Steven Cohen's Point72 Asset Management Acquires New Stake in Syros Pharmaceuticals

Steven Cohen (Trades, Portfolio)'s Point72 Asset Management has recently made a significant investment in Syros Pharmaceuticals Inc (NASDAQ:SYRS), marking a new holding for the firm. On December 21, 2023, the firm purchased 1,471,771 shares of the biopharmaceutical company, with the transaction priced at $5.78 per share. This buy action represents a 0.03% impact on Cohen's portfolio, establishing a 5.70% ownership stake in Syros Pharmaceuticals.

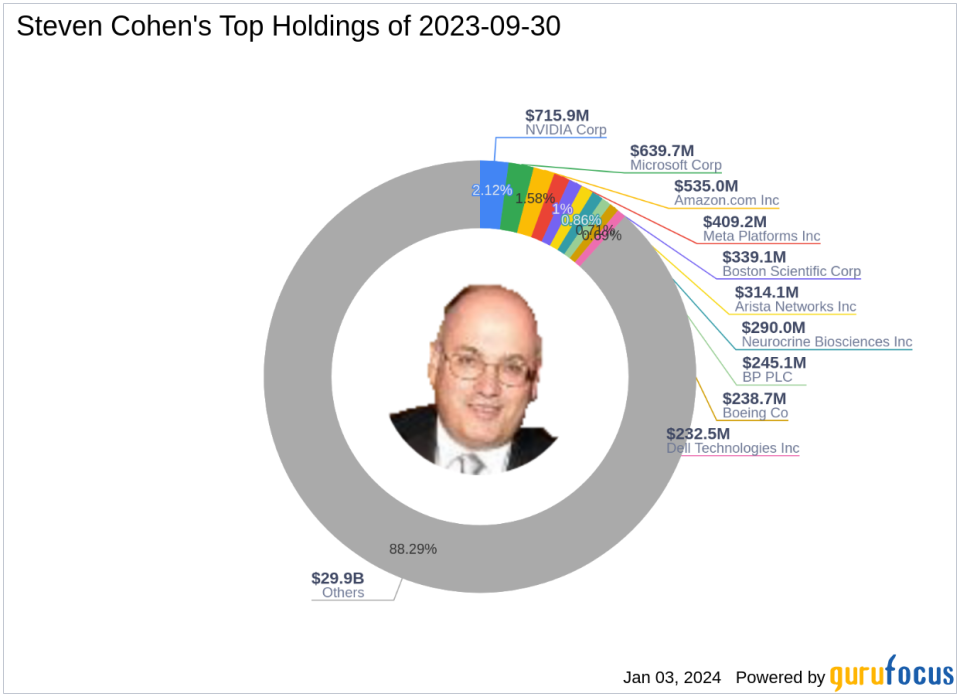

Steven Cohen (Trades, Portfolio) and Point72 Asset Management: A Brief Overview

Steven A. Cohen, the Chairman and CEO of Point72, a prominent investment advisor, is known for his strategic investment decisions. With a career spanning over four decades, Cohen has established a reputation for his long/short equity strategy and a multi-manager platform that emphasizes fundamental bottom-up research. Point72 Asset Management, which evolved from S.A.C. Capital Advisors, focuses on delivering high-quality returns by investing in public markets, alongside ventures in AI-driven private equity and global venture capital.

Understanding Syros Pharmaceuticals

Syros Pharmaceuticals, a player in the biotechnology industry, specializes in gene control and cancer therapeutics. Since its IPO on June 30, 2016, the company has been engaged in the development of treatments that target non-coding regulatory regions of the genome. Operating solely in the United States, Syros Pharmaceuticals has a market capitalization of approximately $183.606 million. Despite being labeled as "Significantly Overvalued" by GuruFocus with a GF Value of $1.62, the stock has seen a 22.15% gain since Cohen's transaction, currently trading at $7.06.

Impact of Cohen's Trade on Portfolio

The acquisition of Syros Pharmaceuticals shares has a modest yet strategic impact on Cohen's portfolio. The 0.03% position size indicates a cautious entry, aligning with the firm's investment philosophy of informed macro investments. The trade has not only diversified the portfolio but also reflects Cohen's confidence in the biotechnology sector, which is one of the top sectors in Point72's holdings, alongside technology and healthcare.

