Steven Cohen's Point72 Asset Management Acquires New Stake in Iterum Therapeutics PLC

Introduction to the Transaction

On January 30, 2024, Steven Cohen (Trades, Portfolio)'s Point72 Asset Management made a significant move in the pharmaceutical sector by purchasing 850,001 shares of Iterum Therapeutics PLC (NASDAQ:ITRM), an Ireland-based clinical-stage pharmaceutical company. The transaction was executed at a trade price of $1.58 per share, marking a new holding for the firm in its diverse investment portfolio. This strategic buy reflects Cohen's confidence in Iterum Therapeutics, despite the company's current market capitalization of $21.095 million and a stock price closely trailing the trade price at $1.57.

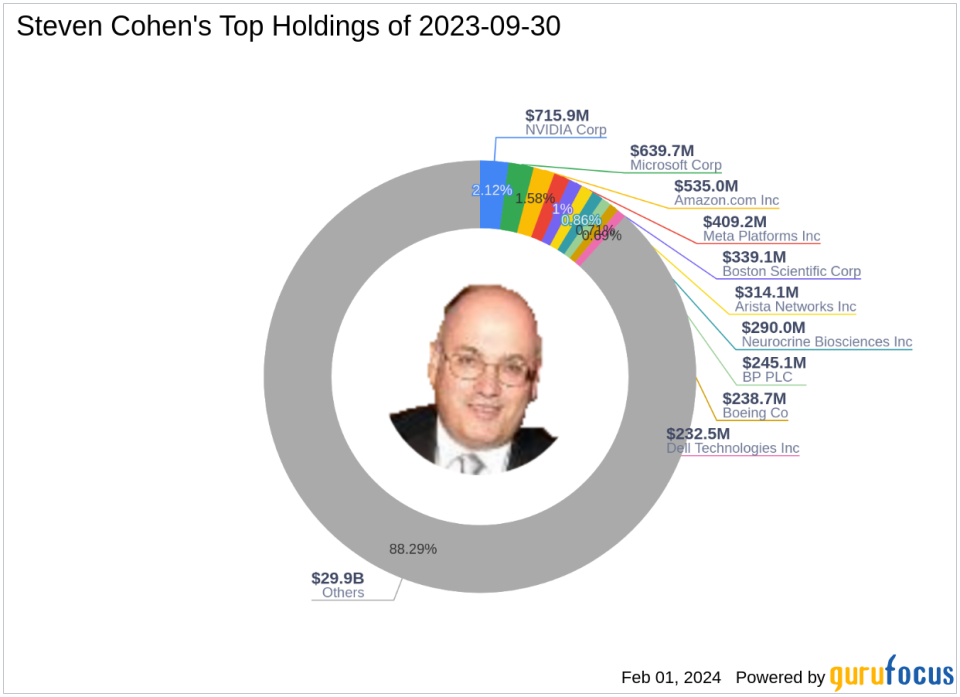

Profile of Steven Cohen (Trades, Portfolio)

Steven A. Cohen, the Chairman and CEO of Point72 Asset Management, is a prominent figure in the investment world. With a career spanning over three decades, Cohen has established a reputation for his long/short equity strategy and a multi-manager platform that emphasizes a fundamental bottom-up research process. Point72, which oversees an equity of $33.83 billion, has a strong focus on technology and healthcare sectors, with top holdings including Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), and Microsoft Corp (NASDAQ:MSFT). Cohen's investment philosophy is deeply rooted in his extensive experience in the public markets, which he also applies to his venture capital and private equity strategies.

Iterum Therapeutics PLC Company Overview

Iterum Therapeutics PLC operates in the biotechnology industry, focusing on the development and commercialization of sulopenem, a potential solution to antibiotic resistance and toxicity limitations. Since its IPO on May 25, 2018, the company has faced challenges reflected in its stock price performance, with a staggering -99.18% decline since the IPO and a -20.51% year-to-date drop. Despite these hurdles, Cohen's investment indicates a potential turnaround or undervalued opportunity in the eyes of the seasoned investor.

Analysis of the Trade Impact

The acquisition of Iterum Therapeutics shares by Point72 Asset Management has not had a significant impact on the firm's portfolio, given the trade impact data is currently not applicable. However, the 6.30% position of the firm's holdings in the traded stock suggests a meaningful stake in the company. This move could signal a strategic interest in Iterum's future prospects or a calculated bet on the biotechnology sector's potential for high returns.

