Steven Cohen Bolsters Position in PagSeguro Digital Ltd

Introduction to the Transaction

Steven Cohen (Trades, Portfolio), through Point72 Asset Management, has recently expanded the firm's portfolio by adding shares of PagSeguro Digital Ltd (NYSE:PAGS). On December 27, 2023, the firm acquired 684,698 shares of the Brazil-based financial technology company, at a trade price of $12.58 per share. This transaction has increased Cohen's total holdings in PagSeguro to 10,702,598 shares, marking a significant investment in the tech sector.

Profile of Steven Cohen (Trades, Portfolio)

Steven A. Cohen stands as a prominent figure in the investment world, heading Point72 Asset Management, a firm with a robust workforce of over 1,650. With a foundation laid in 1992 through S.A.C. Capital Advisors, Cohen transitioned to Point72 in 2014, focusing on long/short equity as the core strategy. The firm's investment approach is deeply rooted in fundamental research, complemented by a multi-manager platform. Beyond finance, Cohen's influence extends to sports and philanthropy, notably as the owner of the New York Mets.

Overview of PagSeguro Digital Ltd

PagSeguro Digital Ltd is at the forefront of providing financial technology solutions in Brazil, catering primarily to micro-merchants and small to medium-sized enterprises. The company's comprehensive digital ecosystem facilitates a variety of financial transactions, offering tools for cash management and business growth. With its IPO dating back to January 24, 2018, PagSeguro has established itself as a key player in the financial service agents and transaction activities sectors.

Analysis of the Trade Impact and Position

The recent acquisition by Steven Cohen (Trades, Portfolio) has a modest impact on the firm's portfolio, with a trade impact of 0.03%. However, the trade has significantly increased the firm's position in PagSeguro, now accounting for 0.4% of the portfolio and representing a 5.10% ownership stake in the company. This move underscores Cohen's confidence in PagSeguro's potential within the tech sector.

Market Performance of PagSeguro Digital Ltd

PagSeguro's market performance presents a mixed picture. With a PE ratio of 13.06, the company's stock is currently trading at $12.47, slightly below the trade price. The GF Value suggests a possible value trap, urging investors to think twice, as the stock price to GF Value ratio stands at 0.35. Despite a year-to-date increase of 51.33%, the stock has experienced a decline of 55.78% since its IPO. The recent trade has seen a marginal drop of 0.87% in stock price.

