STILWELL JOSEPH Acquires Additional Shares in Sound Financial Bancorp Inc

On September 14, 2023, New York-based firm STILWELL JOSEPH (Trades, Portfolio) added 2,500 shares of Sound Financial Bancorp Inc (NASDAQ:SFBC) to its portfolio. The shares were acquired at a trade price of $37, bringing the firm's total holdings in SFBC to 373,491 shares. This transaction represents a 14.53% stake in the company for STILWELL JOSEPH (Trades, Portfolio).

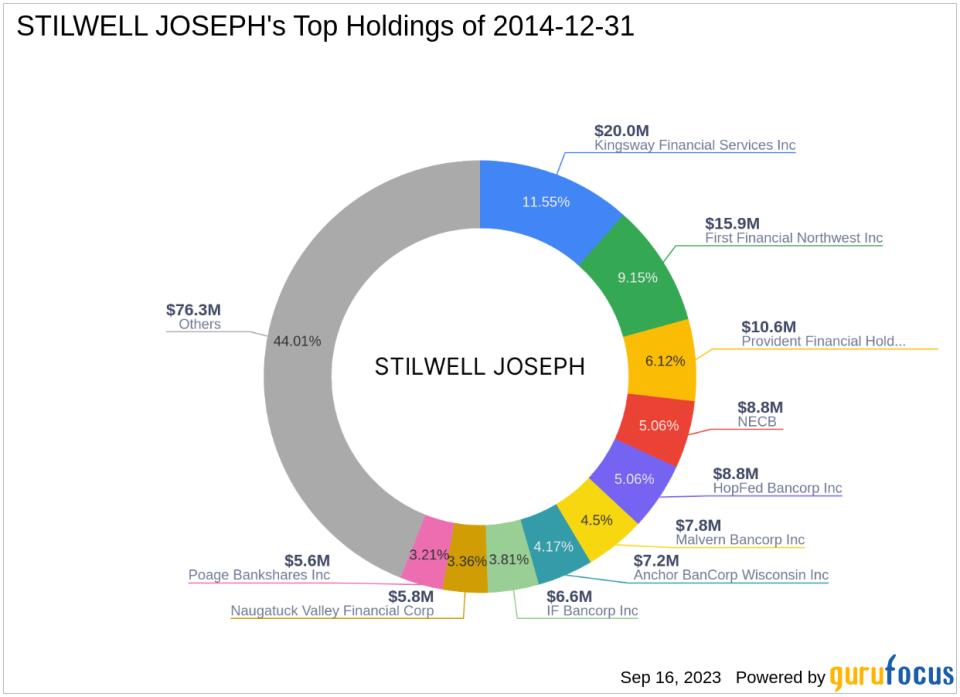

About STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) is a firm located at 111 Broadway, 12th Floor, New York, NY 10006. The firm's investment philosophy is primarily focused on the Financial Services and Consumer Cyclical sectors. With an equity worth $173 million, STILWELL JOSEPH (Trades, Portfolio) has a diverse portfolio of 53 stocks.

Sound Financial Bancorp Inc Overview

Sound Financial Bancorp Inc is a USA-based company with a market capitalization of $95.094 million. The company, which had its IPO on August 24, 2012, provides traditional banking and other financial services. It operates as a single-segment entity, attracting retail and commercial deposits from the public and investing those funds in various types of loans.

Stock Performance Analysis

As of the date of this article, SFBC's stock price stands at $36.99, with a PE Percentage of 9.18. According to GuruFocus's GF Valuation, the stock is modestly undervalued with a GF Value of $44.84. The stock's price to GF Value is 0.82, and it has seen a slight decrease of -0.03% since the transaction.

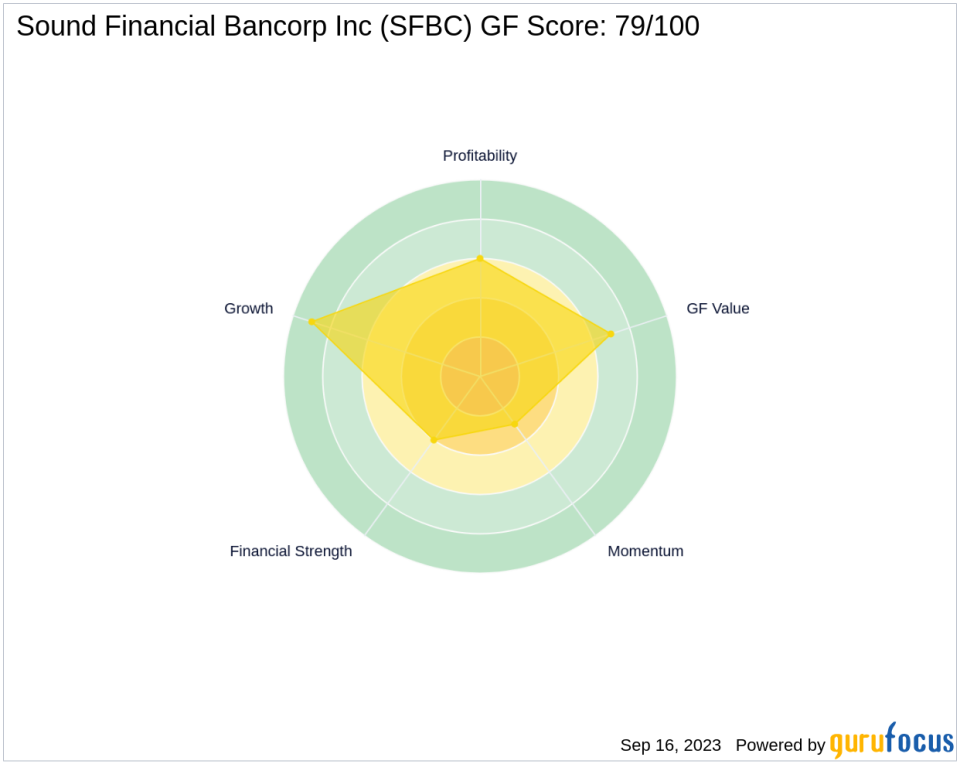

Financial Health Evaluation

Sound Financial Bancorp Inc has a GF Score of 79/100, indicating a likely average performance. The company's Financial Strength is ranked 4/10, while its Profitability Rank is 6/10. The company's Growth Rank stands at 9/10. The stock's Piotroski F-Score is 6, and it has a Cash to Debt ratio of 1.30.

Industry Performance Examination

In the Banks industry, SFBC has a Return on Equity (ROE) of 10.87 and a Return on Assets (ROA) of 1.07. The company has seen a 3-year revenue growth of 8.30 and earning growth of 9.20. The stock's RSI 5 Day is 20.50, RSI 9 Day is 33.00, and RSI 14 Day is 42.01.

Conclusion

In conclusion, STILWELL JOSEPH (Trades, Portfolio)'s recent acquisition of additional shares in Sound Financial Bancorp Inc is a noteworthy transaction. The firm's increased stake in SFBC, coupled with the stock's modest undervaluation and promising growth rank, could potentially yield positive returns. However, investors should also consider the stock's average GF Score and its recent slight decrease in value. As always, thorough research and careful consideration are recommended before making any investment decisions.

This article first appeared on GuruFocus.