STILWELL JOSEPH Acquires Shares in Sound Financial Bancorp Inc

On September 27, 2023, STILWELL JOSEPH (Trades, Portfolio), a New York-based investment firm, added 1,077 shares of Sound Financial Bancorp Inc (NASDAQ:SFBC) to its portfolio. The shares were acquired at a price of $36.75 each, bringing the firm's total holdings in SFBC to 378,580 shares. This transaction represents a 14.73% stake in the company, making it a significant addition to STILWELL JOSEPH (Trades, Portfolio)'s portfolio.

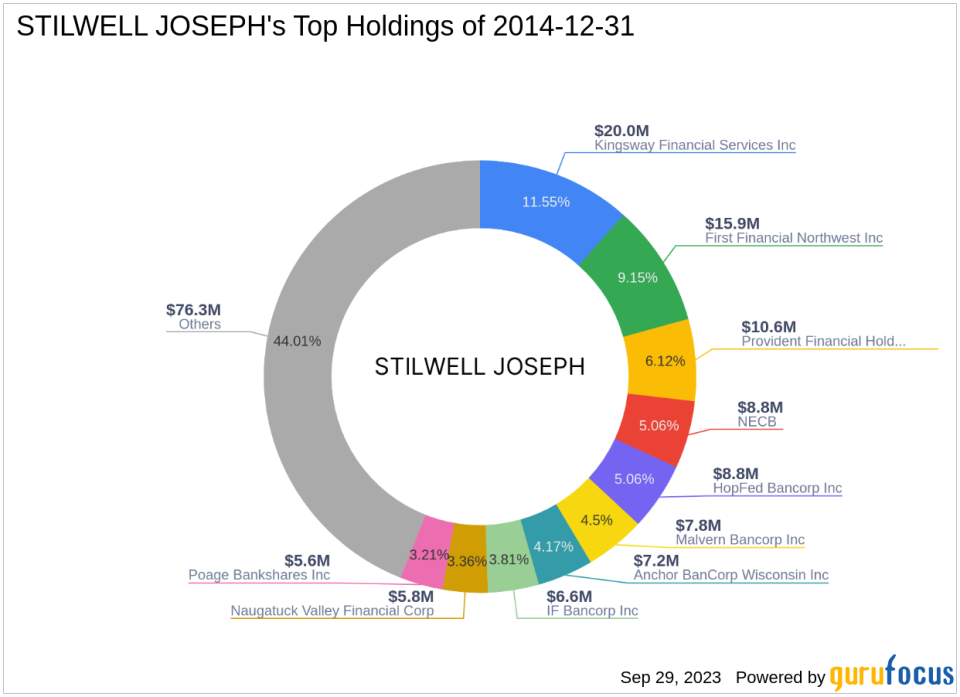

About STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) is a renowned investment firm located at 111 Broadway, 12th Floor, New York, NY 10006. The firm manages an equity portfolio worth $173 million, spread across 53 stocks. Its top holdings are primarily in the Financial Services and Consumer Cyclical sectors.

Sound Financial Bancorp Inc Overview

Sound Financial Bancorp Inc (NASDAQ:SFBC), a USA-based company, operates as a holding company for Sound Community Bank. The bank provides traditional banking and other financial services for individuals and businesses. Since its IPO on August 24, 2012, the company has shown significant growth, with its stock price increasing by 267%. As of September 29, 2023, the company's market cap stands at $95.292 million, and its stock is trading at $37.067. The company's PE ratio is 9.20, indicating a profitable operation. According to GuruFocus's exclusive method, the GF Value of SFBC is $45.00, suggesting that the stock is modestly undervalued.

Stock Valuation and Performance

The stock's price to GF Value is 0.82, and it has gained 0.86% since the transaction. Despite a year-to-date decrease of 5.61%, the stock's GF Score is 81/100, indicating good outperformance potential. The company's balance sheet rank is 4/10, its profitability rank is 7/10, and its growth rank is 9/10. The GF Value Rank and Momentum Rank are 7/10 and 3/10, respectively.

Financial Health and Growth

The company's Piotroski F-Score is 6, indicating a stable financial situation. However, its Altman Z score is 0.00, and its cash to debt ratio is 1.30, ranking 688th in the industry. The company's 3-year revenue growth is 8.30%, and its 3-year earnings growth is 9.20%.

Industry Position and Market Momentum

Sound Financial Bancorp Inc operates in the Banks industry. Its return on equity (ROE) is 10.87%, and its return on assets (ROA) is 1.07%. The company's RSI 5 Day is 53.49, RSI 9 Day is 48.84, and RSI 14 Day is 48.54. The momentum index for 6 - 1 month is 0.83, and for 12 - 1 month is -7.14.

Conclusion

The recent acquisition by STILWELL JOSEPH (Trades, Portfolio) indicates a strong belief in the potential of Sound Financial Bancorp Inc. Despite some fluctuations, the company's overall performance and growth prospects make it a valuable addition to the firm's portfolio. Value investors may want to keep an eye on SFBC, given its current undervaluation and promising GF Score.

This article first appeared on GuruFocus.