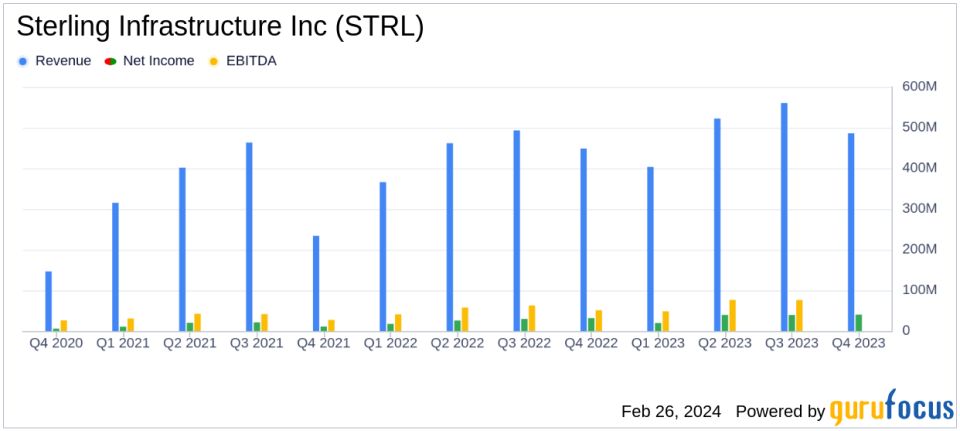

Revenue: Q4 revenue increased by 8% to $486.0 million, with full-year revenue up 11.5%.

Net Income: Q4 net income soared by 99% to $40.2 million, full-year net income rose to $138.7 million.

Earnings Per Share (EPS): Q4 EPS jumped by 94% to $1.28, with full-year EPS at $4.44.

Gross Margin: Improved to 18.9% in Q4, a significant increase from 15.4%.

Backlog: Year-end backlog grew by 46% to $2.07 billion, indicating strong future revenue potential.

Cash Flow: Operations generated $478.6 million in cash for the twelve months ended December 31, 2023.

Sterling Infrastructure Inc (NASDAQ:STRL) released its 8-K filing on February 26, 2024, detailing a record-breaking fourth quarter and full year for 2023. The company, a leader in heavy civil infrastructure construction and residential construction projects, has demonstrated significant growth in its financial performance, with substantial increases in revenue, net income, and earnings per share.

Company Overview

Sterling Infrastructure Inc operates through three primary segments: Transportation Solutions, E-Infrastructure Solutions, and Building Solutions. The company has seen the majority of its revenue generated from the E-Infrastructure Solutions, which caters to large, blue-chip companies in sectors such as e-commerce, data centers, and energy.

Financial Performance and Challenges

The company's performance in the fourth quarter was marked by an 8% increase in revenues to $486.0 million and a significant improvement in gross margin to 18.9%. Net income nearly doubled to $40.2 million, or $1.28 per diluted share, representing a 99% increase compared to the same period last year. The full-year figures were equally impressive, with revenue climbing 11.5% and net income reaching $138.7 million, or $4.44 per diluted share.

Despite these strong results, Sterling Infrastructure Inc faces challenges, including market fluctuations and the need to maintain its backlog to ensure continued growth. The company's ability to navigate these challenges will be crucial for sustaining its upward trajectory.

Financial Achievements and Importance

The company's financial achievements, particularly the growth in backlog to over $2 billion, are indicative of its strong market position and future revenue potential. The increase in gross margin reflects the benefits of project selectivity and mix, which are vital for profitability in the construction industry.

Key Financial Metrics

Important metrics from the earnings report include:

Financial Metric | Q4 2023 | Full Year 2023 |

|---|---|---|

Revenue | $486.0 million | $1,972.2 million |

Net Income | $40.2 million | $138.7 million |

Gross Margin | 18.9% | N/A |

Backlog | N/A | $2.07 billion |

Cash Flows from Operations | N/A | $478.6 million |

These metrics are crucial as they provide insights into the company's operational efficiency, profitability, and future earnings potential.

Management Commentary

"2023 was another record year for Sterling as we grew our adjusted net income by 43% to deliver adjusted diluted EPS of $4.47, which was above the high end of our previously guided range," stated Joe Cutillo, Sterlings Chief Executive Officer. "For the fourth quarter, we delivered adjusted diluted EPS of $1.30, a 94% increase from the corresponding period last year. Our gross margins expanded 350 basis points to 18.9%, reflecting the benefits of project selectivity and mix. We closed the year with backlog of over $2 billion, a 46% increase from year-end 2022 levels, supporting our expectation for continued momentum in 2024."

2024 Outlook

Looking ahead, Sterling Infrastructure Inc provided guidance for the full year 2024, projecting revenue between $2.125 billion and $2.215 billion, net income between $155 million and $165 million, diluted EPS between $4.85 and $5.15, and EBITDA between $285 million and $300 million. This guidance reflects the company's confidence in its ability to continue growing its bottom line at a rate that exceeds top-line growth.

For detailed financial figures and further information, investors are encouraged to review the full 8-K filing and attend the upcoming conference call scheduled for February 27, 2024.

Value investors and potential GuruFocus.com members interested in the construction sector and companies like Sterling Infrastructure Inc (NASDAQ:STRL) with strong growth prospects may find this earnings report particularly compelling. Stay tuned to GuruFocus.com for continued coverage and expert analysis on Sterling Infrastructure Inc and other value investment opportunities.

Explore the complete 8-K earnings release (here) from Sterling Infrastructure Inc for further details.

This article first appeared on GuruFocus.