STILWELL JOSEPH Acquires Additional Shares in Sound Financial Bancorp Inc

On September 18, 2023, New York-based firm STILWELL JOSEPH (Trades, Portfolio) added 292 shares of Sound Financial Bancorp Inc (NASDAQ:SFBC) to its portfolio. The shares were acquired at a trade price of $36.5, bringing the firm's total holdings in SFBC to 376,283 shares. This transaction represents a 14.64% stake in the company, a significant position in the firm's portfolio.

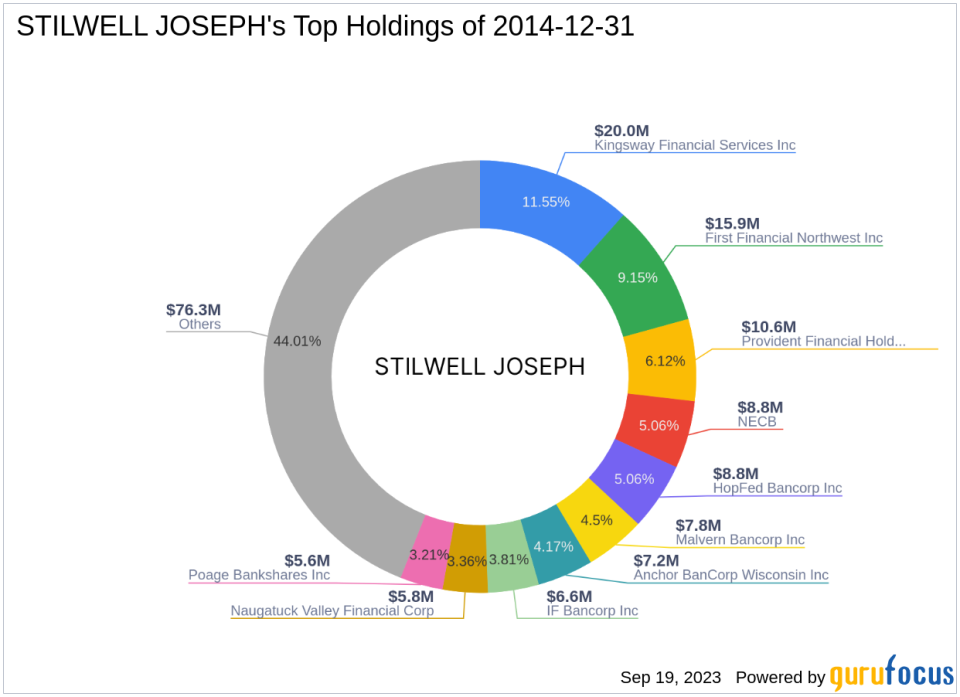

About STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) is a firm located at 111 Broadway, 12th Floor, New York, NY 10006. The firm currently holds 53 stocks in its portfolio, with a total equity of $173 million. The firm's top holdings are primarily in the Financial Services and Consumer Cyclical sectors.

Sound Financial Bancorp Inc Overview

Sound Financial Bancorp Inc is a USA-based company with a market cap of $94.143 million. The company, which went public on August 24, 2012, provides traditional banking and other financial services for individuals and businesses. Its services include retail and commercial deposits, loans secured by first and second mortgages, home equity loans and lines of credit, commercial and multifamily real estate, construction and land, consumer and commercial business loans, and more. The company operates as a single segment.

Stock Performance and Valuation

As of September 20, 2023, SFBC's stock price stands at $36.62, with a PE Percentage of 9.09. According to GuruFocus's GF Valuation, the stock is modestly undervalued, with a GF Value of 44.91. This indicates that the stock's current intrinsic value is higher than its market price, suggesting potential for growth.

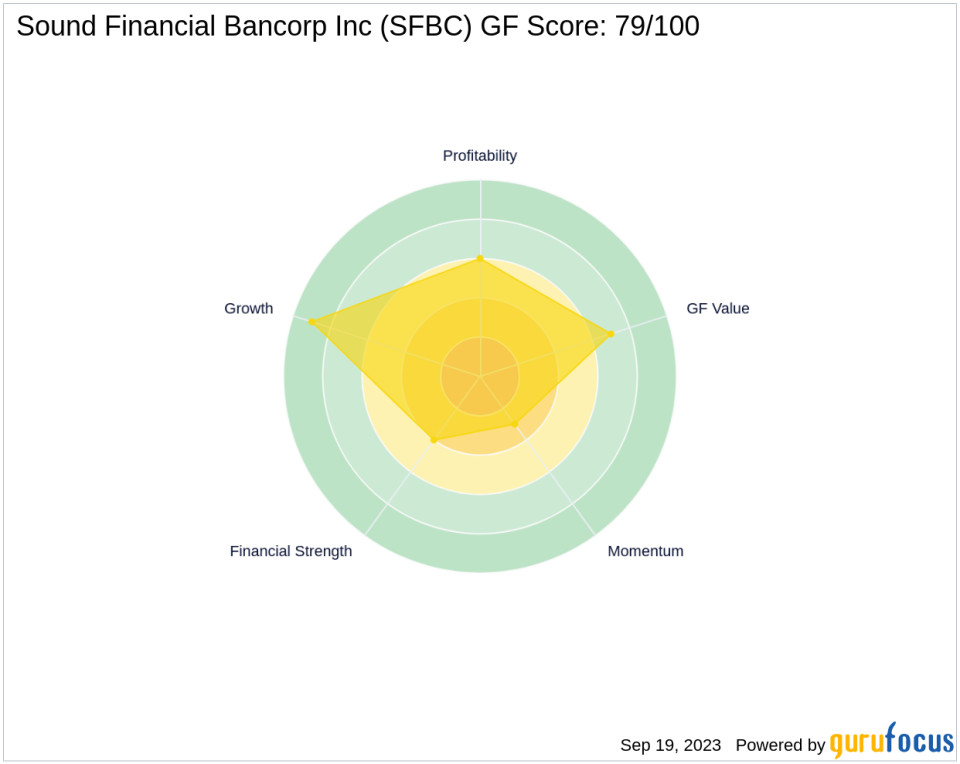

Stock Rankings and Scores

Sound Financial Bancorp Inc has a GF Score of 79/100, indicating likely average performance. The company's Financial Strength is ranked 4/10, while its Profitability Rank is 6/10. The company's Growth Rank is 9/10, its GF Value Rank is 7/10, and its Momentum Rank is 3/10.

Stock Financials and Industry Position

Sound Financial Bancorp Inc has a Cash to Debt ratio of 1.30, ranking 688 in the Banks industry. The company's Return on Equity (ROE) is 10.87, ranking 701, and its Return on Assets (ROA) is 1.07, ranking 620. The company's 3-year Revenue Growth is 8.30, and its 3-year Earnings Growth is 9.20.

Stock Growth and Momentum

Over the past three years, SFBC has shown steady growth, with a Revenue Growth of 8.30 and Earnings Growth of 9.20. However, the company's momentum has been negative, with an RSI 5 Day of 17.55 and a Momentum Index 6 - 1 Month of -1.53.

Conclusion

In conclusion, STILWELL JOSEPH (Trades, Portfolio)'s recent acquisition of additional shares in Sound Financial Bancorp Inc is a significant addition to its portfolio. Given SFBC's modest undervaluation, steady growth, and strong position in the Banks industry, this transaction could potentially yield positive returns for the firm in the future. However, investors should also consider the company's negative momentum and average GF Score when making investment decisions.

This article first appeared on GuruFocus.