STILWELL JOSEPH Acquires Additional Shares in Sound Financial Bancorp Inc

On September 28, 2023, New York-based firm STILWELL JOSEPH (Trades, Portfolio) added 268 shares of Sound Financial Bancorp Inc (NASDAQ:SFBC) to its portfolio. The shares were acquired at a trade price of $36.9, increasing the firm's total holdings in SFBC to 378,848 shares. This transaction now represents 14.74% of the firm's holdings in the traded stock.

About STILWELL JOSEPH (Trades, Portfolio)

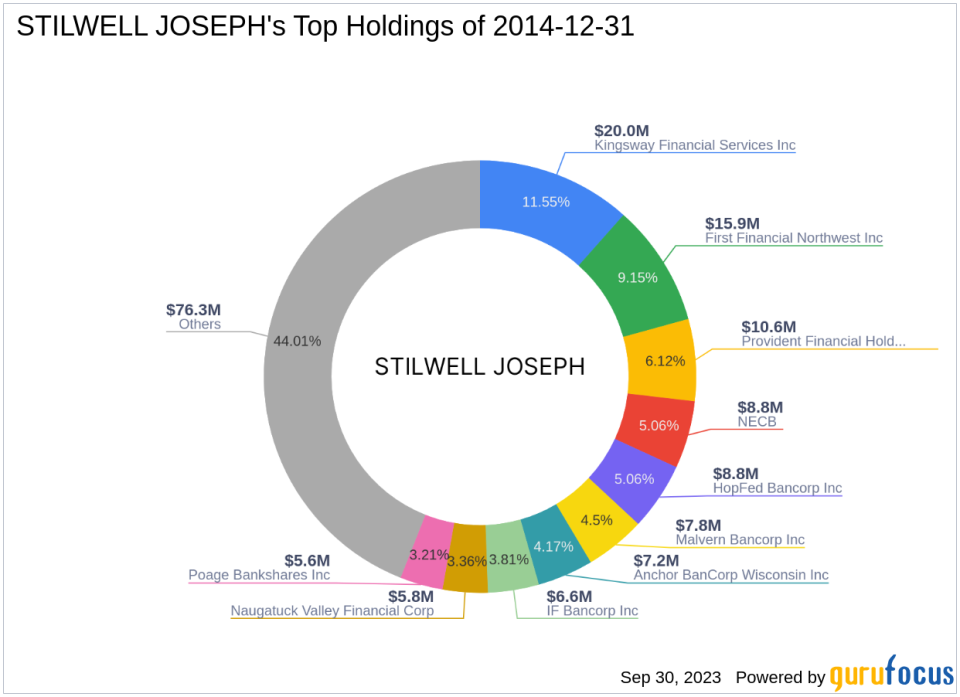

STILWELL JOSEPH (Trades, Portfolio) is a firm located at 111 Broadway, 12th Floor, New York, NY 10006. The firm's investment philosophy is primarily focused on the Financial Services and Consumer Cyclical sectors. With an equity of 173 million and a portfolio of 53 stocks, STILWELL JOSEPH (Trades, Portfolio) has established a significant presence in the investment landscape.

Sound Financial Bancorp Inc: A Brief Overview

Sound Financial Bancorp Inc is a USA-based company with a market cap of 95.043 million. The company, which had its IPO on August 24, 2012, provides traditional banking and other financial services. Operating as a single-segment entity, Sound Financial Bancorp Inc attracts retail and commercial deposits from the public and invests those funds in various types of loans.

Stock Performance and Valuation

As of September 30, 2023, the stock price of Sound Financial Bancorp Inc stands at $36.97, with a PE Percentage of 9.17. According to the GF-Score, the stock is modestly undervalued with a GF Value of $45.00. The Price to GF Value is 0.82, and the stock has gained 0.19% since the transaction.

Financial Health and Growth of the Stock

The financial strength of Sound Financial Bancorp Inc is indicated by its Balance Sheet Rank of 4/10 and Profitability Rank of 7/10. The company's growth is reflected in its Growth Rank of 9/10 and GF Value Rank of 7/10. The stock's Piotroski F-Score is 6, while its Altman Z score is not applicable.

Momentum and Industry Position of the Stock

The stock's momentum is indicated by its Momentum Rank of 3/10 and RSI 14 Day Rank of 913. In the Banks industry, the stock's position is reflected in its ROE Rank of 704 and ROA Rank of 624.

Conclusion

In conclusion, the recent acquisition by STILWELL JOSEPH (Trades, Portfolio) of additional shares in Sound Financial Bancorp Inc is a significant transaction that could potentially influence the stock's performance and the firm's portfolio. With its strong growth indicators and modest undervaluation, Sound Financial Bancorp Inc presents an interesting opportunity for value investors. However, as always, investors are advised to conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.