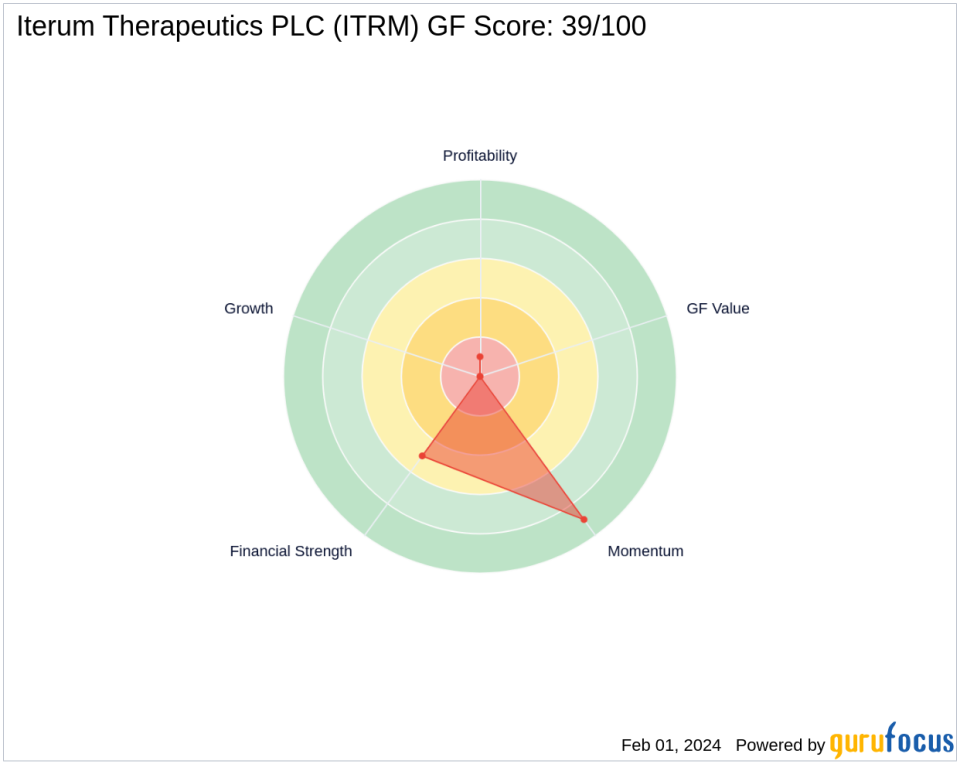

Iterum Therapeutics PLC's Financial Health

Iterum Therapeutics PLC's financial metrics paint a mixed picture. The company's Return on Equity (ROE) and Return on Assets (ROA) stand at a concerning -172.65% and -54.13%, respectively. However, the cash to debt ratio of 1.83, ranking at 1083, indicates a reasonable level of liquidity. The company's financial strength, profitability, and growth ranks are low, with scores of 5/10, 1/10, and 0/10, respectively, suggesting significant room for improvement.

Market Performance and Valuation Metrics

Iterum Therapeutics PLC's stock performance has been underwhelming, with a GF Score of 39/100, indicating poor future performance potential. The stock's valuation metrics, such as PE Percentage and GF Value, are not applicable due to the company's lack of profitability. The stock's momentum rank is high at 9/10, which could be a factor in Cohen's investment decision, considering the potential for short-term gains.

Sector and Industry Context

Steven Cohen (Trades, Portfolio)'s top sectors include technology and healthcare, with Iterum Therapeutics PLC fitting into the latter. The biotechnology industry is known for its high-risk, high-reward nature, and Cohen's investment in Iterum could be aligned with Point72's strategy of identifying undervalued companies with significant upside potential.

Conclusion

Steven Cohen (Trades, Portfolio)'s new holding in Iterum Therapeutics PLC is a noteworthy development for value investors. While the company's financial health and market performance have been less than ideal, Cohen's track record and investment philosophy suggest a deeper strategy at play. As the biotechnology sector continues to evolve, investors will be watching closely to see how this investment unfolds and whether Cohen's Point72 Asset Management can unlock value in Iterum Therapeutics PLC.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.