STILWELL JOSEPH Acquires Additional Shares in Peoples Financial Corp

On October 31, 2023, STILWELL JOSEPH (Trades, Portfolio), a renowned investment firm, added 600 shares of Peoples Financial Corp (PFBX) to its portfolio. The transaction, which saw the firm's total holdings in PFBX rise to 571,130 shares, was executed at a trade price of $12.25 per share. This acquisition represents a 0.11% change in the firm's holdings and has a current position of 12.20% in the traded stock. However, the impact of this trade on the firm's portfolio is yet to be determined.

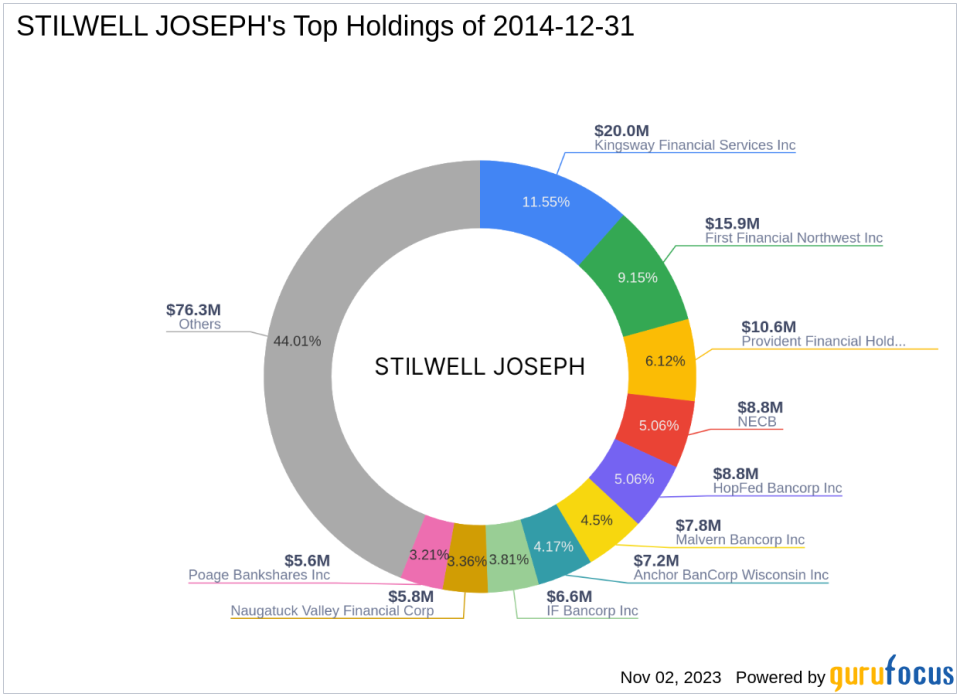

About STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) is a New York-based investment firm with a portfolio comprising 53 stocks. The firm's equity is valued at $173 million, with its top holdings in the Financial Services and Consumer Cyclical sectors. The firm's investment philosophy is centered on value investing, focusing on companies that are undervalued by the market.

Peoples Financial Corp: A Brief Overview

Peoples Financial Corp (PFBX) is a bank holding company based in the USA. The company, which went public on July 19, 1999, offers a range of financial services, including banking, financial, and trust services to individuals, small and commercial businesses operating in Mississippi, Louisiana, and Alabama. As of November 2, 2023, the company has a market capitalization of $58.945 million and a stock price of $12.6. The company's PE percentage stands at 4.65, indicating its profitability.

According to GuruFocus, the stock is significantly undervalued with a GF Value of $20.74. The GF Value is a unique measure that considers historical multiples, GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance. The stock's price to GF Value ratio is 0.61, further emphasizing its undervalued status.

Performance and Financial Health of the Stock

Since its IPO, PFBX has seen a price change of -58%. The year-to-date price change ratio stands at -13.1%. However, since the recent transaction, the stock has gained 2.86%. The stock's GF Score is 70/100, indicating poor future performance potential. The stock's Financial Strength is ranked 6/10, while its Profitability Rank and Growth Rank are both 4/10. The stock's GF Value Rank is 10/10, indicating significant undervaluation.

The stock's Piotroski F-Score is 8, suggesting a healthy financial situation. However, the stock's Altman Z score is 0.00, indicating potential financial distress. The stock's cash to debt ratio is not applicable, and its ROE and ROA are 21.94 and 1.43, respectively.

Stock's Growth and Momentum

Over the past three years, PFBX has seen a revenue growth of 6.80% and an earnings growth of 77.80%. The stock's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 81.70, 63.88, and 56.76, respectively. The stock's momentum index 6 - 1 month is 7.59, while its 12 - 1 month index is -20.37.

Conclusion

In conclusion, STILWELL JOSEPH (Trades, Portfolio)'s recent acquisition of additional shares in Peoples Financial Corp is a strategic move that aligns with the firm's value investing philosophy. Despite the stock's poor performance potential and potential financial distress, its significant undervaluation presents a potential opportunity for value investors. However, the impact of this transaction on the firm's portfolio and the stock's future performance remains to be seen.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.