STILWELL JOSEPH Acquires Provident Bancorp Inc Shares

On September 22, 2023, STILWELL JOSEPH (Trades, Portfolio), a renowned investment firm, added 1,809,355 shares of Provident Bancorp Inc (NASDAQ:PVBC) to its portfolio. This transaction has further solidified the firm's position in the banking industry. Provident Bancorp Inc, a USA-based company, offers a wide range of banking products and services to small and medium-sized commercial customers. The company's operations span across commercial real estate, construction and land, and commercial business loans, among others.

Transaction Details

The transaction saw STILWELL JOSEPH (Trades, Portfolio) acquire the shares at a trade price of $9.75 per share. This acquisition has increased the firm's total holdings in Provident Bancorp Inc to 1,809,355 shares, representing 10.23% of the firm's portfolio. Interestingly, the current stock price of PVBC stands at $9.97, indicating a gain of 2.26% since the transaction.

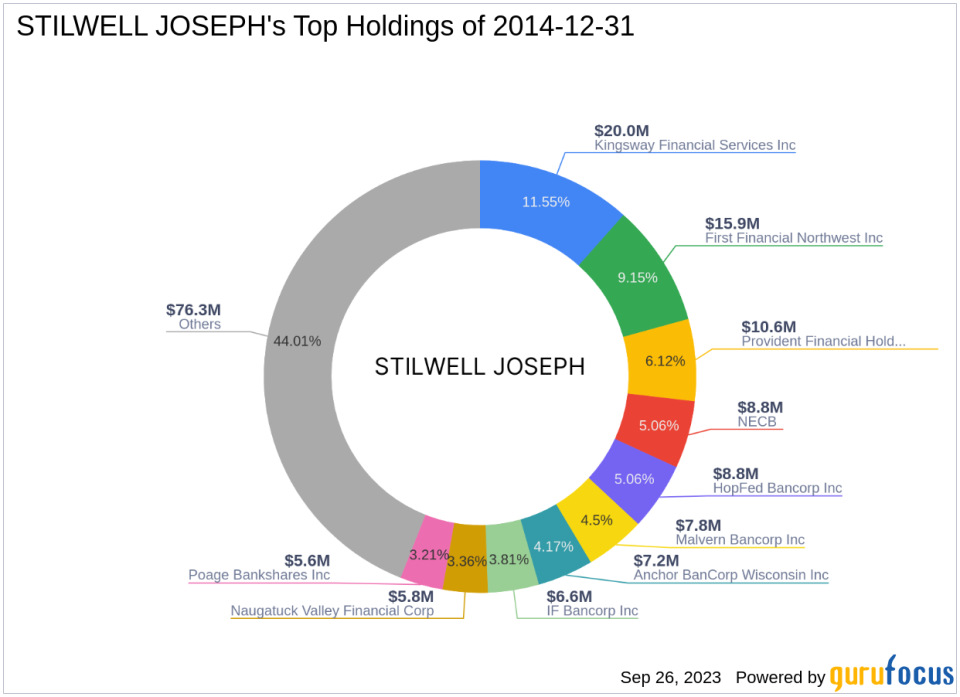

About STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) is a New York-based investment firm with a strong focus on value investing. The firm currently holds 53 stocks in its portfolio, with a total equity of $173 million. The firm's top holdings are primarily in the Financial Services and Consumer Cyclical sectors.

Analysis of Provident Bancorp Inc

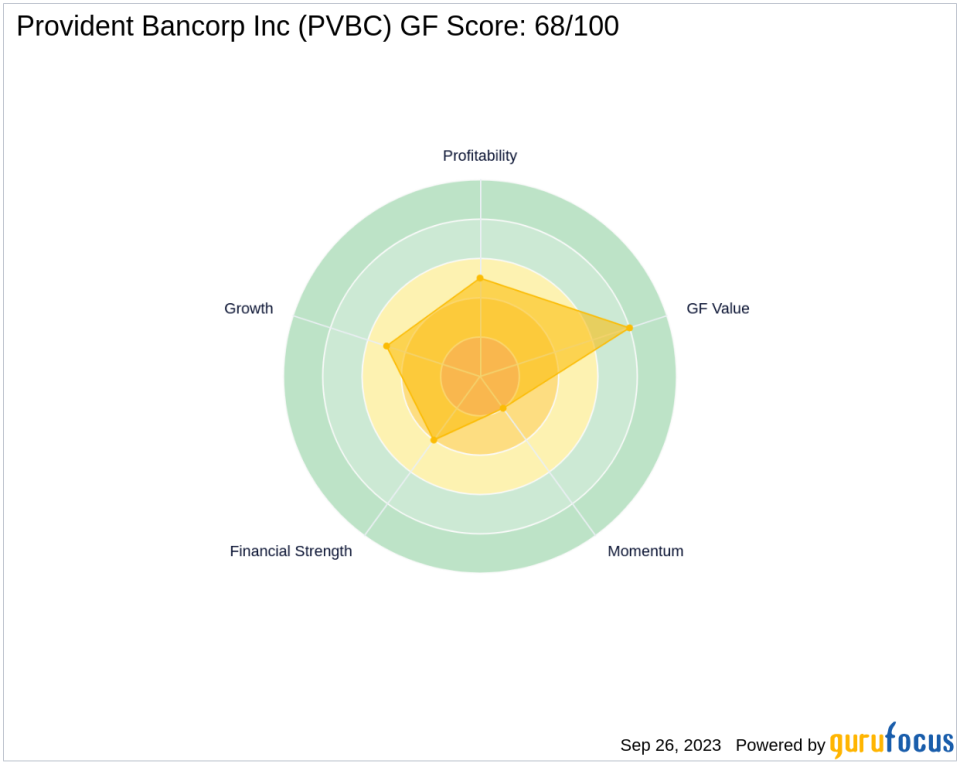

Provident Bancorp Inc, trading under the symbol PVBC, went public on January 8, 1999. The company currently has a market cap of $176.327 million. According to GuruFocus, the stock is significantly undervalued with a GF Value of $18.14, and a Price to GF Value ratio of 0.55. The stock's GF Score stands at 68/100, indicating a good future performance potential.

Performance of Provident Bancorp Inc

Despite a negative IPO percent of -18.61%, Provident Bancorp Inc has shown a promising YTD percent of 37.14%. The company's Financial Strength is ranked 4/10, while its Profitability Rank and Growth Rank are both at 5/10. The GF Value Rank is 8/10, and the Momentum Rank is 2/10.

Financial Health of Provident Bancorp Inc

Provident Bancorp Inc has a Piotroski F-Score of 4 and an Altman Z score of 0.00. The company's cash to debt ratio is 3.55, ranking it 370th in the banking industry. The company's ROE and ROA stand at -12.55 and -1.56 respectively.

Growth and Momentum of Provident Bancorp Inc

Over the past three years, Provident Bancorp Inc has seen a revenue growth of 22.80%, ranking it 106th in the industry. The company's RSI 14 Day stands at 58.02, ranking it 1216th, while its Momentum Index 6 - 1 Month is 32.08, ranking it 265th.

In conclusion, the recent acquisition by STILWELL JOSEPH (Trades, Portfolio) is a strategic move that not only strengthens its position in the banking industry but also offers potential for future growth. The transaction is likely to have a positive impact on both the stock and the firm's portfolio.

This article first appeared on GuruFocus.