Steve Mandel's Lone Pine Capital Bolsters Position in Dick's Sporting Goods Inc

Introduction to the Transaction

Lone Pine Capital, led by renowned investor Steve Mandel (Trades, Portfolio), has recently increased its stake in Dick's Sporting Goods Inc (NYSE:DKS), signaling a strategic move within its investment portfolio. The transaction, which took place on December 31, 2023, involved the acquisition of 2,922,910 shares in the prominent sporting goods retailer. This addition reflects Lone Pine Capital's confidence in DKS and its potential for growth within the retail-cyclical industry.

Profile of Steve Mandel (Trades, Portfolio)

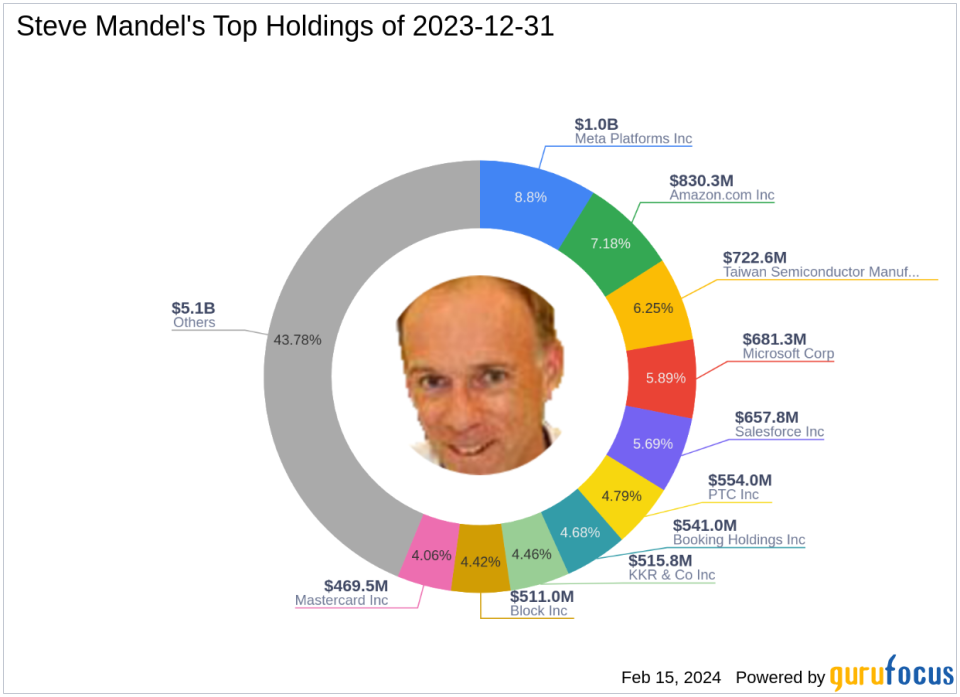

Steve Mandel (Trades, Portfolio), the founder of Lone Pine Capital, has a storied career in the investment world, with stints at Tiger Management (Trades, Portfolio) Corporation and Goldman Sachs before establishing his own firm in 1997. Lone Pine Capital, named after a resilient tree at Dartmouth College, Mandel's alma mater, is known for its long/short equity strategy, fundamental analysis, and a blend of value and growth investing approaches. The firm's top holdings include major names like Amazon.com Inc (NASDAQ:AMZN) and Microsoft Corp (NASDAQ:MSFT), with a strong inclination towards the technology and financial services sectors. As of the latest data, Lone Pine Capital manages an equity portfolio worth $11.56 billion.

Details of the Trade

On the last day of 2023, Lone Pine Capital added 450 shares to its existing position in Dick's Sporting Goods, bringing the total share count to 2,922,910. The trade was executed at a price of $146.95 per share, marking a 4.14% position in the firm's portfolio and representing a 5.00% ownership in DKS. Despite the modest size of the trade, it underscores Lone Pine Capital's strategic investment decisions.

Analysis of Dick's Sporting Goods Inc

Dick's Sporting Goods, founded in 1948 and headquartered in the Pittsburgh area, has grown into a leading retailer for athletic apparel, footwear, and equipment. With over 725 stores and a strong online presence, DKS has successfully established itself in the market, boasting a current market capitalization of $13.65 billion. The stock has shown impressive performance, with a current price of $166.93, reflecting a 13.6% gain since the transaction date and a staggering 5,337.46% increase since its IPO in 2002.

