STILWELL JOSEPH Acquires Shares in Sound Financial Bancorp Inc

On October 11, 2023, the investment firm STILWELL JOSEPH (Trades, Portfolio) added 200 shares of Sound Financial Bancorp Inc (NASDAQ:SFBC) to its portfolio. This article provides an in-depth analysis of this transaction, the profiles of the guru and the traded company, and the potential impact on the stock market.

Details of the Transaction

The transaction took place on October 11, 2023, with STILWELL JOSEPH (Trades, Portfolio) adding 200 shares of SFBC to its portfolio. The shares were traded at a price of $36.89 each. Following this transaction, the firm now holds a total of 382,462 shares in SFBC, representing 14.88% of the guru's holdings in the traded stock. However, the transaction had a negligible impact on the guru's portfolio.

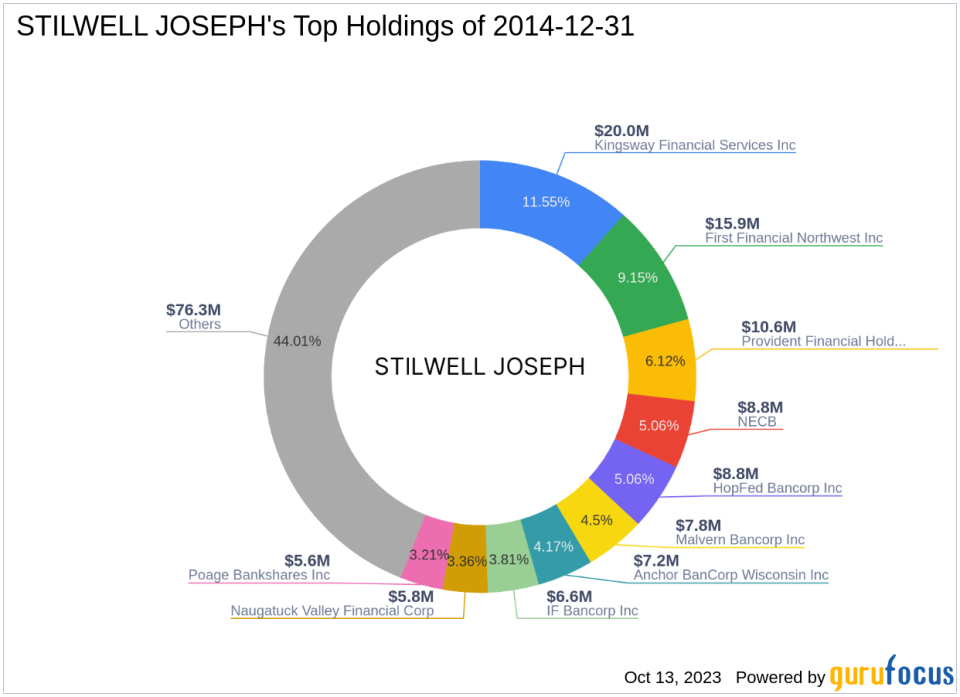

Profile of STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) is an investment firm based in New York, NY. The firm currently holds 53 stocks in its portfolio, with a total equity of $173 million. The firm's top holdings are in the Financial Services and Consumer Cyclical sectors. The firm's investment philosophy is not publicly disclosed.

Overview of Sound Financial Bancorp Inc

Sound Financial Bancorp Inc, with the stock symbol SFBC, is a US-based company that operates as the holding company for Sound Community Bank. The bank provides traditional banking and other financial services for individuals and businesses. The company's market capitalization stands at $94.477 million, with a current stock price of $36.75 and a PE percentage of 9.12. According to GuruFocus, the stock is modestly undervalued with a GF Value of $45.14.

Performance of Sound Financial Bancorp Inc's Stock

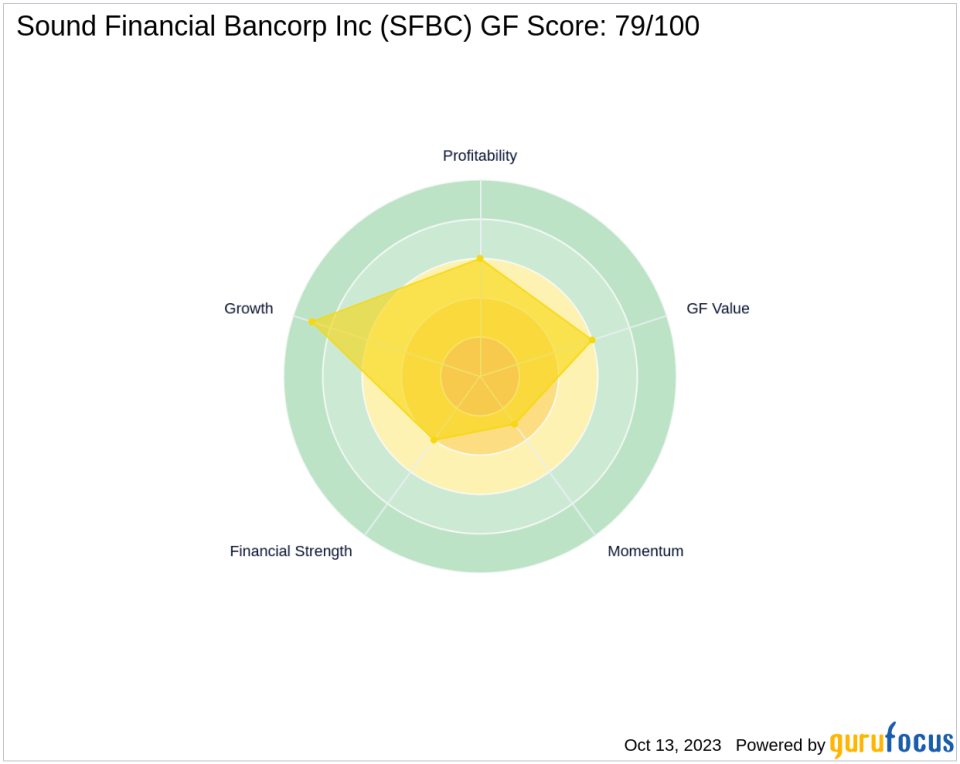

Since the transaction, the stock's price has decreased by 0.38%. However, since its IPO on August 24, 2012, the stock has gained 263.86%. The year-to-date price change ratio stands at -6.42. The stock's GF Score is 79/100, indicating a likely average performance. The stock's Financial Strength is ranked 4/10, its Profitability Rank is 6/10, and its Growth Rank is 9/10.

Financial Health of Sound Financial Bancorp Inc

The company's cash to debt ratio is 1.30, ranking 684th in the industry. The company's ROE and ROA are 10.87 and 1.07, respectively, with respective ranks of 700 and 624. The company's gross margin growth and operating margin growth are not applicable.

Growth of Sound Financial Bancorp Inc

Over the past three years, the company's revenue has grown by 8.30%, and its earnings have grown by 9.20%. However, the company's EBITDA growth over the same period is not applicable.

Momentum of Sound Financial Bancorp Inc's Stock

The stock's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 36.81, 39.57, and 42.26, respectively. The stock's Momentum Index 6 - 1 Month is 1.47, and its Momentum Index 12 - 1 Month is -7.45. The stock's RSI 14 Day Rank is 736, and its Momentum Index 6 - 1 Month Rank is 798.

In conclusion, the recent acquisition by STILWELL JOSEPH (Trades, Portfolio) could potentially influence the performance of SFBC's stock and the firm's portfolio. However, investors should conduct their own research and consider various factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.