STILWELL JOSEPH Acquires Shares in Provident Bancorp Inc

On September 18, 2023, New York-based firm STILWELL JOSEPH (Trades, Portfolio) added 2,272 shares of Provident Bancorp Inc (NASDAQ:PVBC) to its portfolio. The shares were acquired at a trade price of $9.61, bringing the firm's total holdings in PVBC to 1,803,351 shares. Despite the addition, the transaction had no significant impact on the firm's portfolio, with PVBC accounting for 10.19% of the firm's holdings.

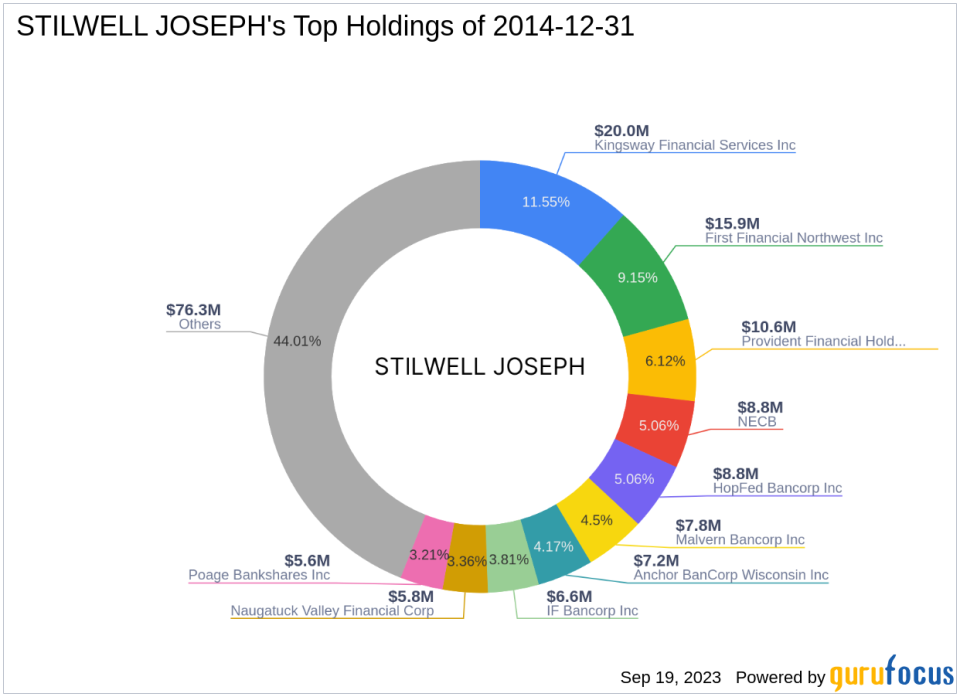

About STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) is a firm located at 111 Broadway, 12th Floor, New York, NY 10006. The firm manages a portfolio of 53 stocks, primarily in the Financial Services and Consumer Cyclical sectors. With an equity of $173 million, the firm's top holdings include Provident Bancorp Inc.

Provident Bancorp Inc Overview

Provident Bancorp Inc (NASDAQ:PVBC) is a banking services provider based in the USA. The company offers a range of banking products and services to small and medium-sized commercial customers. It attracts deposits from the general public and uses those funds to originate various types of loans and to invest in securities. The company operates as a single segment and has a market capitalization of $168.899 million. The current stock price is $9.55, and the stock is significantly undervalued according to the GF Valuation, with a GF Value of $18.08 and a Price to GF Value ratio of 0.53.

Stock Performance Analysis

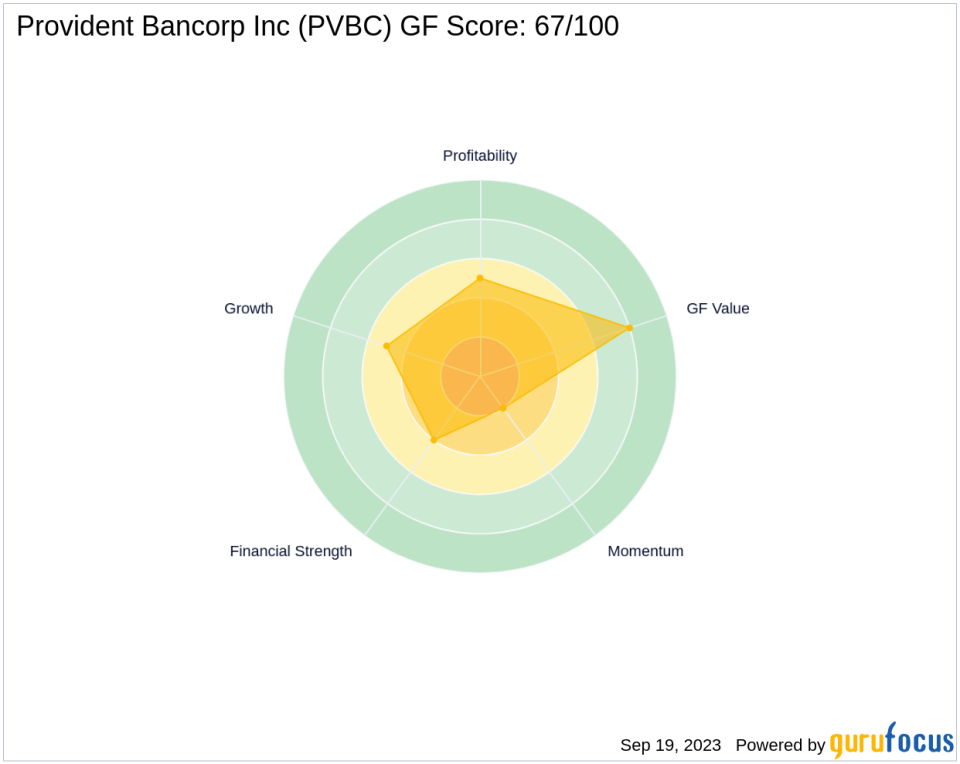

Since its Initial Public Offering (IPO) on January 8, 1999, PVBC's stock has decreased by 22.04%. However, the stock has seen a year-to-date price change ratio of 31.36%. Despite a recent dip of 0.62% since the transaction, the stock's GF Score of 67/100 indicates a good future performance potential.

Financial Health Evaluation

Provident Bancorp Inc's financial health is reflected in its Balance Sheet Rank of 4/10, Profitability Rank of 5/10, and Growth Rank of 5/10. The company's Piotroski F-Score is 4, and it has a Cash to Debt ratio of 3.55, ranking 370th in the industry. However, the company's Altman Z Score is not available due to insufficient data.

Industry Performance and Momentum

In the banking industry, PVBC has a Return on Equity (ROE) of -12.55 and a Return on Assets (ROA) of -1.56. The company's revenue growth over the past three years is 22.80%, ranking 107th in the industry. The stock's RSI 14 Day is 47.68, ranking 900th, and its Momentum Index 6 - 1 Month is 29.04, ranking 292nd. However, the stock's Momentum Index 12 - 1 Month is -34.13, indicating a negative momentum in the past month.

Conclusion

In conclusion, STILWELL JOSEPH (Trades, Portfolio)'s recent acquisition of PVBC shares reflects the firm's confidence in the stock's potential. Despite the stock's recent dip, its GF Score and year-to-date price change ratio suggest a promising future performance. However, investors should also consider the company's financial health and industry performance when making investment decisions.

This article first appeared on GuruFocus.