Steven Cohen's Point72 Adds Caribou Biosciences Inc to Its Portfolio

Introduction to the Transaction

Steven Cohen (Trades, Portfolio)'s investment firm, Point72 Asset Management, has recently expanded its investment portfolio by adding shares of Caribou Biosciences Inc (NASDAQ:CRBU). On February 22, 2024, the firm acquired 4,432,602 shares of the biopharmaceutical company, reflecting a significant commitment to the healthcare sector. This transaction has a modest impact of 0.02% on the firm's portfolio, with the trade executed at a price of $6.92 per share. The addition increases Point72's position in Caribou Biosciences to a substantial 5.00% of the company's outstanding shares.

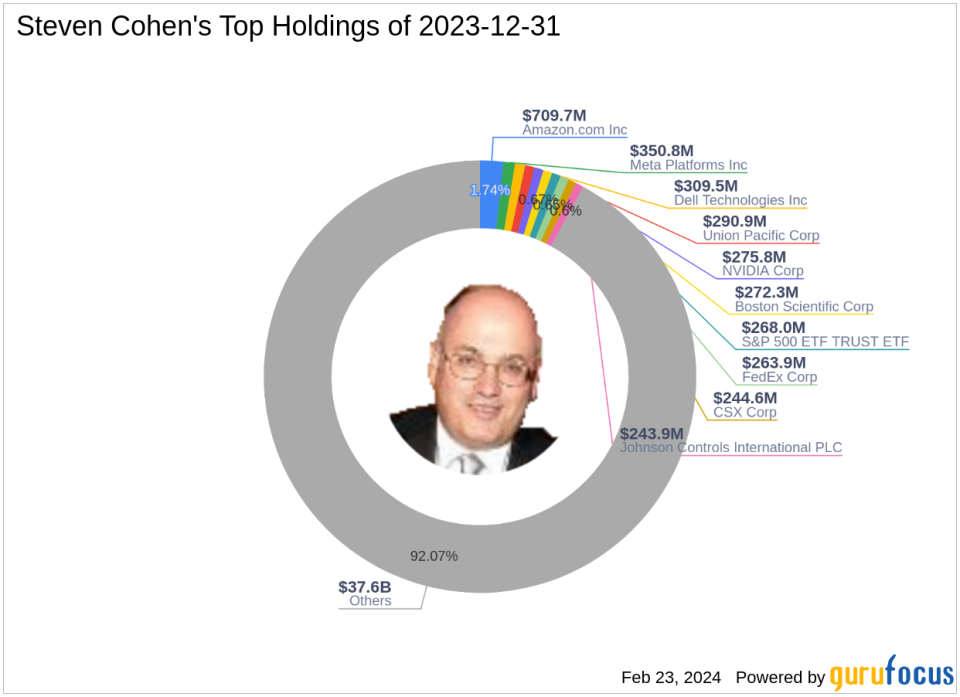

Guru Profile: Steven Cohen (Trades, Portfolio)

Steven A. Cohen is a prominent figure in the investment world, serving as the Chairman and CEO of Point72 Asset Management. The firm, which evolved from S.A.C. Capital Advisors, is known for its long/short equity strategy, employing a multi-manager platform and sector-aligned model. Cohen's investment philosophy hinges on a fundamental bottom-up research process, which is complemented by macro investments and insights. With a portfolio equity of $40.82 billion, Point72's top holdings include Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), and NVIDIA Corp (NASDAQ:NVDA), with a strong focus on the healthcare and technology sectors.

Caribou Biosciences Inc Company Overview

Caribou Biosciences Inc, trading under the symbol CRBU, is a clinical-stage CRISPR biopharmaceutical company based in the USA. Since its IPO on July 23, 2021, the company has been dedicated to developing genome-edited cell therapies for various diseases. With a market capitalization of $614.596 million, Caribou Biosciences operates as a single reportable segment. Despite a challenging market, the stock has shown a year-to-date price increase of 24.78%, with a current stock price of $6.95, slightly above the trade price.

Analysis of the Trade

The recent acquisition by Steven Cohen (Trades, Portfolio)'s Point72 has bolstered its stake in Caribou Biosciences, indicating a strategic move within the biotechnology industry. The trade price of $6.92 is closely aligned with the current stock price of $6.95, suggesting that Point72 sees value at this level. The firm's position in Caribou Biosciences now stands at 0.08% of its total portfolio, with a 5.00% holding in the company's shares, reflecting confidence in the stock's potential.

