STILWELL JOSEPH Acquires Shares in Provident Bancorp Inc

On September 27, 2023, New York-based firm STILWELL JOSEPH (Trades, Portfolio) added 7,926 shares of Provident Bancorp Inc (NASDAQ:PVBC) to its portfolio. The shares were acquired at a traded price of $9.47, bringing the firm's total holdings in PVBC to 1,817,581 shares. This transaction represents a 0.44% change in the firm's holdings and a 10.27% stake in the traded stock.

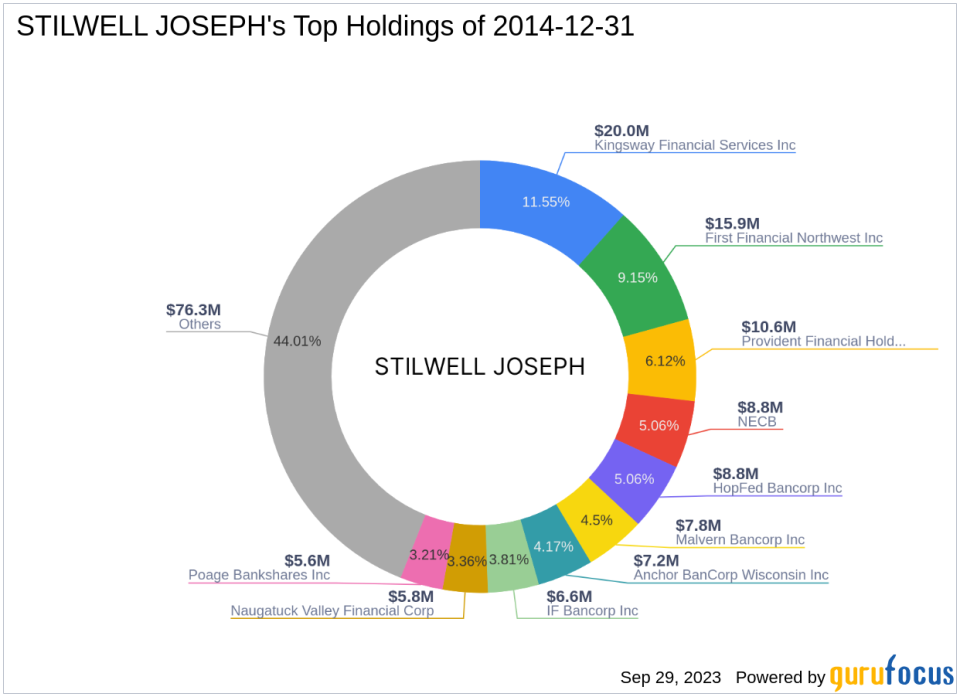

About STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) is a firm located at 111 Broadway, 12th Floor, New York, NY 10006. The firm manages 53 stocks with a total equity of $173 million. Its investment philosophy is primarily focused on the Financial Services and Consumer Cyclical sectors.

Provident Bancorp Inc Overview

Provident Bancorp Inc is a USA-based company with a market cap of $169.783 million. The company provides a range of banking products and services to small and medium-sized commercial customers. Its current stock price is $9.6, and it is significantly undervalued according to the GF Valuation, with a GF Value of $18.16.

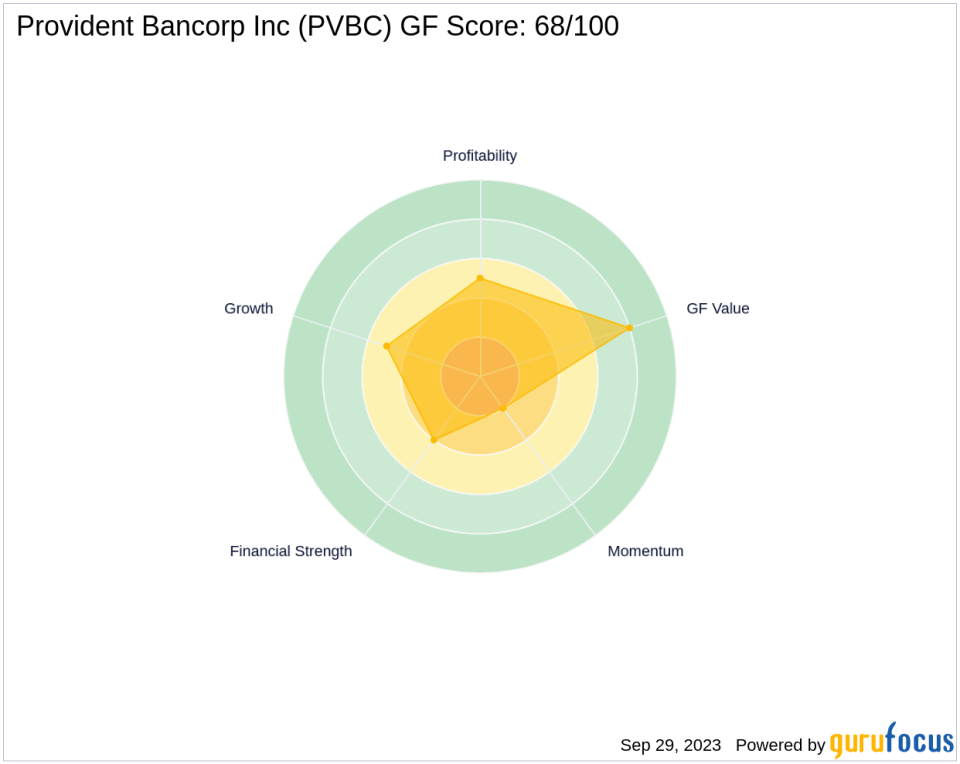

Financial Performance of Provident Bancorp Inc

Provident Bancorp Inc's financial performance is evaluated using various metrics. The company's PE Percentage is 0.00, indicating that it is currently at a loss. Its GF Score is 68/100, and its Balance Sheet Rank is 4/10. The company's Profitability Rank and Growth Rank are both 5/10. Provident Bancorp Inc's cash to debt ratio is 3.55, ranking it 370th in this aspect.

Industry Position of Provident Bancorp Inc

In the Banks industry, Provident Bancorp Inc's ROE and ROA are -12.55 and -1.56, respectively, ranking it 1433rd and 1432nd. The company's revenue growth over the past three years is 22.80, ranking it 106th.

Stock Performance of Provident Bancorp Inc

Since the transaction, Provident Bancorp Inc's stock has gained 1.37%. Since its IPO, the stock has decreased by 21.63%. However, the stock has increased by 32.05% year-to-date. The stock's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 42.40, 44.95, and 47.67, respectively. The stock's momentum index over the past 6 - 1 month is 33.05, and over the past 12 - 1 month, it is -34.18.

Conclusion

In conclusion, STILWELL JOSEPH (Trades, Portfolio)'s recent acquisition of Provident Bancorp Inc shares could be a strategic move given the company's undervalued status and potential for growth. However, the company's current financial performance and industry position should be considered. This transaction could have significant implications for both the stock and the firm's portfolio, and it is worth monitoring for value investors.

This article first appeared on GuruFocus.