Stewart Information Services Corp Reports Q4 2023 Earnings Amid Real Estate Market Uncertainty

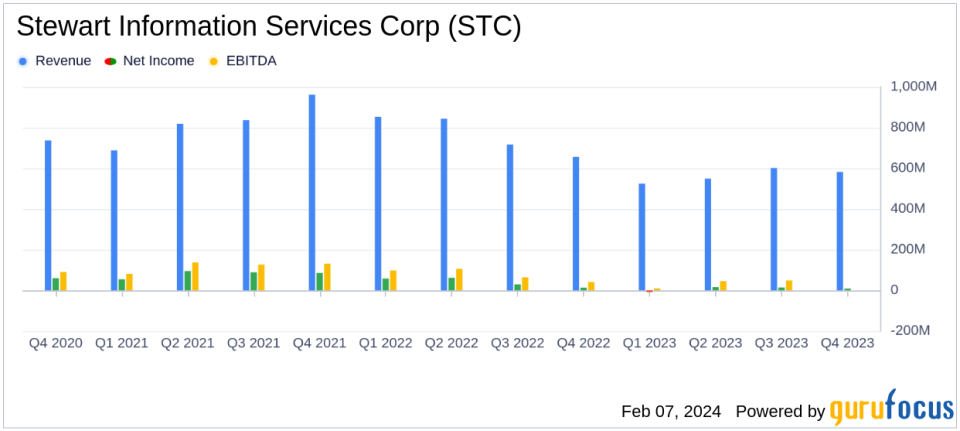

Total Revenues: $582.2 million in Q4 2023, down from $655.9 million in Q4 2022.

Net Income: Reported at $8.8 million in Q4 2023, compared to $13.3 million in Q4 2022.

Diluted EPS: $0.32 per share in Q4 2023, a decrease from $0.49 per share in Q4 2022.

Adjusted Net Income: $16.6 million in Q4 2023, versus $22.9 million in Q4 2022.

Adjusted Diluted EPS: $0.60 in Q4 2023, down from $0.84 in Q4 2022.

Pretax Income: $18.8 million in Q4 2023, slightly down from $20.8 million in Q4 2022.

Operating Cash Flow: Improved to $40.6 million in Q4 2023 from $24.8 million in Q4 2022.

On February 7, 2024, Stewart Information Services Corp (NYSE:STC) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, a global real estate services provider, faced a challenging quarter marked by a decline in total revenues and net income compared to the same period in the previous year. The reported total revenues for Q4 2023 were $582.2 million, a decrease from $655.9 million in Q4 2022. Net income also fell to $8.8 million, or $0.32 per diluted share, compared to $13.3 million, or $0.49 per diluted share, in the prior year's quarter.

Adjusted for certain non-GAAP items, net income for Q4 2023 was $16.6 million, or $0.60 per diluted share, compared to $22.9 million, or $0.84 per diluted share, in Q4 2022. The adjustments include pretax net realized and unrealized gains, office closures, severance expenses, and other items. Despite the lower performance metrics, the company's operating cash flow improved significantly, reaching $40.6 million compared to $24.8 million in the fourth quarter of the previous year.

Segment Performance and Challenges

The Title Segment, which encompasses the core operations of title insurance and related services, experienced a 14% decrease in operating revenues, falling to $503.0 million. This decline was attributed to reduced transaction volumes in both direct and agency title operations. Despite this, the segment managed a slight increase in pretax income, rising to $27.3 million.

The Real Estate Solutions Segment, on the other hand, saw a 12% increase in operating revenues, reaching $61.4 million. This growth was primarily driven by increased credit information services revenues, which offset lower valuation services revenues due to decreased transaction volumes.

STC's Chief Executive Officer, Fred Eppinger, commented on the results, stating:

"Our fourth quarter results reflect continuing uncertainty in the real estate market due to the higher interest rate environment coupled with the normal seasonality. Although we are encouraged by the moderation of interest rates into the mid 6 percent range during the fourth quarter and into early 2024, we maintain our outlook that higher interest rates will negatively impact real estate transaction volume in the first half of 2024."

Financial Analysis and Outlook

The company's financial performance reflects the broader challenges facing the real estate market, particularly the impact of higher interest rates on transaction volumes. The adjusted pretax margin for the Title Segment was 6.1%, a slight improvement over the 6.0% reported in the same quarter of the previous year. The Real Estate Solutions Segment's adjusted pretax margin was 12.0%, a slight decrease from 12.8% in Q4 2022.

Stewart Information Services Corp's balance sheet remains solid, with net cash provided by operations showing a healthy increase. The company's strategic investments throughout 2023 and its focus on balancing cost discipline with long-term initiatives are aimed at creating a more resilient company in the face of ongoing market volatility.

Investors and stakeholders will be looking closely at how Stewart Information Services Corp navigates the first half of 2024, as the real estate market continues to adjust to the higher interest rate environment. The company's efforts to streamline operations and invest in strategic initiatives may prove crucial in maintaining its competitive edge and financial health.

For a more detailed analysis and to stay updated on Stewart Information Services Corp's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Stewart Information Services Corp for further details.

This article first appeared on GuruFocus.