Steven Cohen's Point72 Asset Management Acquires New Stake in Arcutis Biotherapeutics Inc

On January 30, 2024, Steven Cohen (Trades, Portfolio)'s Point72 Asset Management made a significant move by purchasing 4,867,706 shares of Arcutis Biotherapeutics Inc (NASDAQ:ARQT), marking a new holding for the firm. The transaction was executed at a price of $5.87 per share, resulting in a 0.08% impact on the firm's portfolio. This acquisition has increased the firm's stake in Arcutis Biotherapeutics to 5.20%.

Steven Cohen (Trades, Portfolio): A Titan in Investment

Steven A. Cohen, the Chairman and CEO of Point72, is a prominent figure in the investment world. With a career spanning over four decades, Cohen has established a reputation for his savvy investment strategies and his ability to navigate the complexities of the financial markets. Point72, which evolved from S.A.C. Capital Advisors, is a testament to Cohen's commitment to excellence in asset management, leveraging a multi-manager platform and a sector-aligned model that emphasizes long/short equity as its core strategy. Cohen's investment philosophy is grounded in a fundamental bottom-up research process, which is complemented by macro investments and insights.

About Arcutis Biotherapeutics Inc

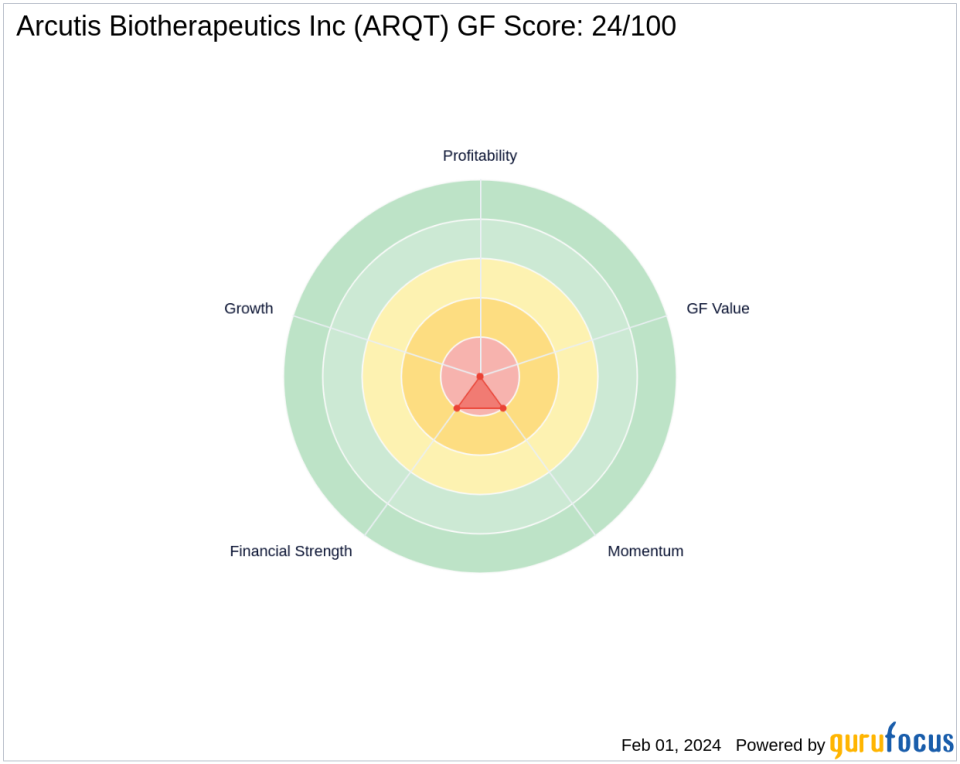

Arcutis Biotherapeutics Inc, a medical dermatology company based in the USA, is focused on developing treatments for patients with immune-mediated dermatological diseases and conditions. The company's lead product candidate, ZORYVE roflumilast cream, has shown promise in pivotal Phase 3 clinical trials for plaque psoriasis. Despite its innovative approach, Arcutis has a market capitalization of $671.744 million and is currently operating at a loss, as indicated by a PE Percentage of 0.00. The company's financial health and growth metrics present a mixed picture, with a GF Score of 24/100, suggesting challenges in future performance potential.

