Steven Cohen's Point72 Asset Management Acquires New Stake in Annexon Inc

Overview of Steven Cohen (Trades, Portfolio)'s Investment in Annexon Inc

On February 2, 2024, Point72 Asset Management, led by Steven Cohen (Trades, Portfolio), made a significant move in the biotechnology sector by purchasing 4,868,603 shares of Annexon Inc (NASDAQ:ANNX). This transaction marked a new holding for the firm, with a trade impact of 0.06% on the portfolio. The shares were acquired at a price of $4.03 each, bringing the total position to 6.20% of Annexon's shares outstanding. This strategic buy reflects Cohen's confidence in Annexon Inc and adds a new dimension to Point72's diverse investment portfolio.

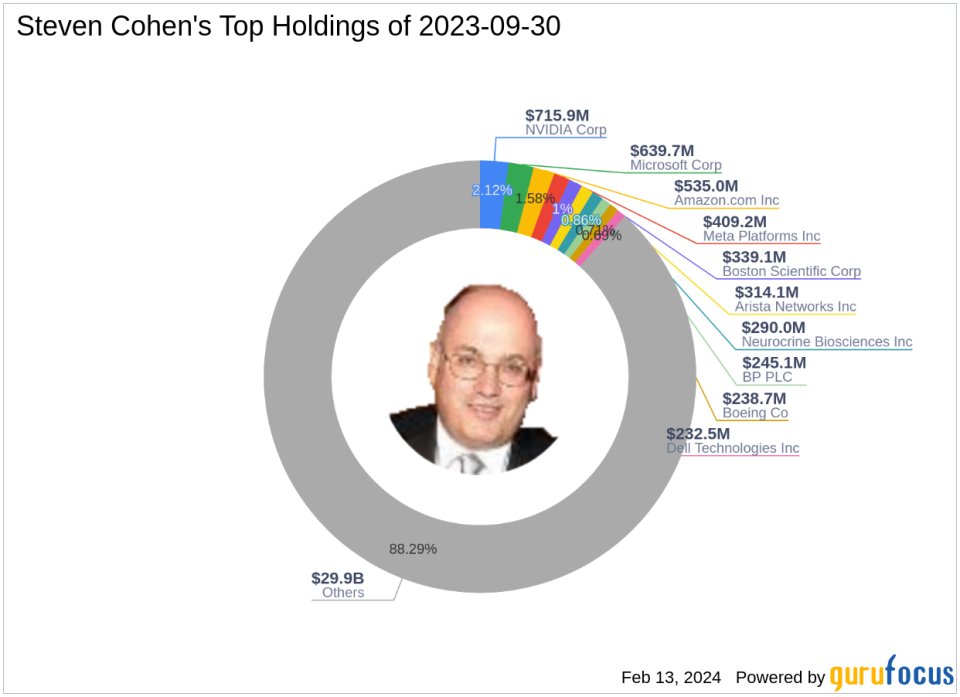

Steven Cohen (Trades, Portfolio) and Point72 Asset Management

Steven A. Cohen is a prominent figure in the investment world, heading Point72 Asset Management, a firm with over 1,650 employees. Cohen's journey began at Gruntal & Co., eventually leading to the establishment of S.A.C. Capital Advisors in 1992, which transitioned to Point72 in 2014. The firm's investment philosophy centers on a long/short equity strategy, utilizing a multi-manager platform and sector-aligned model, underpinned by rigorous bottom-up research. Cohen's portfolio is heavily weighted in technology and healthcare, with top holdings including Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), and Microsoft Corp (NASDAQ:MSFT). Point72 manages an equity portfolio valued at $33.83 billion, reflecting Cohen's significant influence in the market.

Annexon Inc at a Glance

Annexon Inc, operating under the stock symbol ANNX, is a clinical-stage biopharmaceutical company based in the USA. Since its IPO on July 24, 2020, the company has focused on developing therapies for classical complement-mediated disorders. Annexon's innovative pipeline includes candidates like ANX005 and ANX007, targeting autoimmune and neurodegenerative diseases. With a market capitalization of $389.023 million, Annexon is a key player in the biotechnology industry, striving to address significant unmet medical needs.

Significance of Cohen's Annexon Investment

The acquisition of nearly 4.9 million shares of Annexon Inc represents a substantial new position in Cohen's portfolio, accounting for 0.06% of its total value. This move indicates a strategic interest in Annexon, as Cohen now owns 6.20% of the company. The investment is a testament to Cohen's confidence in Annexon's potential and may signal a bullish outlook for the firm's future.

Annexon's Financial and Market Trajectory

Annexon's stock price has seen a 23.33% increase since the transaction date, currently trading at $4.97. Despite a significant drop of 71.44% from its IPO price, the stock has shown a year-to-date increase of 2.69%. Financially, Annexon has a GF Score of 37/100, indicating potential challenges in future performance. The company's financial strength and profitability rank low, with a Profitability Rank of 1/10 and a Growth Rank of 0/10. However, Annexon's balance sheet remains robust, with a Financial Strength rank of 7/10 and a Cash to Debt ratio of 5.25.

Contextualizing Annexon in the Biotech Sector

Cohen's portfolio shows a strong inclination towards technology and healthcare sectors, with Annexon Inc fitting well within this investment landscape. The biotechnology industry, where Annexon operates, is known for its high-risk, high-reward nature, often attracting investors looking for breakthrough opportunities in medical advancements.

Implications for Value Investors

Steven Cohen (Trades, Portfolio)'s investment in Annexon Inc could increase the company's visibility in the market and potentially influence other investors' perceptions. Value investors, however, should consider Annexon's financial health and market performance, including its low GF Score and Profitability Rank, before making investment decisions. The firm's strong balance sheet and Cohen's backing might offer some reassurance, but the overall analysis suggests a cautious approach.

Transaction Analysis and Impact

Steven Cohen (Trades, Portfolio)'s acquisition of Annexon shares is a notable development for both the firm and the company. The investment has already had a positive impact on Annexon's stock price and could further enhance its market presence. For Point72, the new holding diversifies its portfolio and aligns with its strategic focus on the healthcare sector. Investors will be watching closely to see how this investment unfolds and whether Cohen's influence will lead to long-term gains for Annexon Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.