STILWELL JOSEPH Acquires Provident Bancorp Inc Shares

On September 13, 2023, STILWELL JOSEPH (Trades, Portfolio), a renowned investment firm, executed a significant transaction involving Provident Bancorp Inc (NASDAQ:PVBC). This article aims to provide an in-depth analysis of this transaction, the guru's profile, and the traded stock's performance.

Details of the Transaction

STILWELL JOSEPH (Trades, Portfolio) added 7,200 shares of Provident Bancorp Inc to its portfolio at a trade price of $9.75 per share. This transaction increased the firm's total holdings in PVBC to 1,800,879 shares, representing 10.18% of the guru's holdings in the traded stock. Despite the addition, the transaction had no significant impact on the firm's portfolio.

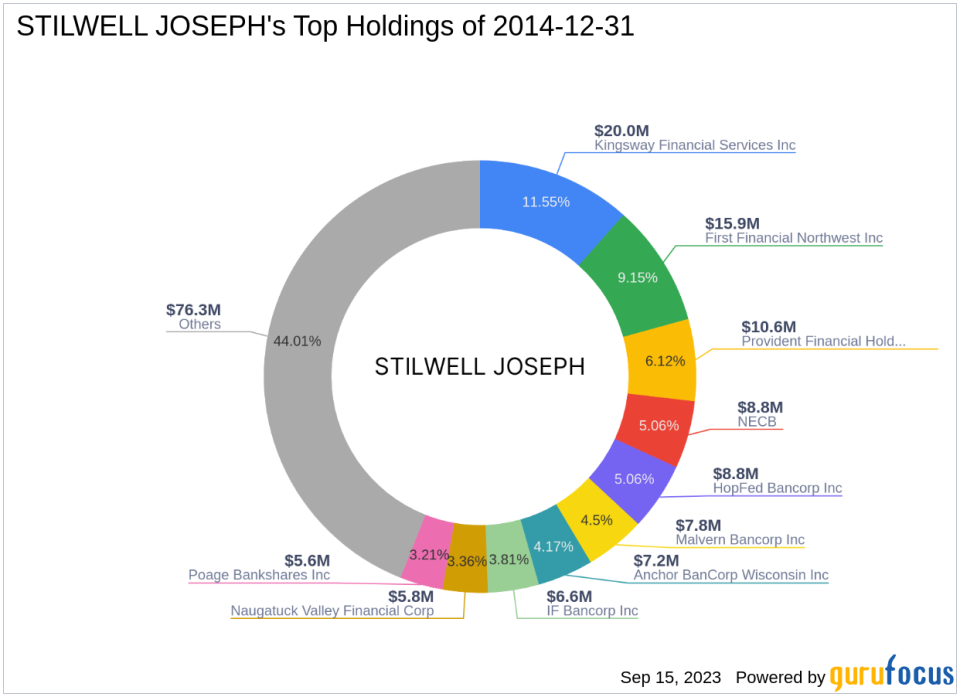

Profile of the Guru

STILWELL JOSEPH (Trades, Portfolio), based at 111 Broadway, 12th Floor, New York, NY 10006, manages 53 stocks with an equity of $173 million. The firm's top holdings are primarily in the Financial Services and Consumer Cyclical sectors.

Overview of the Traded Stock

Provident Bancorp Inc (NASDAQ:PVBC), a USA-based company, offers a range of banking products and services to small and medium-sized commercial customers. The company, which went public on January 8, 1999, has a market capitalization of $176.857 million. Despite a PE percentage of 0.00, indicating a loss, the stock is significantly undervalued according to the GF Value Rank, with a GF Value of 18.01 and a price to GF Value ratio of 0.56. The stock's current price is $10.

Analysis of the Stock's Performance

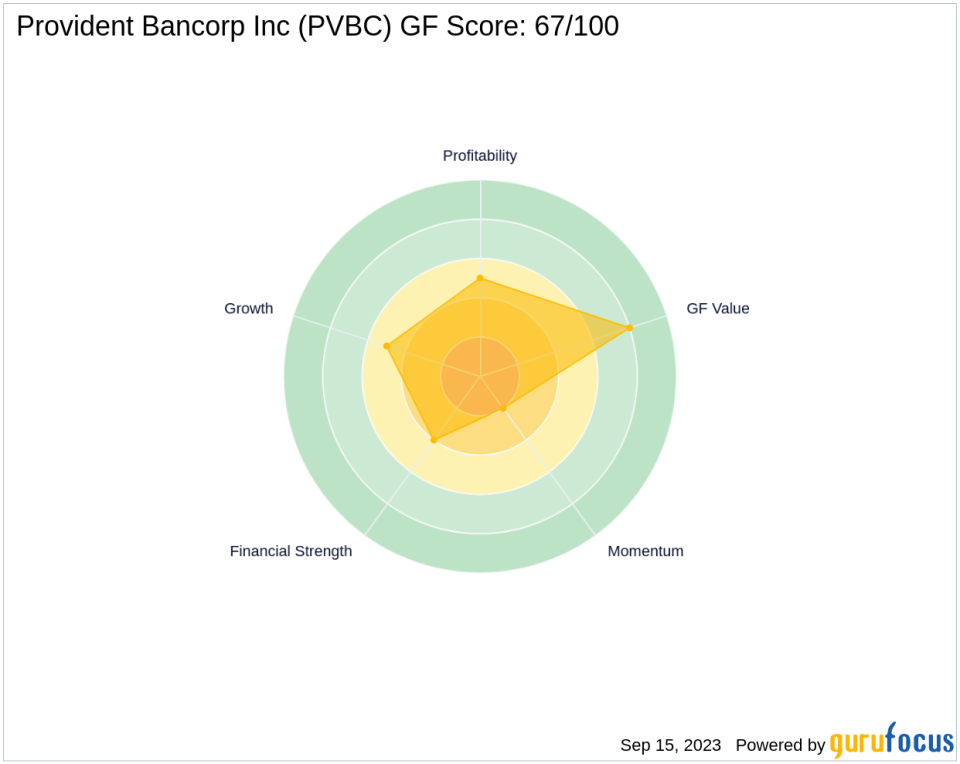

Since its IPO, PVBC has experienced a price change of -18.37%. However, the stock has gained 2.56% since the transaction and has a year-to-date price change ratio of 37.55%. The stock's GF Score is 67/100, indicating a poor future performance potential. The stock's balance sheet rank, profitability rank, growth rank, GF value rank, and momentum rank are 4/10, 5/10, 5/10, 8/10, and 2/10, respectively.

Financial Health of the Stock

Provident Bancorp Inc has a Piotroski F-Score of 4 and an Altman Z Score of 0.00. The company's cash to debt ratio is 3.55, ranking 369th. The stock's ROE and ROA are -12.55 and -1.56, respectively, with ranks of 1424 and 1422. The company has not experienced any growth in gross margin or operating margin, but its 3-year revenue growth is 22.80%.

Stock's Position in the Market

Provident Bancorp Inc operates in the Banks industry. The stock's RSI 5 day, RSI 9 day, RSI 14 day, momentum index 6 - 1 month, and momentum index 12 - 1 month are 65.80, 62.25, 60.27, 21.15, and -32.12, respectively. The stock's RSI 14 day rank and momentum index 6 - 1 month rank are 1262 and 168, respectively.

Conclusion

In conclusion, STILWELL JOSEPH (Trades, Portfolio)'s recent acquisition of Provident Bancorp Inc shares is a noteworthy transaction that value investors should monitor closely. Despite the stock's poor future performance potential and financial health, the firm's decision to increase its holdings could indicate a potential turnaround. As always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

This article first appeared on GuruFocus.