STILWELL JOSEPH Acquires Shares in Sound Financial Bancorp Inc

On October 6, 2023, STILWELL JOSEPH (Trades, Portfolio), a New York-based investment firm, added 2,035 shares of Sound Financial Bancorp Inc (NASDAQ:SFBC) to its portfolio. The shares were acquired at a trade price of $36.75, bringing the firm's total holdings in SFBC to 382,262 shares. Despite the addition, the position of SFBC in the firm's portfolio remains at 0%, while the firm's holdings in SFBC account for 14.87% of the traded stock.

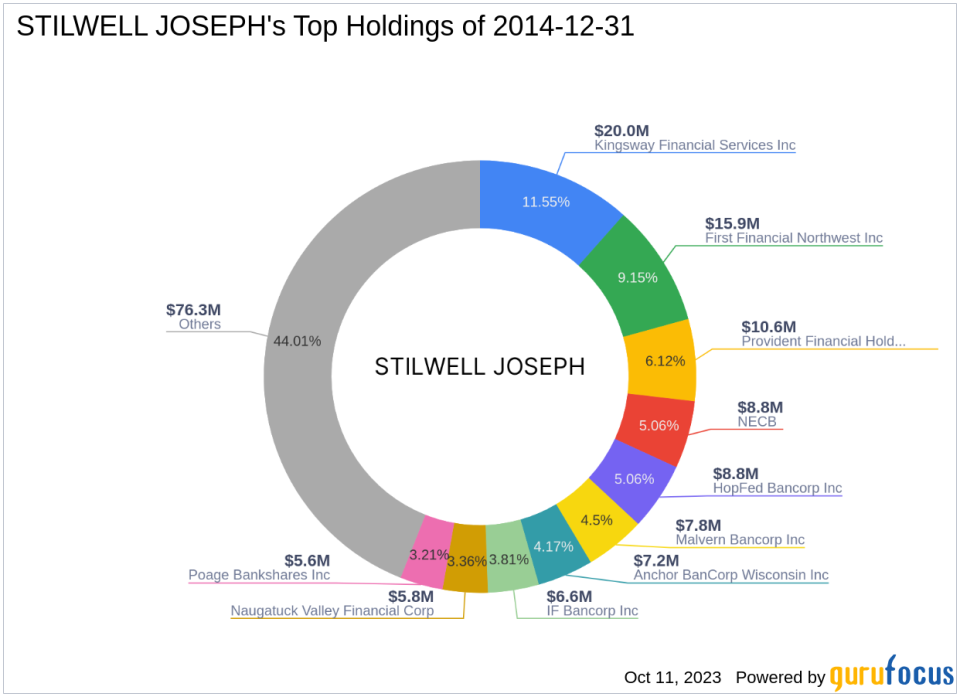

About STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) is an investment firm located at 111 Broadway, 12th Floor, New York, NY 10006. The firm currently holds 53 stocks in its portfolio, with a total equity of $173 million. The firm's top holdings are in the Financial Services and Consumer Cyclical sectors.

Sound Financial Bancorp Inc Overview

Sound Financial Bancorp Inc (NASDAQ:SFBC), based in the USA, is a holding company for Sound Community Bank. The company, which went public on August 24, 2012, provides traditional banking and other financial services for individuals and businesses. SFBC operates in a single segment and has a market cap of $95.531 million. The current stock price is $37.16, with a PE percentage of 9.22.

GuruFocus Valuation of SFBC

According to GuruFocus valuation, SFBC is modestly undervalued with a GF Value of $45.11. The price to GF Value ratio stands at 0.82. Since the transaction, the stock has gained 1.12%, and since its IPO, the stock has gained 267.92%. However, the year-to-date price change ratio is -5.37%.

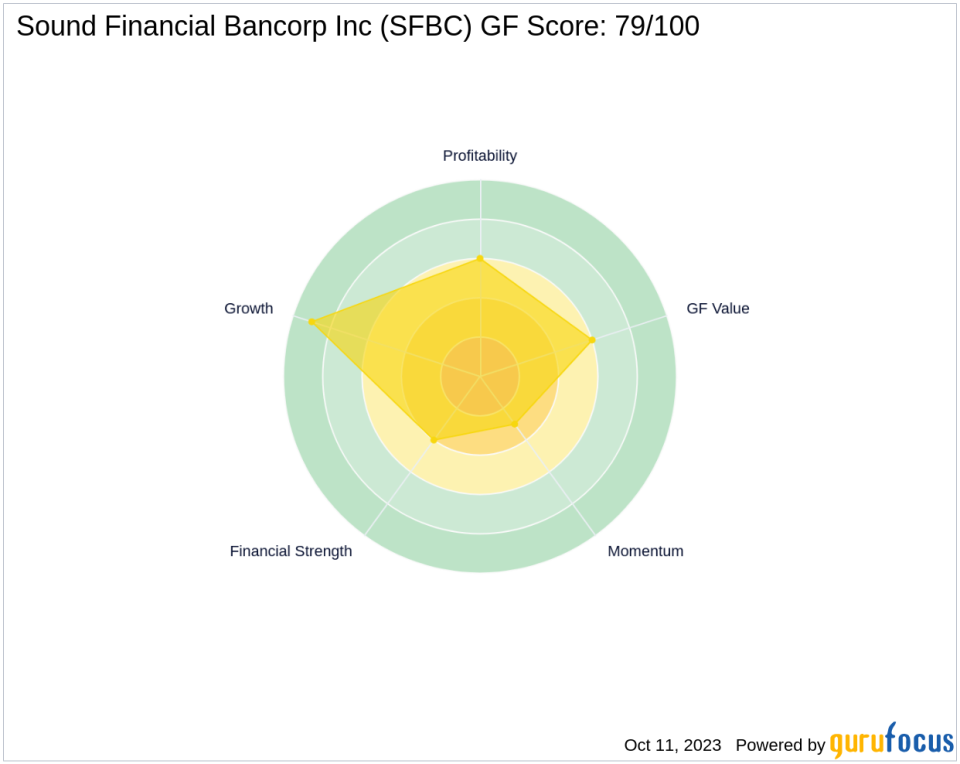

GuruFocus Score and Ranking of SFBC

The GF Score of SFBC is 79/100, indicating a likely average performance. The Balance Sheet Rank is 4/10, the Profitability Rank is 6/10, and the Growth Rank is 9/10. The GF Value Rank and Momentum Rank are 6/10 and 3/10, respectively. The stock's Piotroski F-Score is 6, and its Altman Z Score is 0.00. The Cash to Debt ratio is 1.30, ranking 684th in the industry.

Performance of SFBC

The Return on Equity (ROE) and Return on Assets (ROA) of SFBC are 10.87 and 1.07, respectively. The company ranks 700th in ROE and 624th in ROA. The 3-year revenue growth is 8.30%, and the 3-year earning growth is 9.20%. The company ranks 546th in 3-year revenue growth.

Position of SFBC in the Industry

In the banking industry, SFBC's RSI 5 Day is 36.81, RSI 9 Day is 39.57, and RSI 14 Day is 42.26. The Momentum Index 6 - 1 Month is 2.21, and the Momentum Index 12 - 1 Month is -7.64. The company ranks 738th in RSI 14 Day and 767th in Momentum Index 6 - 1 Month.

Conclusion

In conclusion, STILWELL JOSEPH (Trades, Portfolio)'s recent acquisition of SFBC shares could potentially impact the firm's portfolio and the traded stock. Despite the modest undervaluation and average GF Score, the stock's performance and position in the industry should be closely monitored for potential risks and opportunities. All data and rankings are accurate as of October 11, 2023.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.