Steven Cohen Adjusts Position in Crinetics Pharmaceuticals Inc

Overview of Steven Cohen (Trades, Portfolio)'s Recent Stock Transaction

Steven Cohen (Trades, Portfolio), through Point72 Asset Management, has recently made a notable adjustment in the firm's investment portfolio by reducing its stake in Crinetics Pharmaceuticals Inc (NASDAQ:CRNX). On December 31, 2023, the firm decreased its holdings by 808,400 shares, resulting in a 19.13% change in the position. The transaction was executed at a price of $35.58 per share, leaving the firm with a total of 3,416,900 shares in CRNX. This trade has altered the firm's portfolio by a -0.09% impact, with CRNX now representing 0.36% of the total portfolio and 5.10% of the firm's holdings in the traded stock.

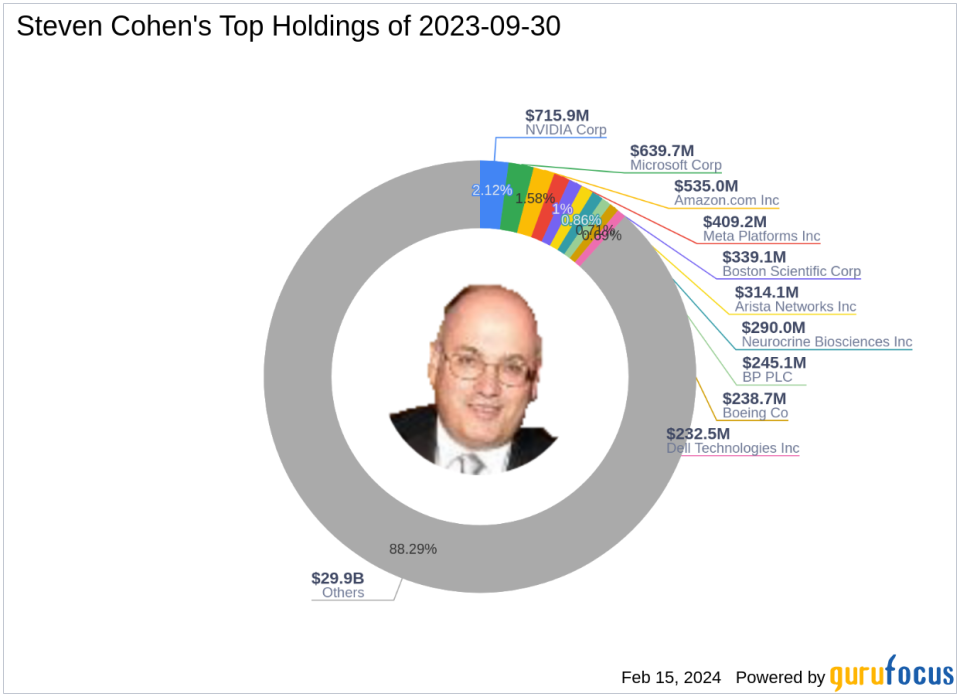

Profile of Steven Cohen (Trades, Portfolio)

Steven A. Cohen stands as the Chairman and CEO of Point72, a significant player in the investment advisory landscape. With a foundation laid in 1992 through S.A.C. Capital Advisors, Cohen transitioned to Point72 in 2014, overseeing a team of over 1,650 professionals. A Wharton School alumnus, Cohen's career began at Gruntal & Co., eventually leading to the establishment of his own investment firm. His investment philosophy centers on a long/short equity strategy, employing a fundamental, bottom-up research process to guide macro investments. Cohen's portfolio is diverse, with top holdings in major companies like Amazon.com Inc (NASDAQ:AMZN) and Meta Platforms Inc (NASDAQ:META). The firm's equity stands at $33.83 billion, with a strong focus on the Technology and Healthcare sectors.

