Steven Cohen Boosts Stake in Health Catalyst Inc

Renowned investor Steven Cohen (Trades, Portfolio) recently increased his holdings in Health Catalyst Inc (NASDAQ:HCAT), a leading provider of data and analytics technology to healthcare organizations. This article delves into the details of the transaction, Cohen's investment strategy, and the financial health and prospects of Health Catalyst Inc.

Details of the Transaction

On July 26, 2023, Steven Cohen (Trades, Portfolio) added 1,438,030 shares of Health Catalyst Inc to his portfolio at a price of $13.33 per share. This transaction increased his total holdings in the company to 2,824,930 shares, representing a 103.69% change. The transaction had a 0.12% impact on Cohen's portfolio and increased his position in the company to 5.00%. This move signifies Cohen's confidence in the future prospects of Health Catalyst Inc.

Profile of Steven Cohen (Trades, Portfolio)

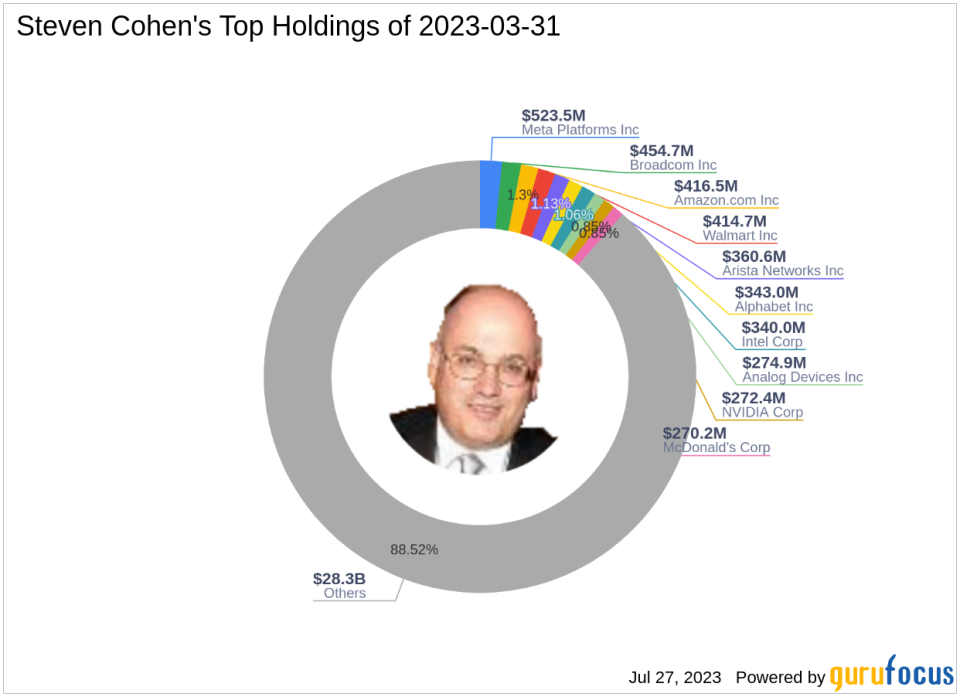

Steven A. Cohen is the Chairman and Chief Executive Officer of Point72, a registered investment advisor with over 1,650 personnel. Cohen founded S.A.C. Capital Advisors in 1992 and transitioned his investment operations to the Point72 Asset Management family office in 2014. He has a B.S. in Economics from The Wharton School at the University of Pennsylvania and began his investing career at Gruntal & Co., where he managed proprietary capital for 14 years before starting his own investment business. Cohen's top holdings include Amazon.com Inc (NASDAQ:AMZN), Broadcom Inc (NASDAQ:AVGO), Meta Platforms Inc (NASDAQ:META), Arista Networks Inc (NYSE:ANET), and Walmart Inc (NYSE:WMT). His firm primarily focuses on the healthcare and technology sectors.

Overview of Health Catalyst Inc

Health Catalyst Inc is a US-based company that provides data and analytics technology and services to healthcare organizations. The company operates in two segments: Technology and Professional Services. The Technology segment, which is the key revenue driver, includes data platform, analytics applications, and support services. The company's market cap stands at $737.572 million, and its stock price is currently $13.11. However, the company's PE percentage is 0.00, indicating that it is currently operating at a loss. The GF Value of the stock is 33.53, suggesting that the stock may be a possible value trap and investors should think twice before investing.