Market Context and Valuation Insights

At the time of the trade, Syros Pharmaceuticals' shares were acquired at $5.78, which is significantly lower than the current price of $7.06. However, the stock's GF Value stands at $1.62, suggesting that it is currently overvalued. The stock's price to GF Value ratio is 4.36, indicating a premium compared to its intrinsic value. Despite this, the stock's recent performance may have been a contributing factor to Cohen's investment decision.

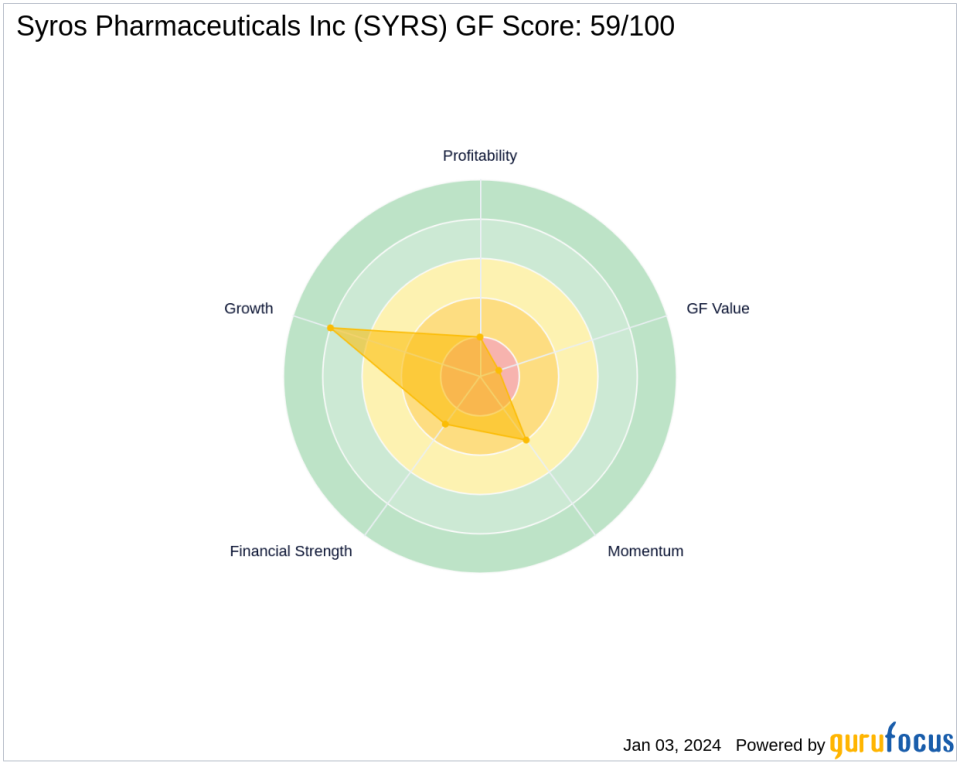

Financial Health and Performance Metrics

Syros Pharmaceuticals' financial health and performance metrics present a mixed picture. The company's Financial Strength is rated 3/10, with a Piotroski F-Score of 2, indicating potential financial weaknesses. However, its Growth Rank is strong at 8/10, reflecting robust revenue growth over the past three years. The company's Profitability Rank is low at 2/10, and it has a negative Return on Equity (ROE) of -110.91% and Return on Assets (ROA) of -49.36%.

Sector Alignment and Market Dynamics

Steven Cohen (Trades, Portfolio)'s investment in Syros Pharmaceuticals aligns with Point72's significant interest in the healthcare sector. The biotechnology industry, where Syros operates, is known for its high-risk, high-reward nature, which fits Cohen's profile of seeking out growth opportunities. The broader market context for biotech stocks is one of innovation and potential for breakthroughs, which can lead to substantial returns on investment.

Historical Performance and Predictive Indicators

Since its IPO, Syros Pharmaceuticals has experienced a significant decline of -95.29% in its stock price. However, the year-to-date performance shows a decrease of -9.95%. The company's GF Score of 59/100 suggests poor future performance potential, and the high Altman Z score of -6.55 indicates financial distress. Nevertheless, the recent Relative Strength Index (RSI) values suggest that the stock may be overbought, which could be a factor for investors to watch closely.

In conclusion, Steven Cohen (Trades, Portfolio)'s recent acquisition of Syros Pharmaceuticals shares is a calculated move that fits within Point72's diverse investment strategy. While the company's financial health and performance rankings present some concerns, the trade's impact on Cohen's portfolio and the stock's market context provide a broader perspective on this investment decision.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.