Financial Health and Stock Valuation

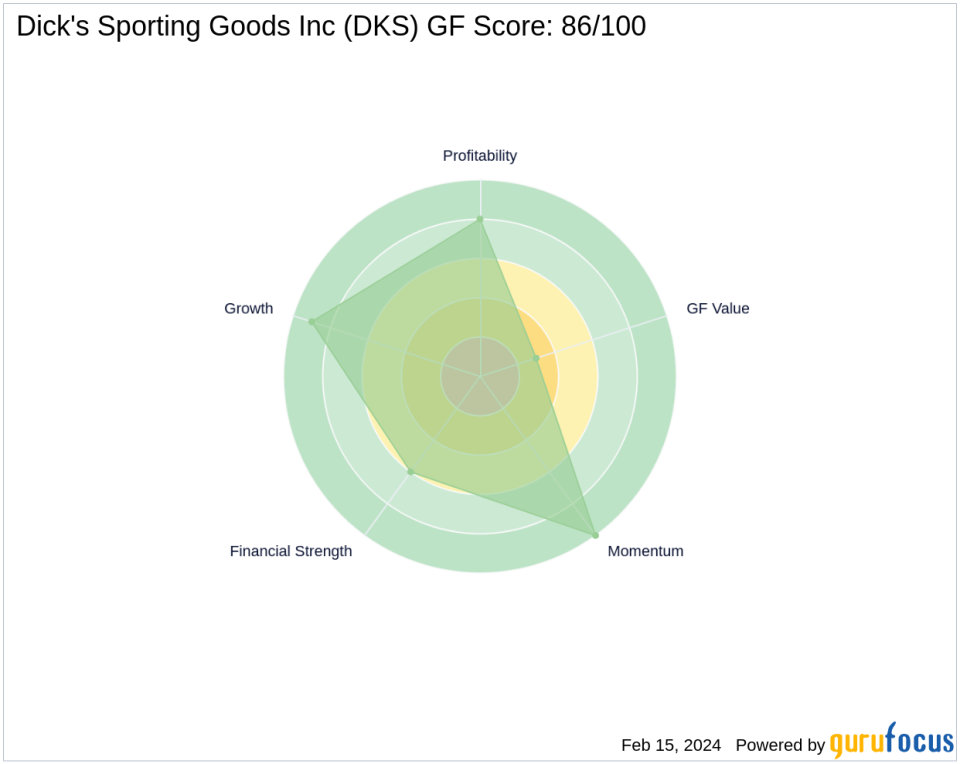

Dick's Sporting Goods exhibits a robust financial profile with a PE Ratio of 14.89, indicating profitability. The company's GF Score stands at an impressive 86/100, suggesting strong future performance potential. However, the stock is currently deemed modestly overvalued with a GF Value of $147.42 and a price to GF Value ratio of 1.13. The company's financial strength and Profitability Rank are also noteworthy, with scores of 6/10 and 8/10, respectively.

Sector and Market Context

Lone Pine Capital's portfolio is heavily weighted towards technology and financial services, yet the addition of DKS reflects a strategic diversification into the retail-cyclical sector. DKS's market performance has been robust, outpacing many of its industry peers and demonstrating resilience in a competitive landscape.

Comparison with Other Gurus

Other notable investors, such as Jefferies Group (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Ron Baron (Trades, Portfolio), also hold positions in Dick's Sporting Goods. However, Lone Pine Capital stands out as the largest guru shareholder, emphasizing the firm's conviction in DKS's potential.

Conclusion

The recent acquisition of additional shares in Dick's Sporting Goods by Steve Mandel (Trades, Portfolio)'s Lone Pine Capital is a calculated move that aligns with the firm's investment philosophy. The trade not only bolsters Lone Pine's position in DKS but also reflects a broader strategy of capitalizing on the growth potential within the retail-cyclical sector. For value investors, this transaction underscores the importance of considering a company's financial health, market position, and the potential for long-term growth when making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.