Steven Madden Ltd (SHOO) Reports Growth in Q4 Revenue, Announces Full Year 2023 Results and ...

Revenue Growth: Q4 revenue increased by 10.4% year-over-year, reaching $519.7 million.

Gross Profit Margin: Q4 adjusted gross profit margin was 41.7%, slightly down from 42.2% in the same period of 2022.

Net Income: Q4 net income attributable to Steven Madden, Ltd. rose to $35.9 million, or $0.49 per diluted share.

Stock Repurchase: During 2023, the company repurchased approximately $142 million of its common stock.

2024 Outlook: Steven Madden Ltd projects an 11% to 13% revenue increase and diluted EPS between $2.55 and $2.65 for 2024.

On February 28, 2024, Steven Madden Ltd (NASDAQ:SHOO), a prominent designer and marketer of fashion-forward footwear, accessories, and apparel, released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023, and provided its outlook for 2024. The company, known for its brand-name and private-label products, operates through department stores, other retailers, and its own stores and websites, with the majority of its revenue stemming from its wholesale footwear segment.

Fourth Quarter and Full Year 2023 Performance

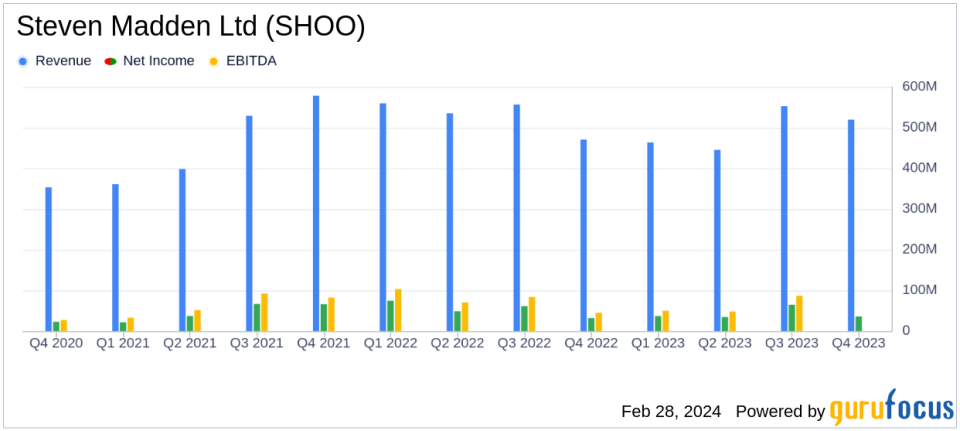

Steven Madden Ltd reported a robust fourth quarter with revenue climbing to $519.7 million, a 10.4% increase compared to the same period in 2022. This growth was driven by organic revenue expansion in both wholesale and direct-to-consumer channels, complemented by the acquisition of Almost Famous. Despite a slight decrease in gross profit margin from 42.2% to 41.3%, the company improved its adjusted operating margin. Net income for the quarter also saw an uptick, with Steven Madden, Ltd. posting $35.9 million, or $0.49 per diluted share, compared to $31.8 million, or $0.42 per diluted share, in the prior year's quarter.

For the full year, however, revenue saw a decrease of 6.6%, totaling $2.0 billion compared to $2.1 billion in 2022. Net income for the year was reported at $171.6 million, or $2.30 per diluted share, a decline from the previous year's $216.1 million, or $2.77 per diluted share.

Financial Highlights and Challenges

Steven Madden Ltd's balance sheet remains solid with cash, cash equivalents, and short-term investments totaling $219.8 million. Inventory levels held steady, approximately flat to the prior year, at $229.0 million. The company's strategic stock repurchases reflect a confident stance in its financial health and future prospects.

Despite these strengths, the company acknowledges a challenging operating environment, marked by macro-economic shifts and potential recessionary conditions. These challenges underscore the importance of the company's ability to adapt and respond to consumer demand and fashion trends promptly.

Looking Ahead: 2024 Outlook

Looking forward, Steven Madden Ltd is optimistic about its positioning for 2024, expecting revenue to increase by 11% to 13% and projecting diluted EPS to be in the range of $2.55 to $2.65. The company's confidence is rooted in its strong brands and business model, which it believes will drive sustainable revenue and earnings growth.

Edward Rosenfeld, Chairman and Chief Executive Officer, expressed satisfaction with the company's performance, stating:

"We are pleased to have delivered fourth quarter results that exceeded expectations on both the top and bottom lines... As we look ahead, while the operating environment remains choppy, we believe the on-trend product assortments created by Steve and his team have us well-positioned for 2024."

Investors and interested parties were invited to a conference call to discuss the company's earnings results and outlook, with a webcast replay available on the company's website.

Steven Madden Ltd's performance in the fourth quarter of 2023 demonstrates resilience and adaptability in a dynamic market. The company's strategic initiatives and focus on trend-responsive assortments position it to navigate the uncertainties ahead and capitalize on growth opportunities in 2024.

Explore the complete 8-K earnings release (here) from Steven Madden Ltd for further details.

This article first appeared on GuruFocus.