Steven Cohen's Point72 Asset Management Adjusts Portfolio, Notably Reduces Adobe Stake

Insights from the Latest 13F Filing Highlight Key Investment Changes

Steven A. Cohen, the renowned investor at the helm of Point72 Asset Management, has made significant changes to his investment portfolio in the third quarter of 2023. Cohen, a Wharton School graduate, is known for his long/short equity strategy and a career that spans over three decades in the public markets. His firm operates on a multi-manager platform, emphasizing a fundamental bottom-up research process to drive macro investments and insights. Beyond finance, Cohen is a philanthropist, venture capitalist, and the owner of the New York Mets.

New Additions to Cohen's Portfolio

Steven Cohen (Trades, Portfolio)'s latest 13F filing reveals the addition of 613 stocks to his portfolio. Noteworthy new entries include:

Western Digital Corp (NASDAQ:WDC), with 3,329,557 shares, making up 0.45% of the portfolio and valued at $151.93 million.

Hologic Inc (NASDAQ:HOLX), comprising 1,902,507 shares, or approximately 0.39% of the portfolio, with a total value of $132.03 million.

Crinetics Pharmaceuticals Inc (NASDAQ:CRNX), with 4,225,300 shares, accounting for 0.37% of the portfolio and valued at $125.66 million.

Significant Increases in Existing Holdings

In addition to new acquisitions, Cohen has increased his stakes in 591 stocks, with the most significant boosts in:

Neurocrine Biosciences Inc (NASDAQ:NBIX), adding 2,466,770 shares for a total of 2,578,128 shares, marking a 2,215.17% increase in share count and a 0.82% portfolio impact, valued at $290.04 million.

Arista Networks Inc (NYSE:ANET), with an additional 1,159,238 shares, bringing the total to 1,707,845 shares, a 211.31% increase in share count, valued at $314.12 million.

Complete Exits from Certain Holdings

Cohen's third-quarter moves also included completely exiting 470 holdings, with significant sell-offs such as:

Dominion Energy Inc (NYSE:D), selling all 3,584,776 shares, impacting the portfolio by -0.56%.

Palo Alto Networks Inc (NASDAQ:PANW), liquidating 724,378 shares, also resulting in a -0.56% portfolio impact.

Notable Reductions in Portfolio Positions

Reductions were made in 427 stocks within Cohen's portfolio. The most impactful reductions include:

Adobe Inc (NASDAQ:ADBE), with a reduction of 696,314 shares, leading to a -92% decrease in shares and a -1.02% portfolio impact. Adobe's stock traded at an average price of $524.63 during the quarter and has seen a 15.72% return over the past three months and a 79.58% year-to-date return.

AutoZone Inc (NYSE:AZO), with a reduction of 95,128 shares, resulting in an -88.01% decrease in shares and a -0.71% portfolio impact. AutoZone's stock traded at an average price of $2,509.45 during the quarter, with a 6.65% return over the past three months and an 8.85% year-to-date return.

