STILWELL JOSEPH Acquires Shares in Sound Financial Bancorp Inc

On September 26, 2023, STILWELL JOSEPH (Trades, Portfolio), a renowned investment firm, added 377,503 shares of Sound Financial Bancorp Inc (NASDAQ:SFBC) to its portfolio. This article aims to provide an in-depth analysis of this transaction, the guru's profile, and the traded stock company's basic information.

Transaction Details

The firm acquired the shares at a price of $36.75 each. This transaction resulted in a 0.05% change in the firm's portfolio, with the total shares of SFBC held by STILWELL JOSEPH (Trades, Portfolio) now standing at 377,503. This represents 14.69% of the guru's holdings in the traded stock. However, the impact of this transaction on the guru's portfolio is currently not applicable.

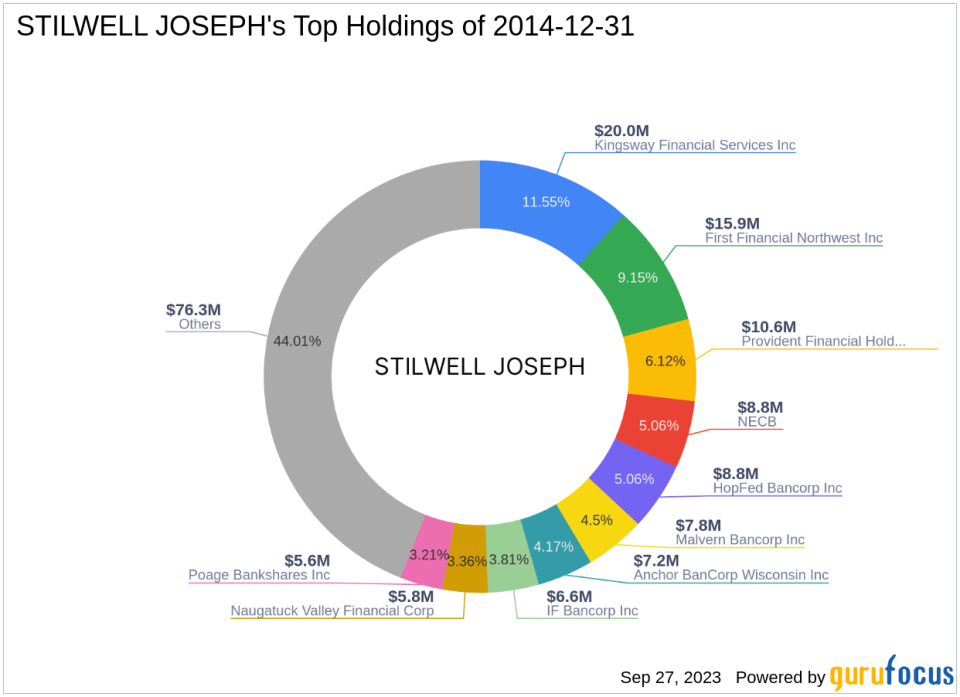

STILWELL JOSEPH (Trades, Portfolio)'s Profile

STILWELL JOSEPH (Trades, Portfolio) is a New York-based investment firm with a portfolio of 53 stocks, primarily in the Financial Services and Consumer Cyclical sectors. The firm's equity stands at $173 million. The firm's top holdings include

.

Sound Financial Bancorp Inc Overview

Sound Financial Bancorp Inc (NASDAQ:SFBC), a USA-based company, operates as the holding company for Sound Community Bank. The bank provides traditional banking and other financial services for individuals and businesses. The company's market capitalization stands at $94.477 million. The current stock price is $36.75. The company went public on August 24, 2012.

Stock Performance and Valuation

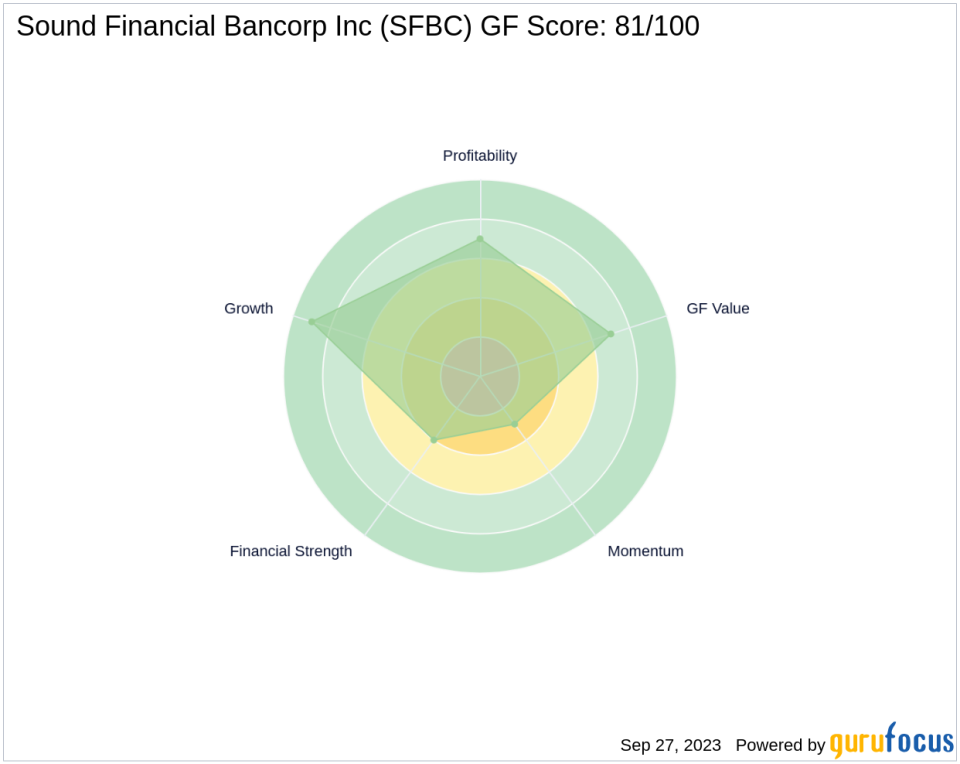

Sound Financial Bancorp Inc has a PE percentage of 9.12, indicating that the company is profitable. The stock is modestly undervalued with a GF Value of $44.99 and a price to GF Value ratio of 0.82. The stock has not gained since the transaction and has seen a 263.86% increase since its IPO. However, the stock has seen a -6.42% change year-to-date. The GF Score of the stock is 81/100, indicating good outperformance potential.

Stock Financial Health and Profitability

The company has a balance sheet rank of 4/10, a profitability rank of 7/10, a growth rank of 9/10, a GF Value rank of 7/10, and a momentum rank of 3/10. The company's Piotroski F-Score is 6, and its Altman Z score is 0.00. The company's cash to debt ratio is 1.30.

Stock's Position in the Industry

Sound Financial Bancorp Inc operates in the Banks industry. The company has a return on equity (ROE) of 10.87 and a return on assets (ROA) of 1.07. The company has seen a 3-year revenue growth of 8.30 and a 3-year earning growth of 9.20.

Stock's Momentum and Predictability

The company's RSI 5 Day is 32.75, RSI 9 Day is 36.97, and RSI 14 Day is 41.15. The company's momentum index 6 - 1 month is -1.82, and the momentum index 12 - 1 month is -10.46. The company's predictability rank is currently not applicable.

In conclusion, this transaction by STILWELL JOSEPH (Trades, Portfolio) is a significant addition to its portfolio. The firm's investment in Sound Financial Bancorp Inc, a company with good outperformance potential, could yield positive returns in the future.

This article first appeared on GuruFocus.