Steven Madden (SHOO) to Report Q1 Earnings: What's in Store?

We expect Steven Madden, Ltd. SHOO to report a year-over-year decrease in its top line when it releases first-quarter 2023 earnings. The Zacks Consensus Estimate of $451.9 million for quarterly revenues suggests a decrease of about 19.3% from the prior-year quarter’s tally.

The Zacks Consensus Estimate for quarterly earnings has been stable at 52 cents per share in the past 30 days. Also, the consensus mark indicates a decline of 43.5% from 92 cents a share earned in the year-earlier quarter.

We expect revenues of $449.6 million to reflect a decline of 19.7% year over year and the bottom line to plunge 43.1% to 52 cents per share for the first quarter.

This fashion-forward footwear, apparel and accessories dealer delivered an earnings surprise of 24.6%, on average, in the trailing four quarters.

Key Factors to Note

Steven Madden’s first-quarter performance is likely to have been hurt by a challenging macroeconomic landscape. The ongoing uncertainties, including inflationary pressure and currency headwinds, might have been deterrents. The company has been witnessing deleveraged operating expenses for a while now. The quarterly results might have also been hurt by tough year-over-year comparisons. All these headwinds might have hurt the company’s performance during the quarter under review.

On its last quarter’s earnings call, management forecast first-quarter revenues and earnings per share (EPS) to fall year over year at a percentage rate similar to the fourth quarter of 2022. Revenues fell 18.6% year over year and EPS plunged 49.4% during the fourth quarter.

On the flip side, Steven Madden’s efforts with respect to brand strength, product assortments, international expansion and direct-to-consumer channels have been encouraging. The company’s expansion into categories outside of footwear, such as handbags and apparel, is an added positive. Overall, Steven Madden has been focused on creating a trend-right merchandise assortment, deepening relations with customers via marketing, enhancing the digital commerce agenda and efficiently controlling expenses.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Steven Madden this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

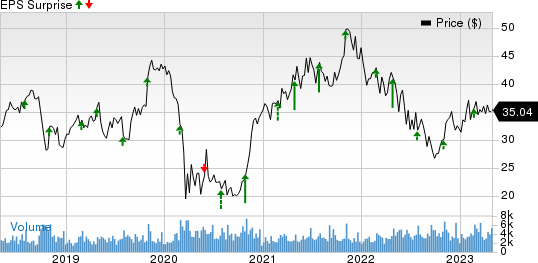

Steven Madden, Ltd. Price and EPS Surprise

Steven Madden, Ltd. price-eps-surprise | Steven Madden, Ltd. Quote

Steven Madden currently has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell).

Stocks With Favorable Combination

Here are some companies, which according to our model, have the right combination of elements to beat on earnings this season:

BJ's Wholesale BJ has an Earnings ESP of +6.76% and a Zacks Rank of 2, currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

BJ is likely to register top-line growth from the year-ago fiscal quarter’s reported figure when it reports first-quarter fiscal 2023 results. The Zacks Consensus Estimate for quarterly revenues is pegged at $4.8 billion, suggesting 6.8% growth from the figure reported in the prior-year quarter.

The consensus estimate for BJ's Wholesale’s earnings for the fiscal first quarter is pegged at 84 cents per share, suggesting a 3.5% decline from 87 cents per share reported in the year-ago fiscal quarter.

Marriott International MAR currently has an Earnings ESP of +0.81% and a Zacks Rank of 2.

MAR is likely to register top and bottom-line growth when it reports first-quarter 2023 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $5.3 billion, suggesting 25.7% growth from the figure reported in the prior-year quarter.

The consensus mark for Marriott’s first-quarter earnings is pegged at $1.86 per share, suggesting year-over-year growth of 48.8%. The consensus mark has increased a penny in the past 30 days. MAR has a trailing four-quarter earnings surprise of 12.8%, on average.

lululemon athletica LULU currently has an Earnings ESP of +1.87% and a Zacks Rank of 3. LULU is likely to register top-line improvement when it reports first-quarter fiscal 2023 numbers.

The Zacks Consensus Estimate for lululemon athletica’s quarterly revenues is pegged at $1.9 billion, calling for growth of 19.5% from the prior-year quarter’s reported figure. The consensus mark for the quarterly EPS of $1.93 suggests a 30.4% increase from the figure reported in the year-ago quarter. LULU has a trailing four-quarter earnings surprise of 6.8%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report