Steven Cohen Adjusts Position in Protagonist Therapeutics Inc

Overview of Steven Cohen (Trades, Portfolio)'s Recent Stock Transaction

Steven Cohen (Trades, Portfolio)'s firm, Point72 Asset Management, has recently made a notable adjustment in its investment portfolio by reducing its stake in Protagonist Therapeutics Inc (NASDAQ:PTGX). On December 31, 2023, the firm decreased its holdings by 572,624 shares, which impacted the portfolio by -0.04%. This transaction has altered the firm's position in the biopharmaceutical company, reflecting a strategic move by the investment giant.

Guru Profile: Steven Cohen (Trades, Portfolio) and Point72 Asset Management

Steven A. Cohen, the Chairman and CEO of Point72 Asset Management, is a prominent figure in the investment world. With a career spanning over four decades, Cohen has established a reputation for his long/short equity strategy and a multi-manager platform that emphasizes fundamental bottom-up research. Point72, which manages over $33.83 billion in equity, has a diverse portfolio with top holdings in technology and healthcare sectors, including Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), and Microsoft Corp (NASDAQ:MSFT).

Protagonist Therapeutics Inc Company Overview

Protagonist Therapeutics Inc, a clinical-stage biopharmaceutical company based in the USA, specializes in developing novel constrained peptide-based drug candidates. Since its IPO on August 11, 2016, the company has focused on addressing significant medical needs through its innovative pipeline products like Rusfertide (PTG-300) and JNJ-2113. With a market capitalization of $1.61 billion, Protagonist Therapeutics is a key player in the biotechnology industry.

Transaction Details and Portfolio Impact

The recent trade by Steven Cohen (Trades, Portfolio)'s firm saw the sale of Protagonist Therapeutics shares at a price of $22.93 each. Following the transaction, the firm holds 2,613,453 shares, representing a 4.50% ownership in the company and a 0.18% ratio in the firm's portfolio. This move indicates a strategic shift in Cohen's investment approach towards PTGX.

Stock Performance and Valuation Metrics

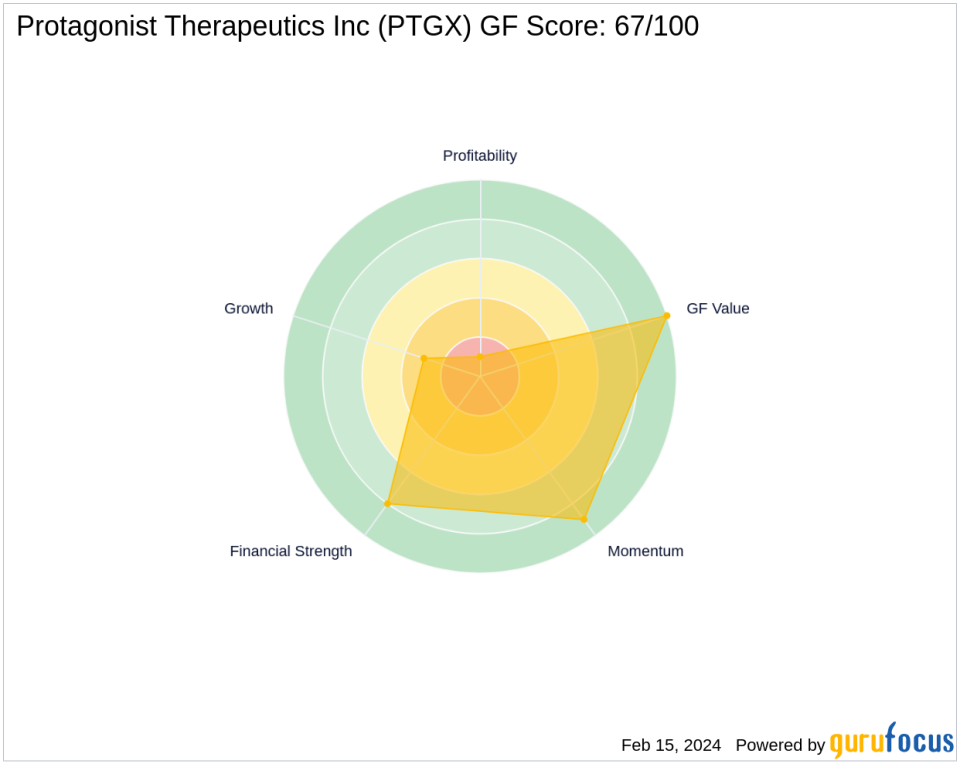

Protagonist Therapeutics Inc's stock has shown a positive trajectory, with its current price at $27.85, marking a 21.46% gain since the transaction date. The stock is also deemed modestly undervalued with a GF Value of $38.71 and a price to GF Value ratio of 0.72. The company's GF Score stands at 67/100, suggesting a potential for future performance.

Sector and Market Context

Within the biotechnology sector, Protagonist Therapeutics Inc holds a competitive position. Steven Cohen (Trades, Portfolio)'s firm has a significant presence in the healthcare sector, with Protagonist Therapeutics being one of its strategic investments. The firm's top holdings and sectors reflect a balanced approach, with a strong inclination towards technology and healthcare.

Comparative Analysis and Market Reaction

While the largest guru shareholder information for PTGX is not provided, the market has responded positively to the stock post-transaction. The stock's momentum has been favorable, with a 14-day RSI of 59.83 and a 12-month momentum index of 63.72, indicating a strong market sentiment towards Protagonist Therapeutics.

Financial Health and Future Prospects

Protagonist Therapeutics Inc's financial health is robust, with a Financial Strength rank of 8/10 and a high Cash to Debt ratio of 177.90. However, the company's Profitability Rank and Growth Rank are lower, at 1/10 and 3/10, respectively. Despite these mixed indicators, the stock's GF Value Rank is at the maximum of 10/10, suggesting that it may be undervalued and has potential for future growth.

In conclusion, Steven Cohen (Trades, Portfolio)'s firm's recent reduction in Protagonist Therapeutics Inc reflects a calculated decision within the context of the firm's investment strategy and the biotechnology market. The stock's current valuation and performance metrics, combined with the company's financial health, suggest that PTGX may still hold potential for future gains, despite the reduced stake by one of the market's leading investment firms.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.