Stock Performance and Valuation

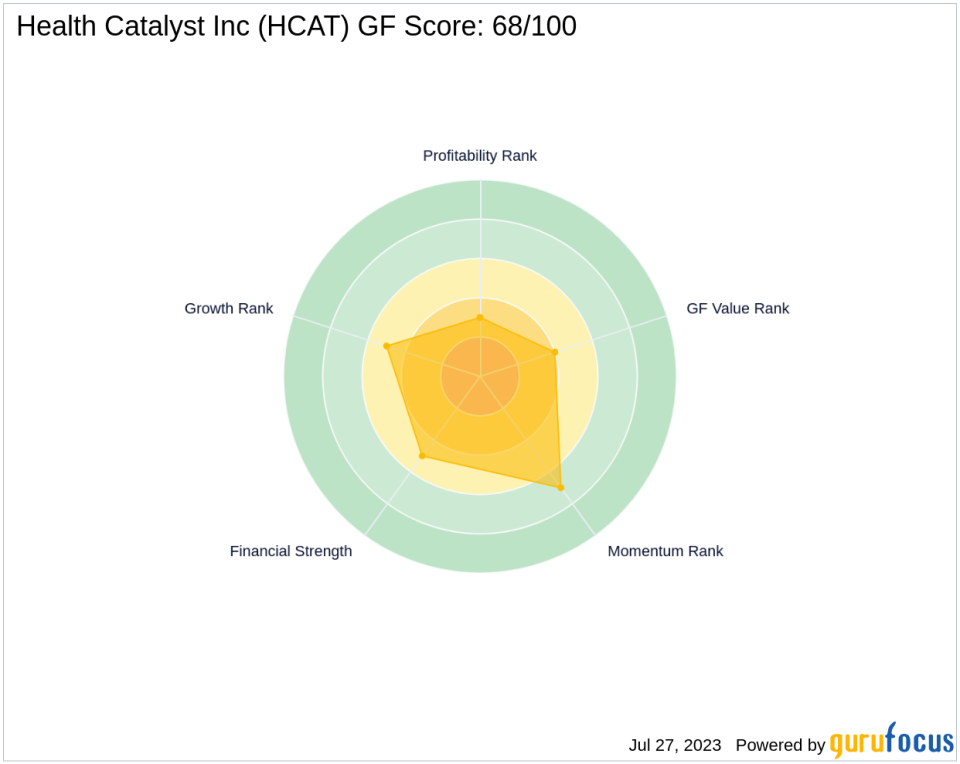

Since its IPO on July 25, 2019, Health Catalyst Inc's stock has declined by 64.92%. However, the stock has gained 26.18% year-to-date. The stock's price to GF Value is 0.39, indicating that it is currently undervalued. The GF Score of the stock is 68/100, suggesting that it has good future performance potential.

Financial Health and Growth Prospects of the Stock

Health Catalyst Inc has a balance sheet rank of 5/10, a profitability rank of 3/10, and a growth rank of 5/10. The company's revenue growth over the past three years is -14.80%, while its EBITDA growth is 14.20% and its earnings growth is 41.10%. These figures suggest that the company has been struggling with revenue growth but has managed to improve its earnings and EBITDA growth.

Stock Momentum and Predictability

The stock's RSI 5 Day is 80.59, its RSI 9 Day is 71.42, and its RSI 14 Day is 65.52. The stock's Momentum Index 6 - 1 Month is -17.38, and its Momentum Index 12 - 1 Month is -28.22. These figures suggest that the stock has strong momentum but lacks predictability.

Largest Guru Holding the Traded Stock

The largest guru holding Health Catalyst Inc is First Eagle Investment (Trades, Portfolio) Management, LLC. The significance of this guru's holding in the context of the traded stock's performance and valuation is yet to be determined.

In conclusion, Steven Cohen (Trades, Portfolio)'s recent acquisition of Health Catalyst Inc shares signifies his confidence in the company's future prospects despite its current financial challenges. This transaction is likely to have a significant impact on the stock and Cohen's portfolio in the future.

This article first appeared on GuruFocus.