Crinetics Pharmaceuticals Inc at a Glance

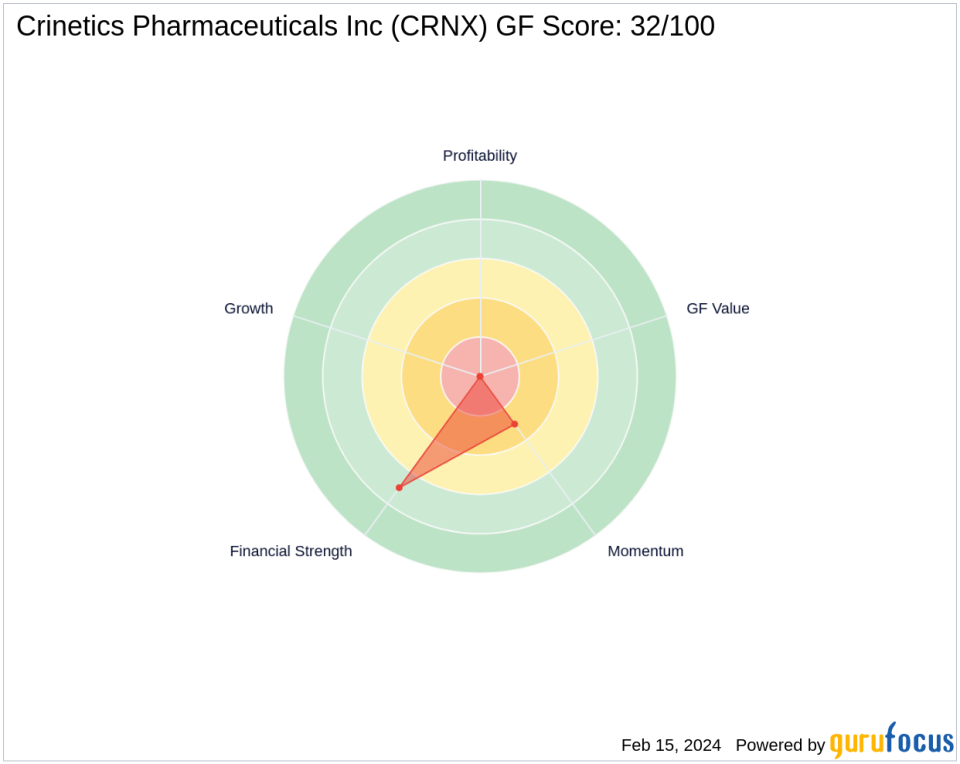

Crinetics Pharmaceuticals Inc, a clinical-stage pharmaceutical company, is dedicated to developing treatments for rare endocrine diseases and related tumors. Since its IPO on July 18, 2018, CRNX has been actively engaged in the Biotechnology industry within the USA. With a market capitalization of $2.42 billion, the company's financial performance has been under scrutiny, especially considering its current status as significantly overvalued according to GuruFocus's GF Value. Despite a current stock price of $36.3, the GF Value stands at a mere $0.66, indicating a price to GF Value ratio of 55.00. The stock has seen a 2.02% gain since the transaction and an 88.57% increase since its IPO, with a year-to-date change of 2.57%. However, the GF Score of 32/100 suggests a cautious outlook on the stock's future performance potential.

Analysis of the Trade Impact

The recent trade by Steven Cohen (Trades, Portfolio)'s firm has a modest impact on the overall portfolio, yet it reflects a strategic move within the firm's investment approach. The reduction in CRNX shares aligns with the firm's practice of actively managing positions based on thorough research and market analysis. Given the stock's current valuation and GF Score, the firm's decision to reduce its stake may be indicative of a broader strategy to optimize portfolio performance in light of market conditions and company-specific factors.

Market Context and Stock Valuation

Crinetics Pharmaceuticals Inc's current market valuation presents a challenging scenario for investors. The stock is deemed significantly overvalued, with a GF Value that suggests a considerable disconnect between the stock's intrinsic value and its market price. The stock's price has slightly increased since the transaction, yet it remains high compared to the GF Value, which could signal caution for potential investors.

Sector and Industry Insights

Steven Cohen (Trades, Portfolio)'s firm maintains a significant exposure to the Technology and Healthcare sectors, with CRNX being part of the latter. The Biotechnology industry, where CRNX operates, is a key area of interest for the firm, and investment decisions within this sector are likely informed by the firm's extensive research and sector-aligned investment model.

Performance Metrics and Rankings

Crinetics Pharmaceuticals Inc's financial metrics and rankings provide a mixed picture. The company's Financial Strength ranks at 7/10, supported by a Cash to Debt ratio of 10.63. However, its Profitability Rank and Growth Rank are both at 0/10, indicating challenges in these areas. The GF Value Rank and Momentum Rank also reflect areas of concern, with low scores that may have influenced the firm's decision to reduce its position.

Comparative Analysis with Largest Shareholder

Fisher Asset Management, LLC, another prominent investment firm, holds a significant position in Crinetics Pharmaceuticals Inc. While specific share percentage data is not provided, comparing the investment approaches of Steven Cohen (Trades, Portfolio)'s firm and Fisher Asset Management can offer insights into how different investment philosophies are applied within the same industry and company.

In conclusion, Steven Cohen (Trades, Portfolio)'s recent transaction involving Crinetics Pharmaceuticals Inc reflects a strategic adjustment in the firm's portfolio. While the trade has a minor impact on the overall portfolio, it is a calculated move that aligns with the firm's investment philosophy and market outlook. Investors and market watchers will be keen to observe how this decision plays out in the context of the firm's performance and the evolving landscape of the Biotechnology sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.