Impact of Cohen's Trade on Portfolio and Arcutis

The acquisition of Arcutis Biotherapeutics shares by Steven Cohen (Trades, Portfolio)'s firm is a strategic addition to the portfolio, with a 0.08% position. This move not only diversifies the firm's holdings but also reflects Cohen's confidence in the potential of Arcutis. Given the firm's expertise in long/short equity strategies and its focus on fundamental research, this investment could signal a belief in the underlying value and future prospects of Arcutis, despite its current financial metrics.

Market Response to the Trade

Since the trade, Arcutis Biotherapeutics Inc's stock price has risen to $6.94, an 18.23% increase. This uptick is particularly notable considering the stock's year-to-date performance, which shows a remarkable 102.33% surge. However, when compared to its IPO price, the stock is still down by 69.9%, indicating that the company has faced significant challenges since going public.

Financial Health and Growth Prospects

Arcutis Biotherapeutics Inc's financial rankings and ratios paint a concerning picture. With a Financial Strength of 2/10, a Profitability Rank of 0/10, and a Growth Rank of 0/10, the company's financial stability and growth prospects appear limited. The Piotroski F-Score of 4 and an Altman Z score of -4.45 further underscore the financial risks associated with the company. However, a Cash to Debt ratio of 1.11 suggests that the company has managed to maintain a reasonable level of liquidity.

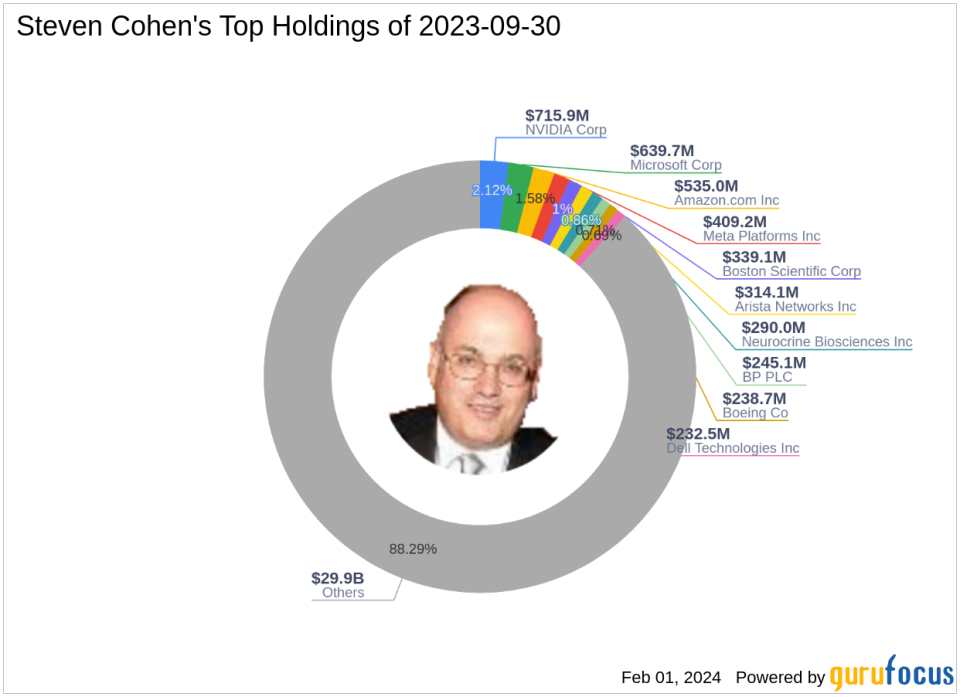

Cohen's Investment Preferences

Steven Cohen (Trades, Portfolio)'s top holdings predominantly lie in the Technology and Healthcare sectors, with major stakes in companies like Amazon.com Inc (NASDAQ:AMZN), Meta Platforms Inc (NASDAQ:META), and NVIDIA Corp (NASDAQ:NVDA). The investment in Arcutis Biotherapeutics Inc aligns with Cohen's interest in the Healthcare sector, indicating a strategic move to capitalize on potential opportunities within this industry.

Concluding Insights

For value investors, Steven Cohen (Trades, Portfolio)'s new stake in Arcutis Biotherapeutics Inc is a development worth monitoring. While the company's current financial health and growth metrics may raise concerns, Cohen's track record and investment approach suggest a calculated bet on the company's future. As Arcutis continues to navigate the biotechnology landscape, the impact of Cohen's investment on its performance will be closely watched by investors and industry analysts alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.