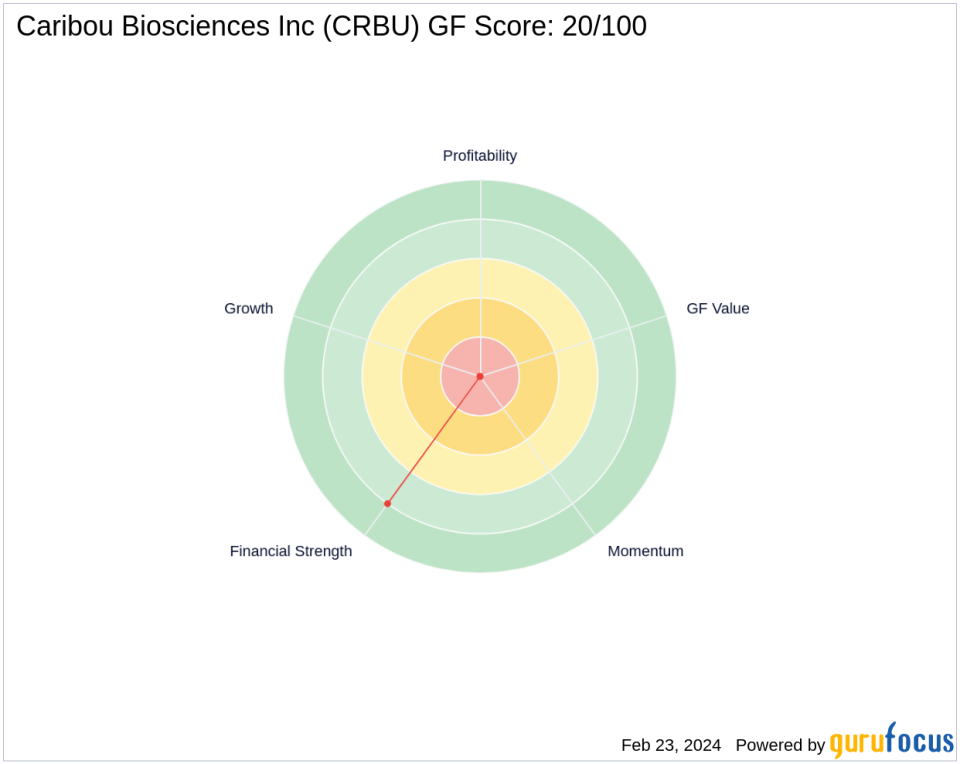

Caribou Biosciences Inc Financial Health

Caribou Biosciences' financial health is a mixed picture. The company has a strong Financial Strength with a Balance Sheet Rank of 8/10 and a Cash to Debt ratio of 12.33. However, it is currently not profitable, as indicated by a Profitability Rank of 0/10 and a negative Return on Equity (ROE) of -30.09%. The company's Growth Rank and GF Value Rank are also at the lower end, reflecting the challenges it faces in a competitive biotechnology sector.

Sector and Market Context

Point72's exposure to the healthcare and technology sectors is significant, with Caribou Biosciences fitting well within its investment strategy. The biotechnology industry is known for its high-risk, high-reward nature, and Cohen's firm appears to be positioning itself to capitalize on potential breakthroughs in CRISPR technology and cell therapies.

Comparative Guru Holdings

Other notable investment gurus, including Jefferies Group (Trades, Portfolio), also hold shares in Caribou Biosciences. However, the largest guru shareholder is Bruce & Co., which indicates a broader interest in the company among savvy investors. The comparative holdings suggest that Caribou Biosciences is on the radar of several influential market players.

Conclusion

Steven Cohen (Trades, Portfolio)'s Point72 Asset Management has made a calculated addition to its portfolio with the acquisition of Caribou Biosciences Inc. The firm's investment reflects a belief in the company's potential within the biotechnology sector. While Caribou Biosciences faces financial challenges, its strong balance sheet and the innovative nature of its CRISPR technology may offer long-term rewards. As Point72 continues to navigate the healthcare and technology landscapes, Caribou Biosciences represents a strategic piece in its complex investment puzzle.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.