STILWELL JOSEPH Acquires Provident Bancorp Inc Shares

On September 15, 2023, New York-based firm STILWELL JOSEPH (Trades, Portfolio) added 200 shares of Provident Bancorp Inc (NASDAQ:PVBC) to its portfolio. The shares were acquired at a traded price of $9.66, bringing the firm's total holdings in PVBC to 1,801,079 shares. This transaction represents a 10.18% stake in the company for STILWELL JOSEPH (Trades, Portfolio).

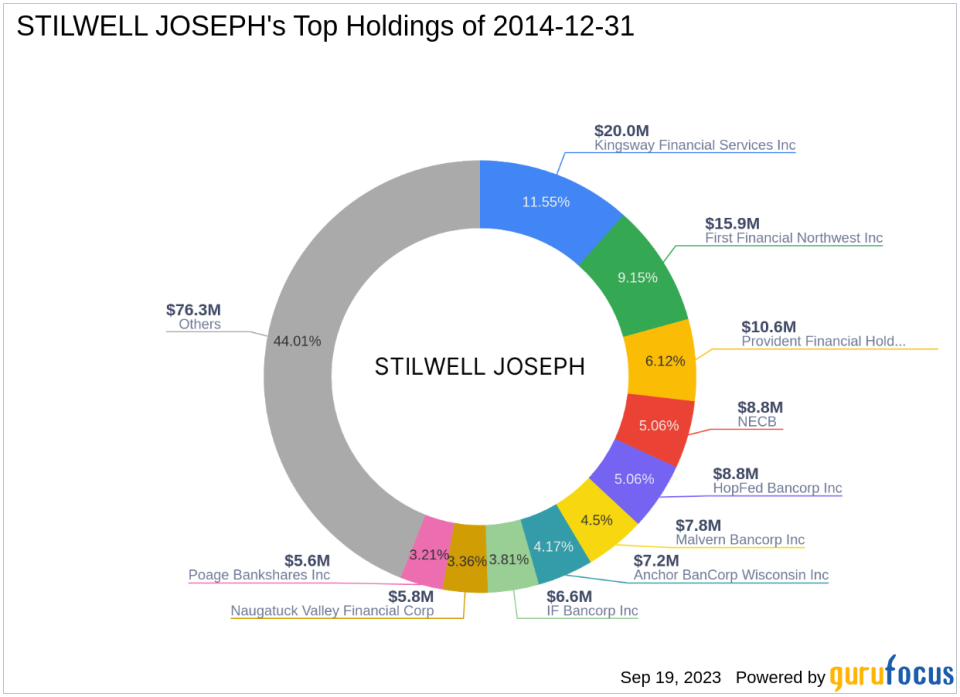

About STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) is a firm located at 111 Broadway, 12th Floor, New York, NY 10006. The firm manages an equity portfolio worth $173 million, with a focus on the Financial Services and Consumer Cyclical sectors. The firm's investment philosophy is centered around identifying undervalued companies with strong growth potential.

Provident Bancorp Inc Overview

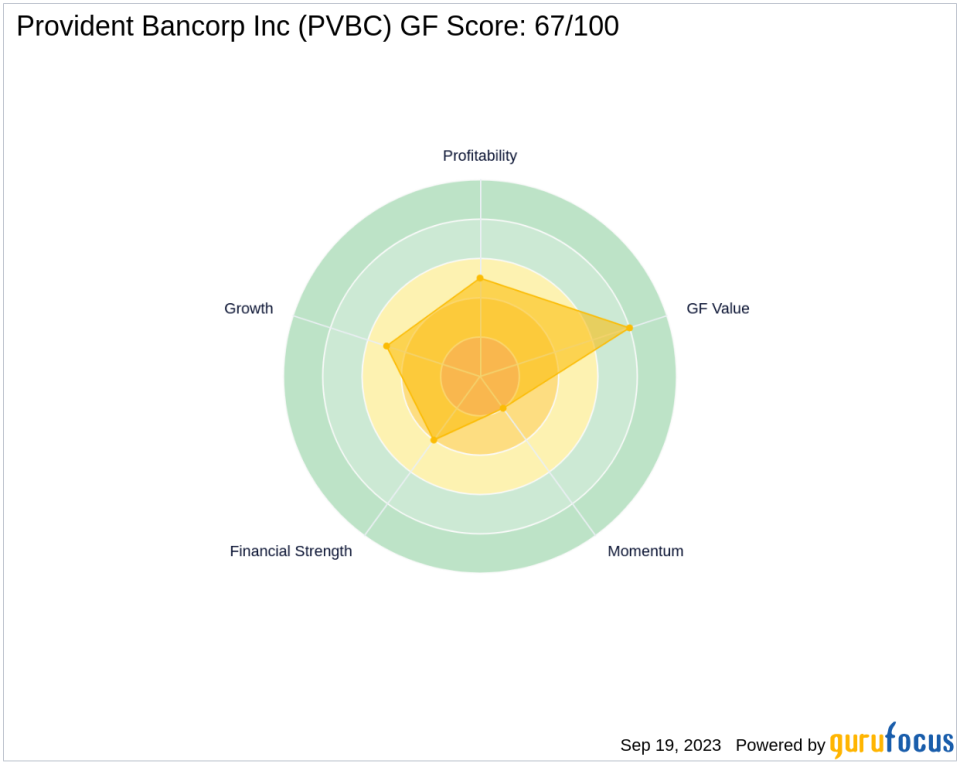

Provident Bancorp Inc (NASDAQ:PVBC) is a banking services provider based in the USA. The company offers a range of banking products and services to small and medium-sized commercial customers. It attracts deposits from the general public and uses those funds to originate various types of loans and to invest in securities. The company's market capitalization stands at $164.556 million. GF-Score of Provident Bancorp Inc is 67/100, indicating a good future performance potential.

Financial Performance of Provident Bancorp Inc

Provident Bancorp Inc's financial performance is characterized by a PE Percentage of 0.00, indicating that the company is currently at a loss. The company's stock price has decreased by 2.48% since the transaction. However, the year-to-date price change ratio stands at 29.57%. The company's Financial Strength is ranked 4/10, while its Profitability Rank is 5/10.

Growth and Momentum of Provident Bancorp Inc

The company's growth is reflected in its Growth Rank of 5/10 and a 3-year revenue growth of 22.80%. In terms of momentum, the company's RSI 14 Day stands at 50.11, and its Momentum Index 6 - 1 Month is 29.04. However, the company's Momentum Rank is 2/10, indicating a relatively low momentum.

Financial Health of Provident Bancorp Inc

Provident Bancorp Inc's financial health is characterized by a Cash to Debt ratio of 3.55, a ROE of -12.55, and a ROA of -1.56. The company's Cash to Debt Rank is 370, while its ROE Rank and ROA Rank are 1427 and 1426, respectively. These figures indicate that the company's financial health could be improved.

Conclusion

In conclusion, STILWELL JOSEPH (Trades, Portfolio)'s recent acquisition of Provident Bancorp Inc shares could be a strategic move to capitalize on the company's growth potential. Despite the company's current financial performance and health, its growth and momentum indicators suggest a promising future. This transaction could potentially have a significant impact on both the stock and the guru's portfolio. However, as with any investment, it is crucial for investors to conduct their own due diligence before making investment decisions.

This article first appeared on GuruFocus.