Steven Cohen's Point72 Adds PagSeguro Digital Ltd to Its Portfolio

Overview of Steven Cohen (Trades, Portfolio)'s Latest Trade

Steven Cohen (Trades, Portfolio)'s investment firm, Point72, has recently expanded its portfolio by adding shares of PagSeguro Digital Ltd (NYSE:PAGS), a prominent financial technology company based in Brazil. On December 31, 2023, Point72 acquired 10,933,610 shares of PagSeguro Digital, reflecting a notable investment move in the tech sector.

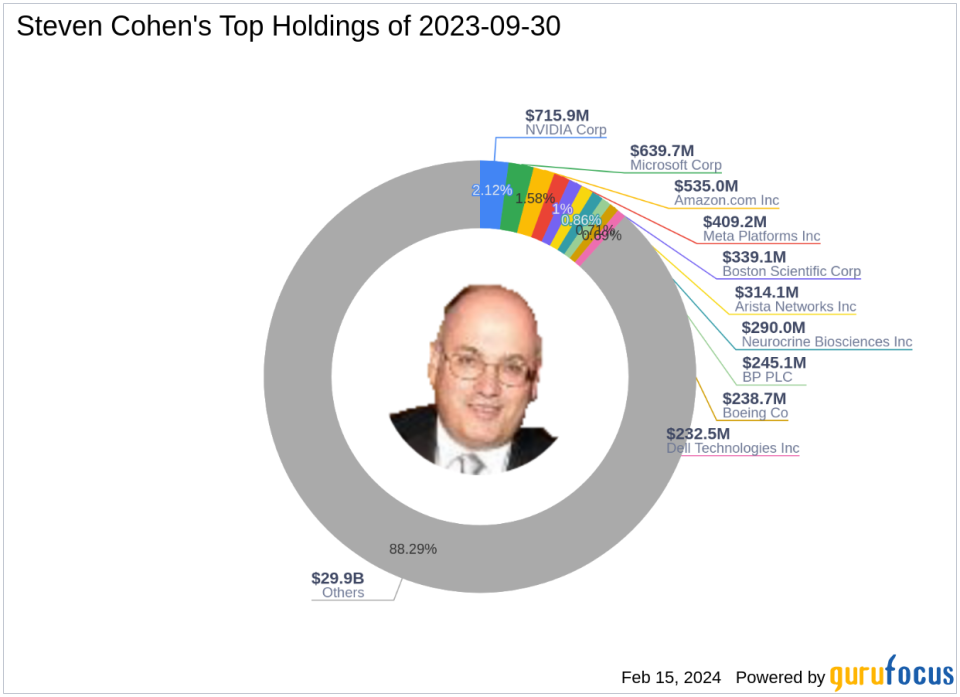

Profile of Investment Firm Point72

Point72, led by Chairman and CEO Steven A. Cohen, is a well-established investment advisor with a focus on long/short equity as its core strategy. The firm operates on a multi-manager platform, emphasizing a fundamental bottom-up research process to drive its macro investments. Cohen's extensive experience in public markets has also led to the creation of Point72 Ventures and Point72 Hyperscale, expanding the firm's reach into venture capital and private equity. With top holdings in technology and healthcare sectors, Point72 manages an equity portfolio worth $33.83 billion, featuring companies like Amazon.com Inc (NASDAQ:AMZN) and Meta Platforms Inc (NASDAQ:META).

Details of the PagSeguro Digital Acquisition

The transaction executed on December 31, 2023, saw Point72 adding 231,012 shares to its existing stake in PagSeguro Digital, at a trade price of $12.47 per share. This trade has increased the firm's position in PAGS to 0.4% of its portfolio, with a 5.60% ownership of the company's outstanding shares. The trade impact on Point72's portfolio was a minimal 0.01%.

Introduction to PagSeguro Digital Ltd

PagSeguro Digital Ltd operates as a provider of innovative financial technology solutions, primarily catering to micro-merchants, small, and medium-sized companies in Brazil. The company offers a comprehensive digital ecosystem that addresses various financial needs, from payment processing to access to working capital. Since its IPO on January 24, 2018, PagSeguro has been committed to facilitating business management and growth for its clients through its diverse range of services.

