Steven Cohen's Point72 Adds Cidara Therapeutics to Its Portfolio

Introduction to the Transaction

Steven Cohen (Trades, Portfolio)'s investment firm, Point72, has recently expanded its portfolio with the addition of Cidara Therapeutics Inc (NASDAQ:CDTX). On December 31, 2023, Point72 acquired 1,250,228 shares of the biotechnology company, reflecting a new position in the firm's diverse investment landscape. The transaction was executed at a trade price of $0.794 per share, marking a strategic move by one of the industry's leading investment entities.

Profile of the Investment Firm: Steven Cohen (Trades, Portfolio)'s Point72

Steven A. Cohen stands at the helm of Point72 as its Chairman and CEO, overseeing a robust team of over 1,650 professionals. The firm, which evolved from S.A.C. Capital Advisors, operates as a registered investment advisor since 2014. Cohen's investment philosophy centers around a long/short equity strategy, employing a fundamental bottom-up research process to drive macro investments and insights. With top holdings in technology and healthcare sectors, including giants like Amazon.com Inc (NASDAQ:AMZN) and Meta Platforms Inc (NASDAQ:META), Point72 manages an impressive equity of $33.83 billion. Cohen's leadership extends beyond finance, with philanthropic endeavors and ownership of the New York Mets baseball team.

Details of Cidara Therapeutics Inc

Cidara Therapeutics Inc, a USA-based biotechnology company, has been on the radar of investors since its IPO on April 15, 2015. The company is dedicated to the discovery, development, and commercialization of novel anti-infectives. Its flagship product, Rezafungin, is a groundbreaking molecule in the echinocandin class of antifungals, aimed at treating and preventing serious fungal infections. With a market capitalization of $60.584 million and a current stock price of $0.66993, Cidara operates within a single segment focused on anti-infective therapies.

Analysis of the Trade Impact

The recent acquisition by Steven Cohen (Trades, Portfolio)'s Point72 has not had a significant impact on the firm's portfolio due to the lack of trade impact data and position ratio. However, the trade represents a 1.40% holding in Cidara Therapeutics, indicating a targeted investment approach by the firm. The trade's influence on the stock and Point72's portfolio will be closely monitored by investors and industry analysts alike.

Financial Health and Stock Performance of Cidara Therapeutics Inc

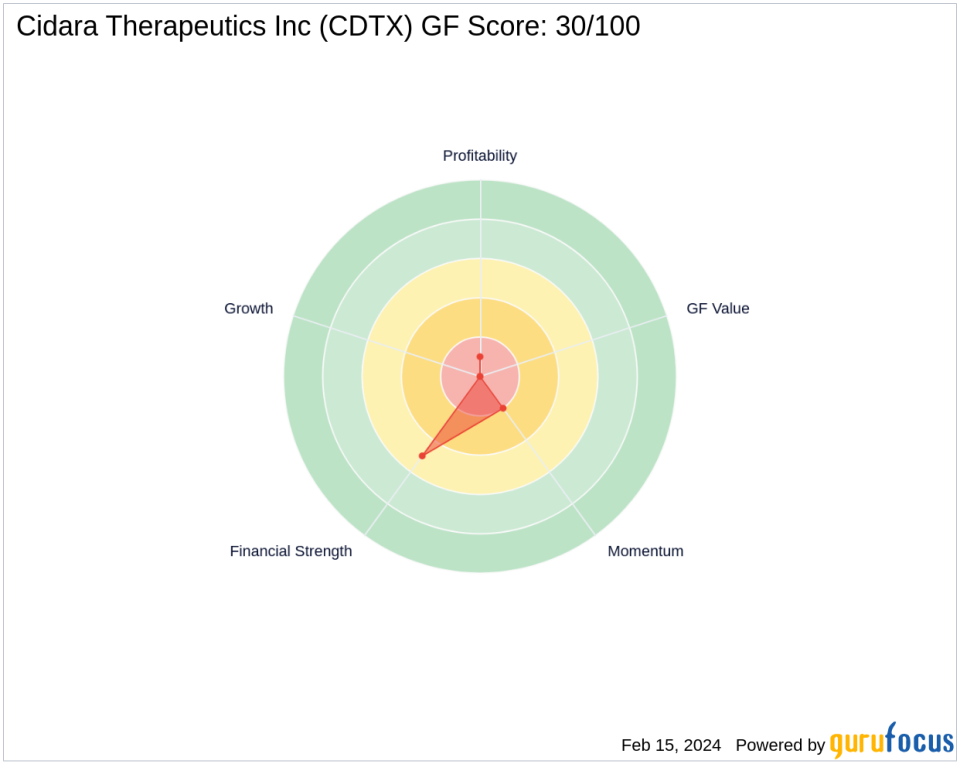

Cidara Therapeutics' financial health, as indicated by its GF Score of 30/100, suggests potential challenges in future performance. The company's financial strength and Profitability Rank are also areas of concern, with scores of 5/10 and 1/10, respectively. Despite these figures, Cidara's stock is considered modestly undervalued, with a price to GF Value ratio of 0.74. Since its IPO, the stock has experienced a significant decline of -95.93%, with a year-to-date change of -16.33% and a post-transaction decrease of -15.63%.

Sector and Market Considerations

Steven Cohen (Trades, Portfolio)'s Point72 has shown a keen interest in the technology and healthcare sectors, with Cidara Therapeutics fitting well within these preferences. The biotechnology industry, where Cidara operates, is known for its high-risk, high-reward nature and is currently facing a dynamic market environment. Investors are watching closely as the industry navigates through innovation, regulatory landscapes, and market demands.

Comparative Valuation Metrics

When assessing Cidara Therapeutics' stock valuation, it is modestly undervalued with a GF Value of $0.90. The stock's valuation metrics, including its price to GF Value ratio, suggest a potential opportunity for investors seeking undervalued assets. However, the stock's modest undervaluation must be weighed against its financial health and market performance.

Conclusion

The acquisition of Cidara Therapeutics by Steven Cohen (Trades, Portfolio)'s Point72 may signal a strategic move based on the firm's investment philosophy and sector focus. While the financial health and stock performance of Cidara present certain risks, the modest undervaluation could offer a potential upside for value investors. As the biotechnology sector continues to evolve, this transaction will be an interesting case study for the investment community.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.