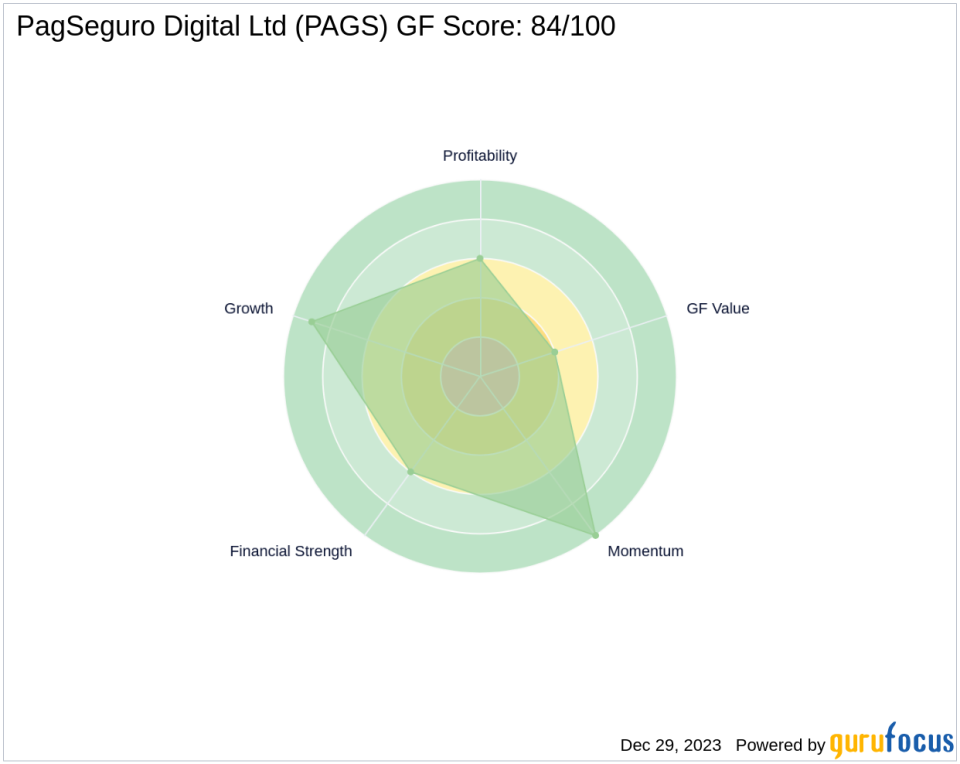

Fundamental Analysis of PagSeguro Digital Ltd

PagSeguro's financial health and growth prospects are reflected in its financial ratios and ranks. The company boasts a strong GF Score of 84/100, indicating good outperformance potential. Its Financial Strength and Profitability Rank both stand at 6/10, while the Growth Rank is impressive at 9/10. However, the GF Value Rank is lower at 4/10, and the Momentum Rank is at the top with 10/10.

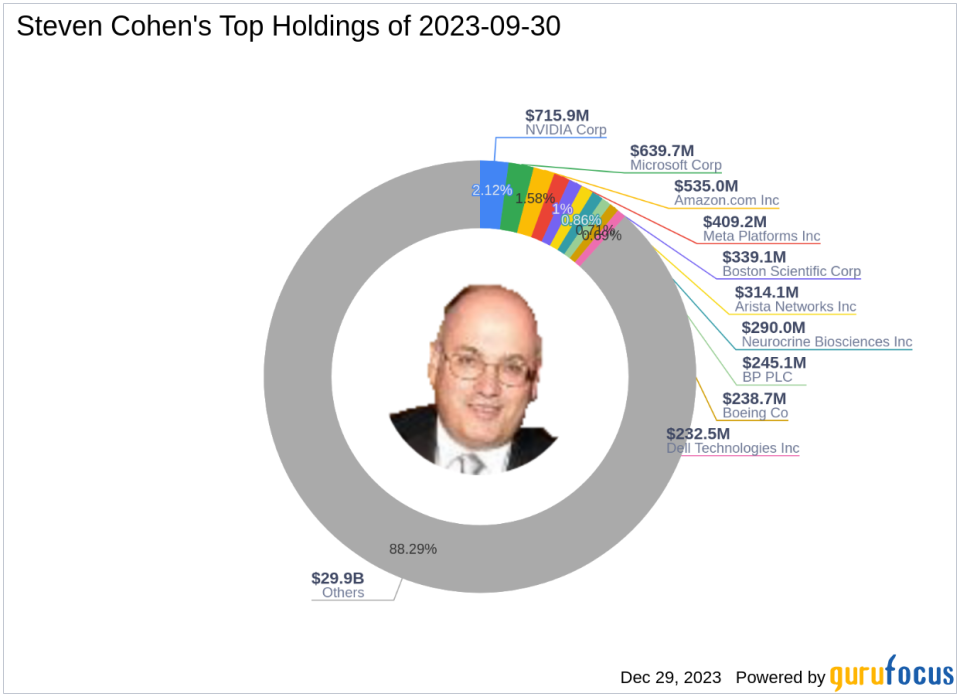

Sector and Market Context

Technology and healthcare are the top sectors in Cohen's investment strategy, with PagSeguro aligning well with the firm's focus on technology. Point72's top holdings include tech giants such as Amazon.com Inc (NASDAQ:AMZN) and Microsoft Corp (NASDAQ:MSFT), indicating a strong inclination towards innovative and growth-oriented companies within the tech landscape.

Conclusion

The addition of PagSeguro Digital Ltd to Steven Cohen (Trades, Portfolio)'s portfolio is a strategic move that aligns with the firm's investment philosophy and sector preferences. While the market performance and GF Value of PagSeguro suggest caution, the firm's strong GF Score and growth prospects may offer a compelling case for value investors. As the market continues to evolve, the implications of Cohen's investment decision will be closely monitored by the investment community.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.