Stock Performance and Valuation of PagSeguro Digital

Since the trade date, PagSeguro Digital's stock price has seen an increase of 6.26%, currently trading at $13.25. However, the stock has experienced a significant decline of 53.01% since its IPO. The company's valuation metrics suggest caution, with a GF Value of $35.89 and a stock price to GF Value ratio of 0.37, indicating a possible value trap. The stock's year-to-date performance shows a positive trend with a 9.32% increase.

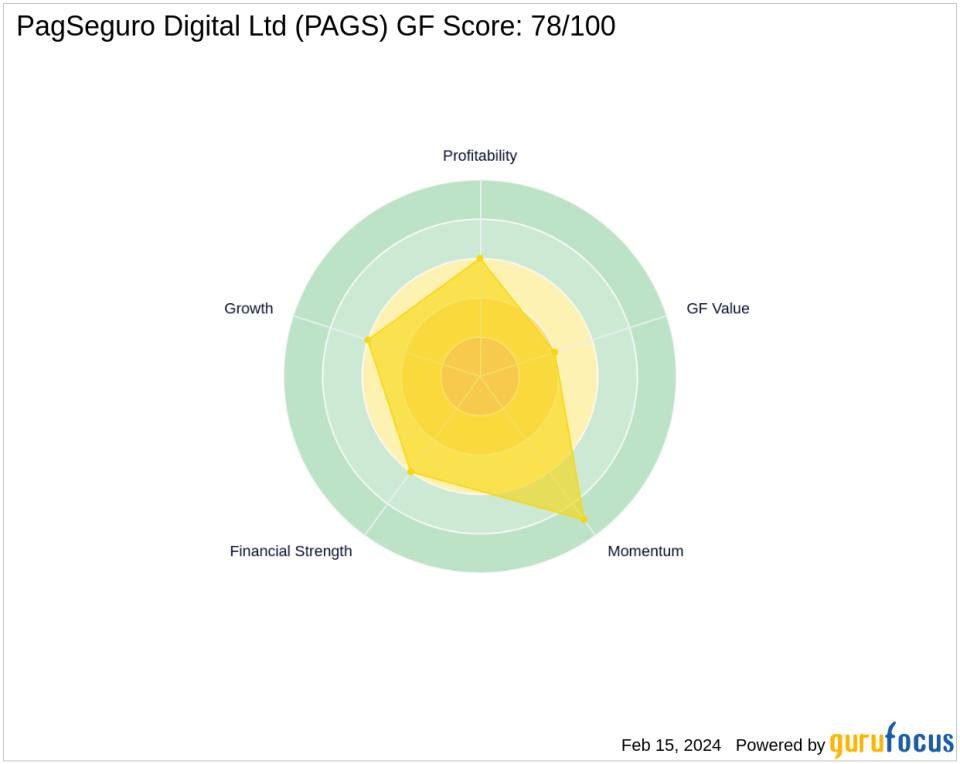

Comparative Financial Analysis

PagSeguro Digital's financial health and growth prospects are measured against industry standards, with a GF Score of 78/100, indicating likely average performance. The company's financial strength, profitability, and growth ranks are all scored at 6/10, while its GF Value Rank is at 4/10. The Momentum Rank stands out at 9/10, reflecting strong recent performance.

Sector and Market Context

Point72's top holdings are concentrated in the technology and healthcare sectors, areas that are subject to rapid innovation and market shifts. These sectors' dynamics can significantly influence the performance of companies like PagSeguro Digital, which operates at the intersection of technology and financial services.

Leading Guru Shareholders in PagSeguro Digital

While Point72 has increased its stake in PagSeguro Digital, it is worth noting that Barrow, Hanley, Mewhinney & Strauss is the largest guru shareholder in the company. The significance of their share percentage, although not specified, represents a strong vote of confidence in PagSeguro Digital's potential.

Impact of the Trade on Point72's Portfolio

The recent acquisition of PagSeguro Digital shares by Steven Cohen (Trades, Portfolio)'s Point72 is a strategic move that diversifies the firm's portfolio within the technology sector. While the trade impact on the overall portfolio was minimal, the firm's increased stake in PagSeguro Digital reflects confidence in the company's future performance and its role in the evolving fintech landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.