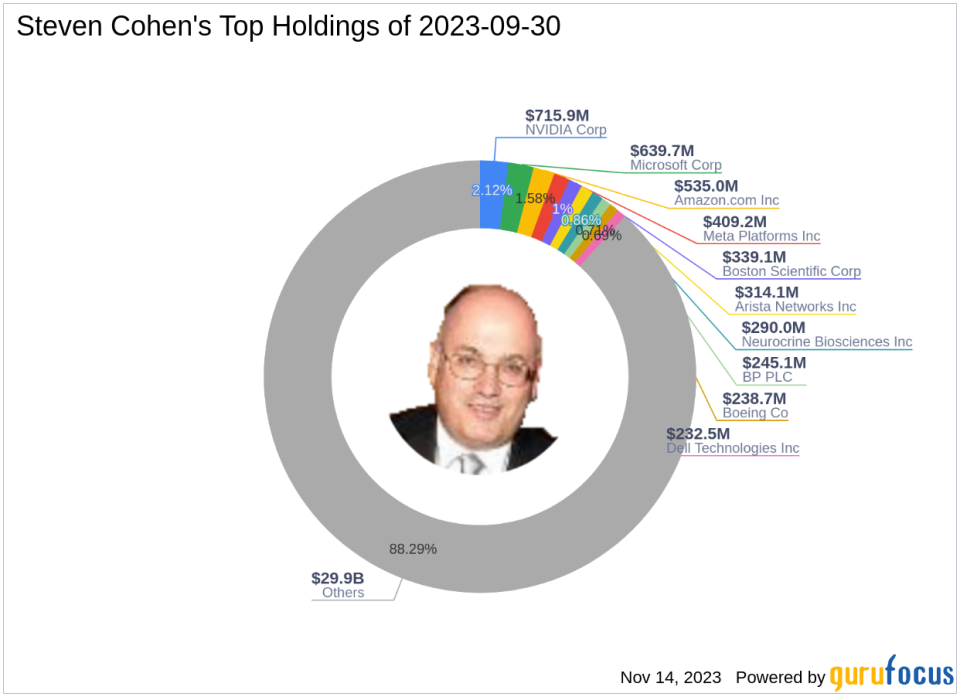

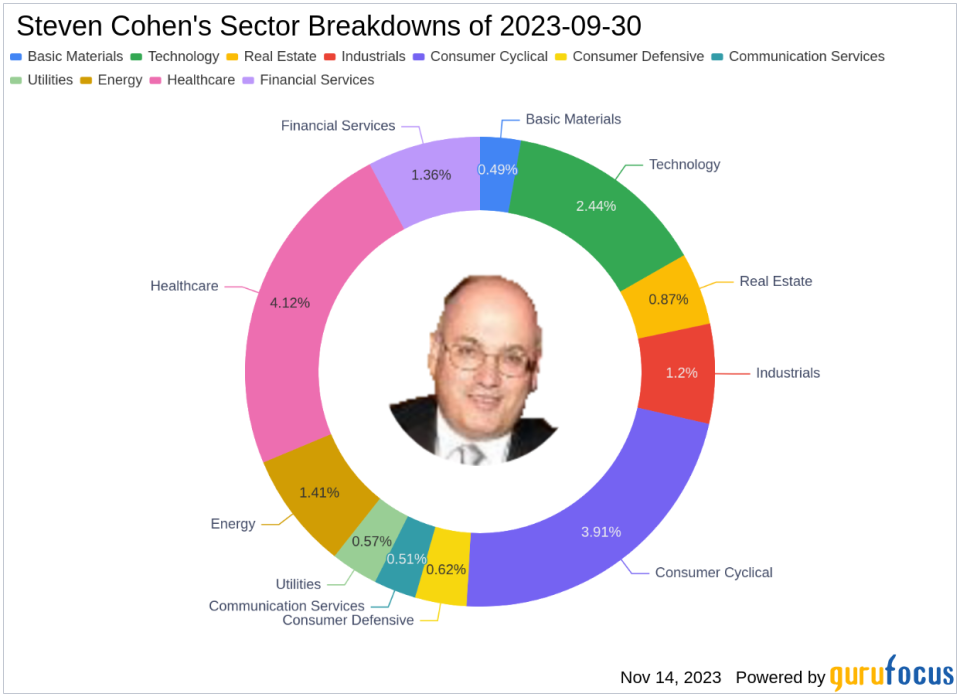

Overview of Steven Cohen (Trades, Portfolio)'s Portfolio

As of the third quarter of 2023, Steven Cohen (Trades, Portfolio)'s portfolio encompasses 2,363 stocks. The top holdings include 2.12% in NVIDIA Corp (NASDAQ:NVDA), 1.89% in Microsoft Corp (NASDAQ:MSFT), 1.58% in Amazon.com Inc (NASDAQ:AMZN), 1.21% in Meta Platforms Inc (NASDAQ:META), and 1% in Boston Scientific Corp (NYSE:BSX). The investments are primarily concentrated across all 11 industries, with a focus on Technology and Healthcare sectors.

The strategic shifts in Cohen's portfolio reflect his dynamic approach to investing, adapting to market trends and opportunities. For value investors and those seeking to make informed financial decisions, these insights into the investment maneuvers of one of the industry's leading figures are invaluable. Stay tuned to GuruFocus for more updates and analyses on guru investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.