Sterling (STRL) to Report Q2 Earnings: Here's What to Expect

Sterling Construction Company, Inc. STRL is slated to report second-quarter 2023 results on Aug 7, after the closing bell.

In the last reported quarter, the company’s earnings topped the Zacks Consensus Estimate by 14.3% and increased by 8% year over year. Revenues increased by 10% year over year, topping the consensus mark by 4.7%, backed by broad-based growth across the E-Infrastructure and Building segments.

The Trend in Estimate Revision

The Zacks Consensus Estimate for Sterling’s second-quarter earnings is pegged at 93 cents per share, suggesting a rise of 8.1% from the year-ago quarter’s figure of 86 cents.

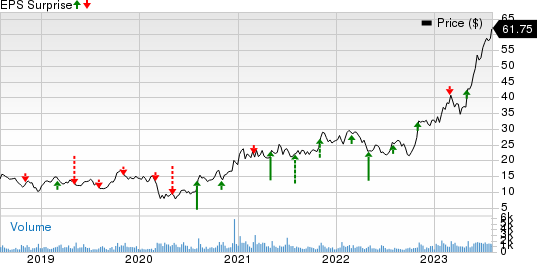

Sterling Infrastructure, Inc. Price and EPS Surprise

Sterling Infrastructure, Inc. price-eps-surprise | Sterling Infrastructure, Inc. Quote

The consensus estimate for revenues is pegged at $491.5 million, indicating a 3.7% decrease from the prior-year period.

Factors to Note

Sterling’s second-quarter results are likely to have been aided from its focus on higher-margin and lower-risk projects as well as business transformation moves to become a leading specialty infrastructure provider.

Its diversified portfolio, including Transportation Solutions, E-Infrastructure Solutions and Building Solutions units, is likely to have acted as a tailwind as it reduces market risks. STRL has been executing a robust pipeline of projects for large, high-profile customers who are building new distribution centers, data centers and warehouses.

Yet, inflation challenges, seasonality, the risk of material delays and labor woes might have put pressure on its second-quarter performance.

Segment-wise, the E-infrastructure Solutions business is likely to have gained from bolt-on acquisitions, high levels of demand from data centers and advanced manufacturing customers. Recently, STRL announced that the segment recorded bookings of $424 million in the second quarter. These include a new award to its subsidiary company — Plateau — from Hyundai Engineering America, Inc. for an additional phase of work on the Bartow County, GA, EV battery plant. The Hyundai project is the largest contract in the company's history.

Its Building Solutions segment is likely to have witnessed soft demand, especially from the residential market. The segment has been experiencing inflationary pressure and interest rate hikes, due to which management has announced multiple price increases. These headwinds might have put pressure on second-quarter results. Nonetheless, rising demand in the multi-family market is likely to somewhat offset these negatives.

The Transportation Solutions segment is likely to have gained from an increase in non-highway service revenues. The rising demand for infrastructural activities for public project work is expected to have supported growth. However, lower heavy highway and aviation projects may hurt the results.

The consensus estimate for the combined backlog is pegged at $1,636 million, suggesting a decline from $1,690 million reported at 2022-end and $1,730 million in the prior year.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Sterling this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Sterling carries a Zacks Rank #3 and an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are some companies in the Zacks Construction sector that, according to our model, have the right combination of elements to post an earnings beat in the quarter to be reported.

AECOM ACM — a Los Angeles, CA-based company — beat earnings estimates in all the last four quarters, the average surprise being 4.8%. The Zacks Consensus Estimate for AECOM’s fiscal third-quarter earnings is pegged at 95 cents per share, implying growth of 10.5% from the year-ago reported figure.

It has an Earnings ESP of +1.05% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Willdan Group, Inc. WLDN currently has an Earnings ESP of +108.33% and a Zacks Rank #3.

WLDN’s earnings for the to-be-reported quarter are expected to increase by 300%. The company reported better-than-expected earnings in two of the last four quarters and missed on two occasions, the average surprise being 1,289.3%.

Dycom Industries, Inc. DY presently has an Earnings ESP of +0.12% and a Zacks Rank #3.

DY’s earnings for the to-be-reported quarter are expected to increase 13.7%. The company reported better-than-expected earnings in the last four quarters, the average surprise being 153.7%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report