Steven Cohen's Point72 Asset Management Acquires New Stake in Vaccinex Inc

Introduction to the Transaction

Point72 Asset Management, led by renowned investor Steven Cohen (Trades, Portfolio), has recently initiated a position in Vaccinex Inc (NASDAQ:VCNX), a biotechnology company focused on cancer and neurodegenerative disease treatment. On February 6, 2024, the firm acquired 1,631,648 shares of Vaccinex Inc, marking a new holding in its investment portfolio. The shares were purchased at a price of $0.5863 each, reflecting a significant move by the firm into the biotech sector.

Profile of Steven Cohen (Trades, Portfolio)

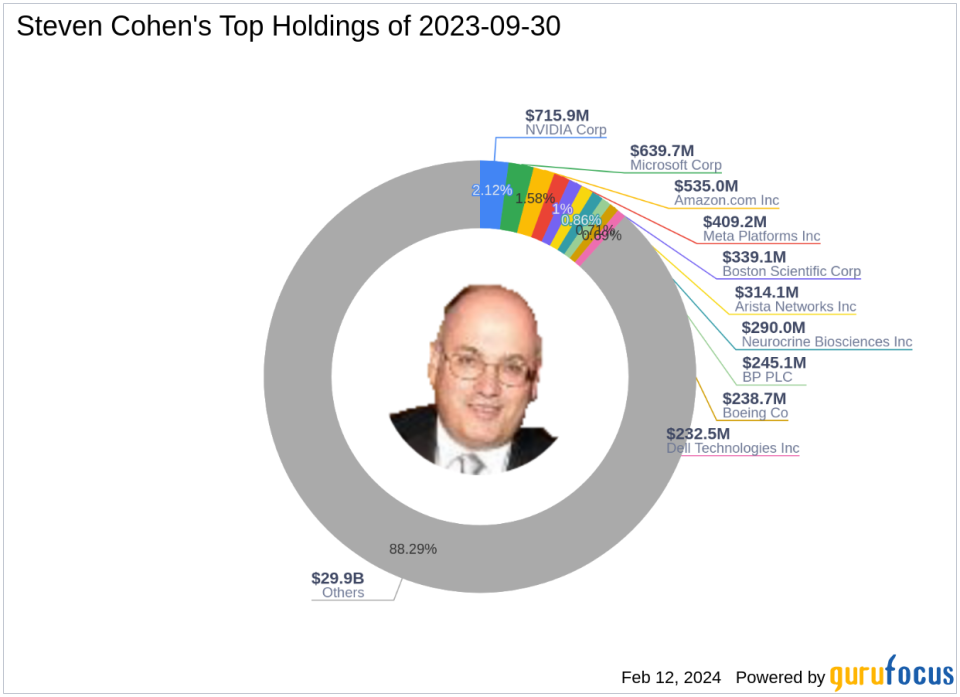

Steven A. Cohen, the Chairman and CEO of Point72 Asset Management, is a prominent figure in the investment world. With a career spanning over four decades, Cohen has established a reputation for his long/short equity strategy, utilizing a multi-manager platform and sector-aligned model. His firm emphasizes a fundamental bottom-up research process to drive macro investments and insights. Cohen's diverse portfolio includes leading technology and healthcare companies, with top holdings such as Amazon.com Inc (NASDAQ:AMZN) and Meta Platforms Inc (NASDAQ:META). Point72 manages an impressive equity of $33.83 billion, with technology and healthcare as its top sectors.

Overview of Vaccinex Inc

Vaccinex Inc, operating under the stock symbol VCNX, is a U.S.-based biotechnology company that went public on August 9, 2018. The company is at the forefront of developing treatments for cancer and neurodegenerative diseases through its lead drug candidate, pepinemab. Vaccinex's financial metrics reveal a market capitalization of $8.661 million and a current stock price of $0.6931. However, the company's PE percentage stands at 0.00, indicating it is currently not profitable.

Analysis of the Trade's Impact

The acquisition of Vaccinex Inc shares by Point72 Asset Management does not significantly impact the firm's portfolio due to its "New Holdings" status. With a trade position of 2.79% in Vaccinex Inc, the transaction represents a strategic entry rather than a major portfolio shift. The trade impact is currently marked at 0, suggesting that the firm is cautiously approaching this investment.

Vaccinex Inc's Market Performance

Since the transaction, Vaccinex Inc's stock has experienced an 18.22% gain, indicating a positive short-term response to the market. However, the stock's historical performance shows a staggering 99.61% decline since its IPO and an 8.05% decrease year-to-date. The company's price to GF Value ratio is currently at 0.00, with a GF Value of 1,222.43, suggesting that investors should exercise caution as it may be a possible value trap.

Vaccinex Inc's Financial Health Indicators

The financial health of Vaccinex Inc is a concern, with a GF Score of 37/100, indicating poor future performance potential. The company's Financial Strength and Profitability Rank are low at 2/10 and 1/10, respectively. Additionally, Vaccinex Inc's Growth Rank and GF Value Rank are also at the bottom with scores of 1/10. These indicators, along with a negative Altman Z score of -213.59, raise questions about the company's stability and growth prospects.

Sector and Industry Context

Steven Cohen (Trades, Portfolio)'s Point72 Asset Management has a history of investing in technology and healthcare sectors, with Vaccinex Inc fitting into the latter category. The biotechnology industry is known for its high-risk, high-reward nature, and Vaccinex Inc's position within this sector is precarious given its current financial health. Cohen's investment may be based on the potential upside of the company's drug development pipeline rather than its present financial metrics.

Conclusion

In summary, Steven Cohen (Trades, Portfolio)'s Point72 Asset Management has taken a new position in Vaccinex Inc, a biotech company with a focus on innovative cancer and neurodegenerative disease treatments. Despite the company's challenging financial health and market performance, the firm's investment could be a strategic move anticipating future success from Vaccinex's drug candidates. Investors should monitor the company's progress closely, considering the potential risks and rewards associated with the biotechnology sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.