Steven Madden (SHOO) Acquires Almost Famous for $52 Million

Steven Madden, Ltd. SHOO is well-poised to tap the positive trends in the fashion world on its digital endeavors and other robust strategies. Its strategic endeavors include making prudent buyouts to enhance its brands’ portfolio, which, in turn, boosts overall sales and stakeholders’ value. In the latest developments, management revealed that it concluded the buyout of privately-held Almost Famous, a major women apparel’s designer and marketer.

We note that the Almost Famous’ acquisition value was $52 million in cash, which is subjected to a working capital adjustment and an earn-out provision on financial performance in the future. Almost Famous sells products under its own brands, mainly Almost Famous and private label brands for retailers. This has also been the exclusive licensee of the buyer’s NYC apparel since 2022, when Almost Famous was launched.

Almost Famous distributes its products to wholesale customers comprising mass merchants, department stores, off-price retailers and chain stores across the United States. It had generated revenues of about $163 million for the 12-month ended Sep 30, 2023.

What’s More?

Steven Madden has acquired a direct-to-consumer company, BB Dakota, which is a California-based women's apparel company. With this acquisition, the company is expanding its apparel category. Additionally, management had concluded the acquisition of the remaining 49.9% share of its European joint venture. This transaction distributes the company’s branded footwear and accessories across the majority of countries in Europe.

This Zacks Rank #3 (Hold) company remains committed to boosting its e-commerce wing via making prudent investments in digital marketing as well as efforts to optimize the features and functionality of its website. Gains from increased investment in digital marketing and robust consumer reception capabilities, such as try before you buy, have been strengths. It has also been significantly accelerating its digital commerce initiatives with respect to distribution.

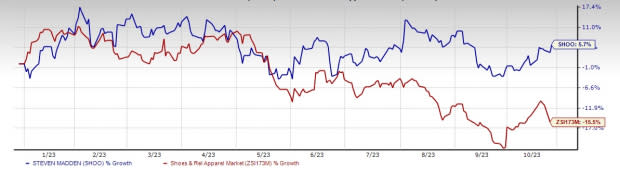

Image Source: Zacks Investment Research

Management has added high-level talent to the organization, ramped up digital marketing spending, improved data science capabilities, launched a try-before-you-buy payment facility, rolled out buy online, pick-up in store across its entire U.S. full-price retail outlets, introduced advanced delivery and return options. Management expects the direct-to-consumer business to revert to year-over-year growth in the back half of the current year.

Undoubtedly, management is focused on creating a trend-right merchandise assortment, deepening relations with customers via marketing, enhancing the digital commerce agenda, expanding international markets and efficiently controlling expenses. Buoyed by such strengths, shares of this footwear dealer have gained 5.7% against the industry’s 15.5% decline in the year-to-date period.

Eye These Solid Picks

Some better-ranked companies are G-III Apparel Group GIII, lululemon athletica LULU and Ralph Lauren RL.

G-III Apparel sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

GIII has a trailing four-quarter earnings surprise of 526.6%, on average. The Zacks Consensus Estimate for GIII’s 2023 sales and earnings per share (EPS) indicates increases of 2.4% and 14.7%, respectively, from the year-ago period’s reported levels.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 18.1% and 20.5%, respectively, from the year-ago corresponding figures. LULU has a trailing four-quarter earnings surprise of 6.8%, on average.

Ralph Lauren, a footwear and accessories dealer, has a Zacks Rank of 2 at present. RL has a trailing four-quarter earnings surprise of 17.3%, on average.

The Zacks Consensus Estimate for Ralph Lauren’s current financial-year sales and EPS suggests growth of 2.4% and 13.4%, respectively, from the year-ago corresponding figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report