STILWELL JOSEPH Acquires Additional Shares in Sound Financial Bancorp Inc

On October 5, 2023, New York-based investment firm STILWELL JOSEPH (Trades, Portfolio) added 152 shares of Sound Financial Bancorp Inc (NASDAQ:SFBC) to its portfolio. This article provides an in-depth analysis of this transaction, the profiles of both the guru and the traded company, and the potential implications for value investors.

Details of the Transaction

The transaction saw STILWELL JOSEPH (Trades, Portfolio) acquire an additional 152 shares of SFBC at a traded price of $36.75 per share. This acquisition increased the firm's total holdings in SFBC to 380,227 shares, representing 14.79% of the guru's holdings in the traded stock. However, the transaction had no significant impact on the firm's portfolio.

Profile of STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) is a renowned investment firm located at 111 Broadway, 12th Floor, New York, NY 10006. The firm manages 53 stocks with a total equity of $173 million. Its top holdings are primarily in the Financial Services and Consumer Cyclical sectors.

Overview of Sound Financial Bancorp Inc

Sound Financial Bancorp Inc, a USA-based company, has been publicly traded since its IPO on August 24, 2012. The company operates as a single-segment entity, providing traditional banking and other financial services for individuals and businesses. As of October 7, 2023, the company has a market capitalization of $95.364 million and a stock price of $37.095. Its PE percentage stands at 9.20, indicating that the company is profitable.

GuruFocus Valuation of Sound Financial Bancorp Inc

According to GuruFocus valuation, SFBC is modestly undervalued with a GF Value of $45.08. The price to GF Value ratio is 0.82, suggesting that the stock is currently trading below its intrinsic value.

Performance of Sound Financial Bancorp Inc's Stock

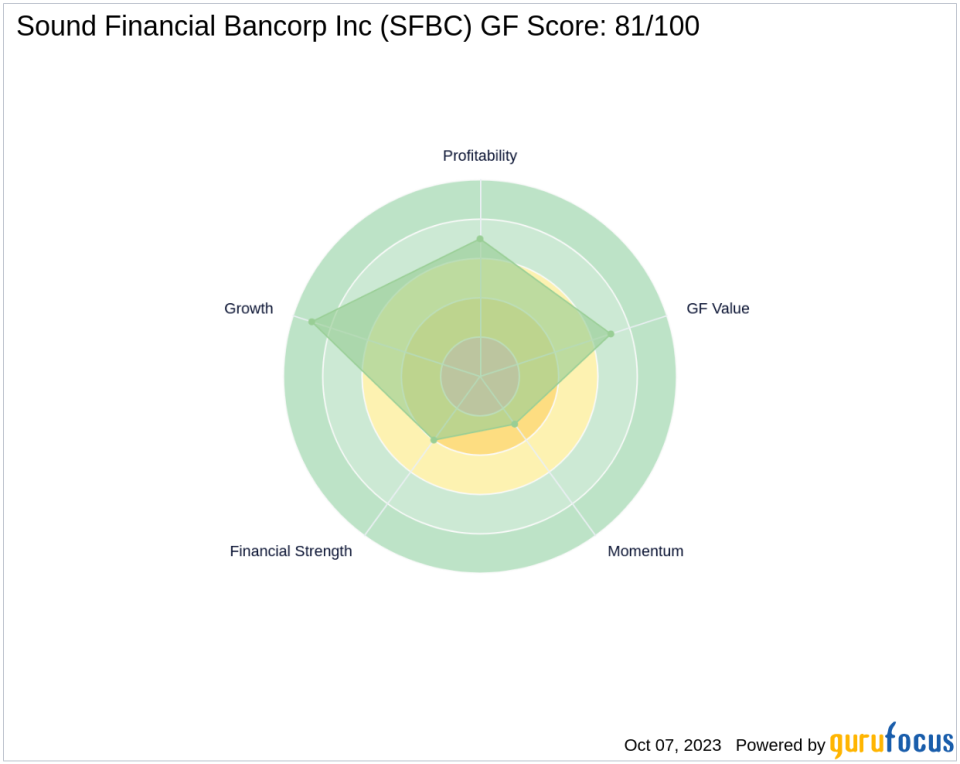

Since its IPO, SFBC's stock has gained 267.28%. However, the stock has experienced a year-to-date decline of 5.54%. The stock's GF Score is 81/100, indicating good outperformance potential.

Sound Financial Bancorp Inc's Financial Health

Sound Financial Bancorp Inc has a balance sheet rank of 4/10, a profitability rank of 7/10, and a growth rank of 9/10. The company's cash to debt ratio is 1.30, ranking it 685th in the Banks industry. Its Piotroski F-Score is 6, indicating a stable financial situation.

Conclusion

In conclusion, STILWELL JOSEPH (Trades, Portfolio)'s recent acquisition of additional shares in Sound Financial Bancorp Inc is a noteworthy transaction. The firm's increased stake in a modestly undervalued and financially stable company with good outperformance potential could be of interest to value investors. However, as always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.