STILWELL JOSEPH Acquires Provident Bancorp Inc Shares

On September 19, 2023, investment firm STILWELL JOSEPH (Trades, Portfolio) added 1,806,055 shares of Provident Bancorp Inc (NASDAQ:PVBC) to its portfolio. This article provides an in-depth analysis of the transaction, the guru's profile, and the traded stock company's basic information. The aim is to provide valuable insights to our value investor members.

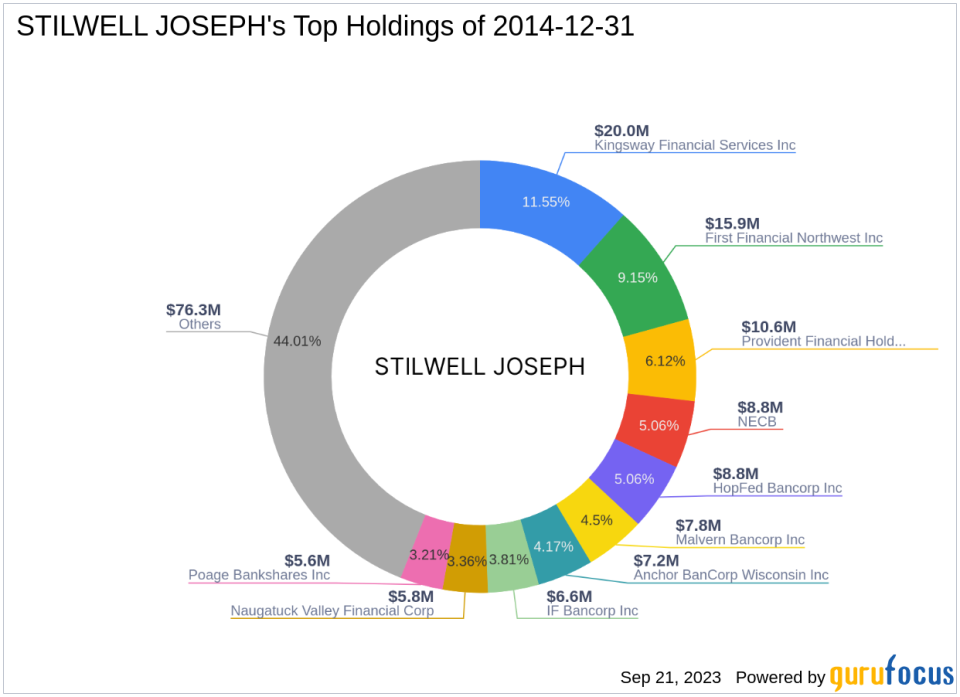

STILWELL JOSEPH (Trades, Portfolio): A Profile

STILWELL JOSEPH (Trades, Portfolio) is a New York-based investment firm with a portfolio of 53 stocks, primarily in the Financial Services and Consumer Cyclical sectors. The firm's equity stands at $173 million. The firm's investment philosophy is centered around long-term value creation, with a focus on undervalued stocks with strong fundamentals and growth potential.

Transaction Details

The transaction took place on September 19, 2023, with STILWELL JOSEPH (Trades, Portfolio) adding 2,704 shares of Provident Bancorp Inc to its portfolio at a price of $9.52 per share. This transaction increased the firm's total holdings in PVBC to 1,806,055 shares, representing 10.21% of the guru's holdings in the traded stock. However, the impact on the guru's portfolio was not significant.

Provident Bancorp Inc Overview

Provident Bancorp Inc, a US-based company, provides a range of banking products and services to small and medium-sized commercial customers. The company's market cap stands at $171.021 million. The company's stock is currently priced at $9.67, which is significantly undervalued according to the GF Value of $18.08. The stock has gained 1.58% since the transaction and has seen a year-to-date increase of 33.01%. However, it has lost 21.06% since its IPO on January 8, 1999.

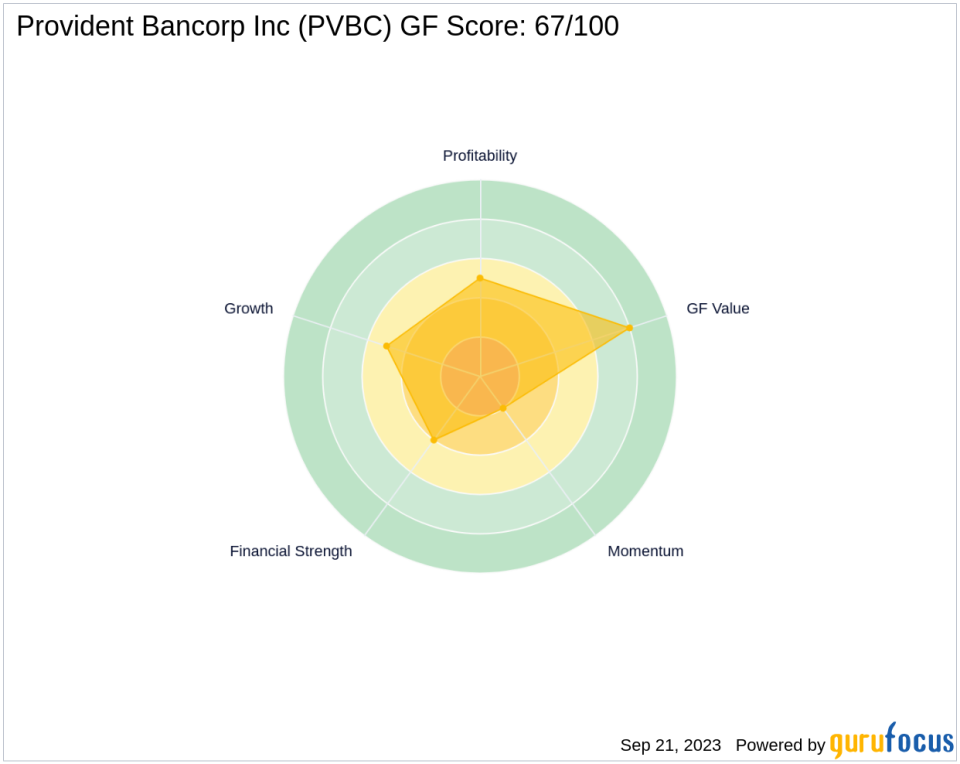

Stock Analysis

Provident Bancorp Inc's stock has a GF Score of 67/100, indicating a good outperformance potential. The company's Financial Strength is ranked 4/10, while its Profitability Rank and Growth Rank are both 5/10. The GF Value Rank is 8/10, and the Momentum Rank is 2/10. The company's Piotroski F-Score is 4, indicating average financial health.

Industry Overview

Provident Bancorp Inc operates in the banking industry, where it has seen a 3-year revenue growth of 22.80%. However, the company's ROE and ROA are -12.55 and -1.56, respectively, indicating a need for improvement in profitability and efficiency.

Stock Predictability and Momentum

Provident Bancorp Inc's stock predictability is not available. The stock's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 44.04, 47.31, and 50.25, respectively. The Momentum Index 6 - 1 Month is 23.95, while the Momentum Index 12 - 1 Month is -34.49.

Conclusion

In conclusion, STILWELL JOSEPH (Trades, Portfolio)'s recent acquisition of Provident Bancorp Inc shares could be a strategic move to capitalize on the stock's undervaluation and potential for outperformance. However, the transaction's impact on the guru's portfolio is minimal. Value investors may want to keep an eye on this stock, considering its growth potential and the guru's interest.

This article first appeared on GuruFocus.